Here’s how we got here, and why it will probably continue – H/T daytrip!

The U.S. is home to a working class suffering from stagnant incomes and declining job prospects—widespread struggles that helped elect Republican Donald Trump. The relative wealth of Americans in all age groups keeps falling, compared with previous decades.

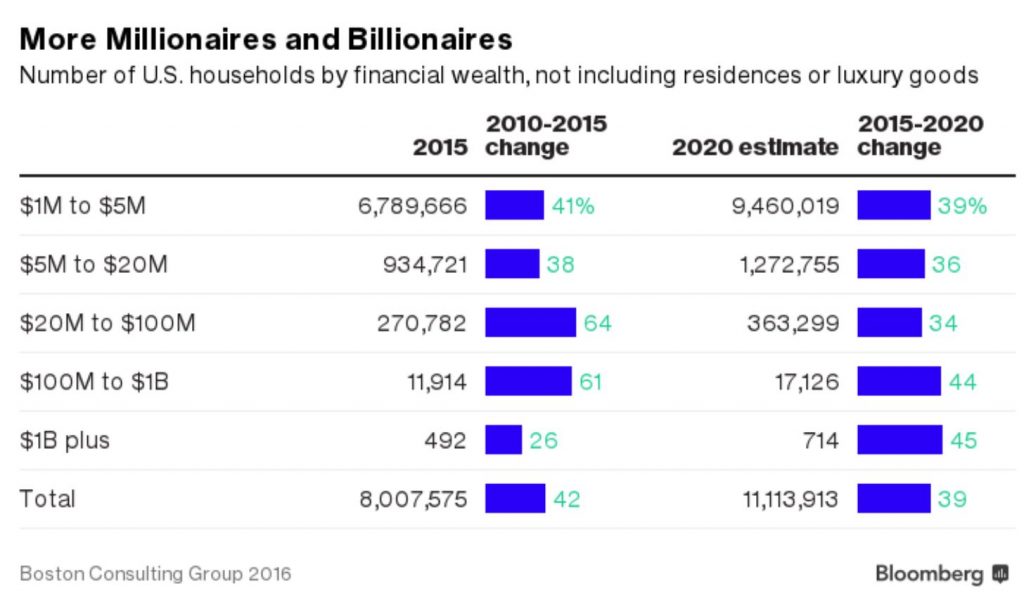

At the same time, the country is also home to an unprecedented amount of wealth, a divergence that has made income inequality a household phrase. America has $55.6 trillion in private financial assets and more millionaires than any other nation in the world by far. Today, more than 8 million households have financial assets of $1 million or more, not including homes or luxury goods, according to Boston Consulting Group. From 2010 to 2015, the number of millionaires jumped by 2.4 million. Another 3.1 million will be created by 2020, BCG estimates, at the pace of 1,700 new American millionaires every day.

But before your faith in upward mobility is restored, realize this: The very oldest Americans hold a disproportionate chunk of all those trillions, and they’re handing it off to their already well-off kids in what is the largest generational transfer of wealth in history.

Inheritance is an increasingly significant driver of wealth in America. Wide swaths of the country live from month to month with virtually no savings safety net. About three-quarters of the country are “strugglers,” unable to save anything from year to year, the Federal Reserve Bank of St. Louis concluded in a study last year. The other quarter of the country, however, are “thrivers,” the St. Louis Fed said—people who successfully save money and accumulate wealth over the years. These include the top 1 percent, who have steadily taken more and more of the nation’s economic output.

Being a millionaire isn’t what it used to be. A net worth of $1 million has the same buying power today that $341,000 did in 1980 and that $45,000 did 100 years ago, according to Bureau of Labor Statistics data. If you’re making six figures and saving regularly, you should eventually end up with a million dollars or more in your investment accounts. (You’d better, since you’ll need to save that much to have any hope of maintaining your lifestyle in retirement.

I think someone may have typo’d the calculator. When I put in $1M for 2016 I get $884K for 2006. However, “buying power” is a very uneven thing. I have purchased three brand new cars, in 1987, 1998, and 2011. I paid right around $20K (real, not adjusted) for each, and each was a significant improvement over the last, in terms of features, safety, and reliability. Same with any technology product, they have become cheaper and/or you get more for your $$$. Manufactured goods have been least impacted by inflation, while goods and services where labor and/or real estate are a major component (e.g. housing, restaurants, most personal services [including health care], retail markups) show the greatest impact. So you can improve your chances for a comfortable retirement not only by saving, but also by minimizing your exposure to elements of the economy most affected by inflation: stay healthy, eat at home, and buy don’t rent!

Thanks Ross!

Oops, the article says $45,000 for *100* years ago, which I mis-read as 10. Sorry!

Where I live there are 45 000 of which by the grace of God a technical education and a second job in my earlier years I am one.

That’s right, I invested in real estate.