We’re breathing again – the Senate’s version of tax reform doesn’t change the mortgage-interest deduction, leaving the cap at $1,000,000:

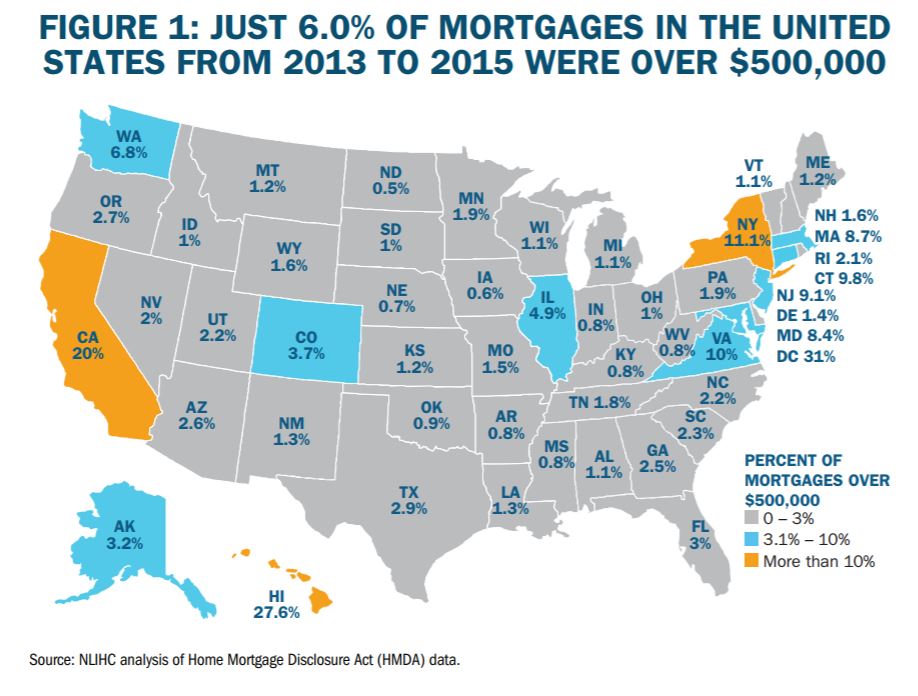

The mortgage interest deduction stays. The current mortgage interest deduction rules remain intact in the Senate plan: Americans would still be able to deduct the interest they pay on the first $1 million of mortgage debt. The House plan reduced that threshold for new mortgages to $500,000, causing outcry from some real estate agents and builders as well as congressmen who represent areas with extremely hefty real estate costs. While there was pushback on the House plan, the reality is only about 6 percent of new mortgages are valued at more than $500,000, according to a report by the United for Homes campaign.

So far this year, 37% of the mortgages funded in San Diego were over $500,000, so there is a significant impact upon our area:

In the San Francisco metro area, 60% of new loans were for more than $500,000, while in Los Angeles and San Diego, the figures were 44% and 37%, respectively.

While there is still more wrangling to come for the House and Senate to agree on a bill to send to the President, at least this might be enough to stop the NAR from declaring that the sky is falling.

…. but Senate is even harsher on SALT, with zero deductibility.

…. but Senate is even harsher on SALT, with zero deductibility.

Yeah, but the realtor party will let that go. The 10% scare didn’t have any research or facts to support it – no, just an off-the-cuff guess. There’s no way to measure what a partial, re-negotiated bill will do to housing values.

Think of the NAR position now. After a week of scaring a ‘more than 10% decline in home values’, do they now say, “JUST KIDDING – WE’RE FINE NOW, BUY, BUY, BUY!”

Or does NAR get behind the fight against losing the SALT deductions too? Doubtful.

Yes, the total loss of property tax deduction is significant. Not for the person spending 2/3 million , they have the brains to figure a way around thru LLC etc or get cpa advice.

Who it effectively hits the hardest is the first time buyer…it’s going to me more expensive to buy and maintain. It gives corporate buyers a edge due to the deduction when competing with that buyer.

If they grandfather that deduction in look out for the rush to buy. People will adapt to the change but look especially here in California Not to move and raise the property tax base unless calif will transfer the basis to everyone.

Which means lower inventory.

Dr. B said that if losing the state and local tax deductions were that big of a deal, Californians could always demand lower taxes.

Think of a Republican-held district, but in a tight race (Darrell Issa, for example).

They could run on a lower-tax campaign, and pick up the more-affluent voters. After a few elections, we might get somewhere.

Which means lower inventory.

But we might pick up some of the move-up buyers who want to finance their next purchase with a loan between $500,000 and $1,000,000 – those who might have talked themselves out of it if they MID was a big deal to them.

Here’s my prediction, going way out on a limb: In 2018, we will have, what we have.

https://www.cnbc.com/2017/11/09/heres-how-the-house-and-senate-tax-bills-compare.html

Everyone is forgetting that the cost to employ a Californian will take a hit from the SALT elimination.

Well, time for California to lower the property tax rate to 0.5%? 😛

Whoops not Issa, but a state assemblyperson.

WASHINGTON, DC – Shortly after the House Ways and Means Committee passed their tax bill out of committee today, the Senate Finance committee released a policy outline of their own tax overhaul.

Jim Houser, owner of Hawthorne Auto Clinic in Portland, Oregon, and Main Street Alliance Executive Committee member, issued the following statement:

“Republican Rep. Peter King said ‘People will think you’re nuts’ if Congress passes the House tax bill. He’s right. Members of Congress in both the House and Senate are nuts to suggest that the tax plans we’ve seen in recent days would do anything to help small business owners like me, or our customers.

The Senate didn’t improve on the House’s bill, they’re merely shuffling the cards to try to create a bill they can unilaterally jam through Congress to please the huge corporations and extremely wealthy donors who hold the purse strings. The pass-through rate cut is still designed to give hedge fund managers and corporate lawyers a tax break on their personal income. Eliminating major deductions like state and local income and property taxes still decreases my customers’ disposable income. Delaying the corporate tax cut one year still means big corporations won’t pay their fair share of taxes like small businesses do.

The Senate’s paltry policy highlights released today offer more questions than answers, but we know with certainty that the whole premise of these tax bills is fundamentally flawed. Republicans in Congress are trying to sell the American public on the myth that trickle-down tax cuts for the very rich lead to magical economic growth for small businesses and the middle class. Small business owners know that hasn’t happened in the past, and it won’t happen now.

As a long-time small business owner, experience has taught me that to grow my business, I need more customers, not tax cuts. If Republicans care about small businesses like they say they do, they have to craft tax legislation that invests first and foremost in the health and well-being of everyone in this country, not just the wealthy 1% that fund their campaigns.”

http://www.mainstreetalliance.org/

The zversion:

https://www.zillow.com/research/mortgage-interest-deduction-taxes-17195/

Changes to the nation’s tax code as proposed by the U.S. House of Representatives and the Senate are set to impact current and would-be homeowners in a number of ways.

Increasing the standard deduction and limiting or eliminating key itemized deductions – including the Mortgage Interest Deduction (MID), property tax deduction and deductions for state and local taxes (SALT) – make it very likely many individual filers may choose not to itemize. More homeowners may instead choose to take the larger standard deduction, as the pool of homes worth enough to make maximum financial use of these deductions shrinks.

Tweaks from the House bill that impact the standard deduction vs. itemizing decision:

Lowers the cap on MID to $500,000 from $1 million currently

Eliminates MID-eligibility for second homes

Essentially doubles the standard deduction (to $24,000 for married couples filing jointly, from $12,700 currently)

Eliminates deduction for state and local income or sales taxes

Caps state and local property tax deduction at $10,000

Tweaks from the Senate bill that impact the standard deduction vs. itemizing decision:

Keeps existing $1 million MID cap

Essentially doubles the standard deduction (to $24,000 for married couples filing jointly, from $12,700 currently)

Eliminates deduction for state and local income or sales taxes

Eliminates deduction of state and local property taxes

Nationally, under the current set up, roughly 44 percent of homes are worth enough for it to make sense for the owner to itemize their deductions and take advantage of the mortgage interest deduction.[1] Under the House plan, that proportion of homes drops to only 12 percent, and drops even further under the Senate proposal – to 7 percent.[2]

How about meet down the middle. Let jumbo or $750k mortgages be deductible, and property taxes up to $7500/year? If not, then the elderly, who have long ago paid off their homes, will take the prop tax hit.

How about meet down the middle. Let jumbo or $750k mortgages be deductible, and property taxes up to $7500/year? If not, then the elderly, who have long ago paid off their homes, will take the prop tax hit.

Good idea, Jeeman!