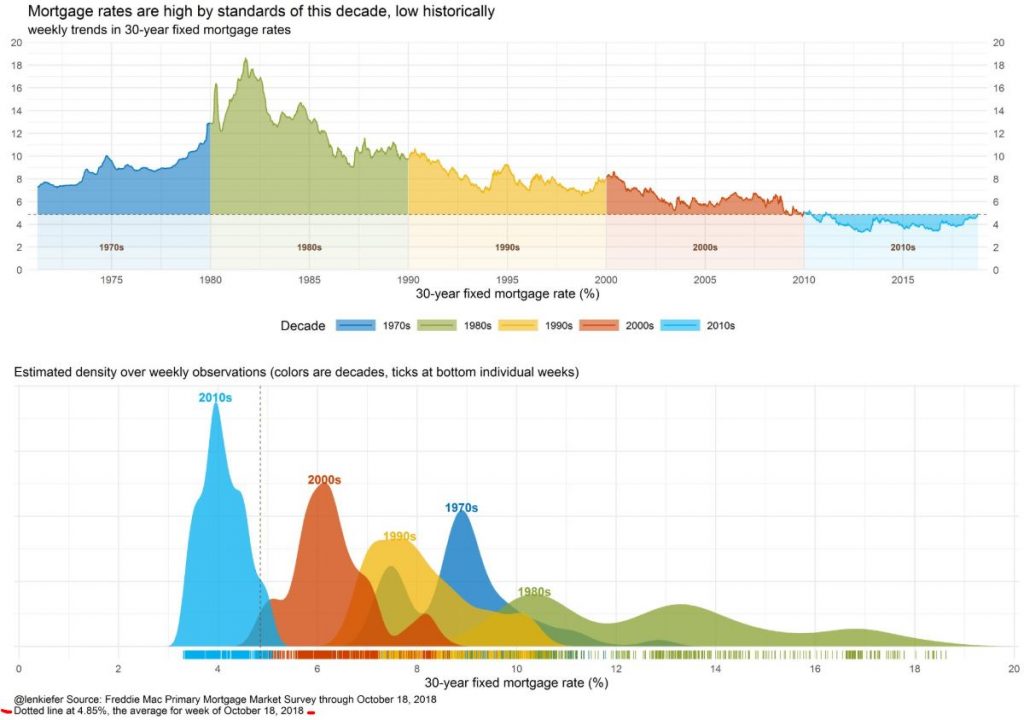

For those who insist on reminding us that rates are still historically low, here’s a colorful demonstration of where we’ve been. Today’s rates are as high as we’ve seen this decade – which is all people remember! (Click to enlarge)

5 Comments

Jim Klinge

Klinge Realty Group

Are you looking for an experienced agent to help you buy or sell a home?

Contact Jim the Realtor!

- 682 S. Coast Hwy 101, Suite #110

Encinitas, CA 92024 - (858) 997-3801 call or text

- klingerealty@gmail.com

CA DRE #01527365, CA DRE #00873197

View More Interest Rates

Trustindex verifies that the original source of the review is Google. We sold a home with Jim and Donna and from beginning to end they were consummate professionals. Their initial walk through the property resulted in a list of items to be repaired or updated. They supplied a list of vendors and job quotes to do the repairs and updates. We originally wanted to sell ‘as is’ and just get it over with. They gave us a selling price for ‘as is’ and options for doing a few updates/repairs to doing it all with the selling price for each option. We agreed to do all they suggested and we sold for the exact price they predicted. For every dollar spent we got back more than $2 back in the selling price. And they got that price in a rising interest rate environment! Donna and Jim are extremely detailed and guide you through ever aspect of the sale. There were no surprises thanks to their guidance. We couldn’t be more pleased with their representation. Thank you Donna and Jim, Jerry and MaryTrustindex verifies that the original source of the review is Google. We have known Jim & Donna Klinge for over a dozen years, having met them in Carlsbad where our children went to the same school. As long time North County residents, it was a no- brainer for us to have the Klinges be our eyes and ears for San Diego real estate in general and North County in particular. As my military career caused our family to move all over the country and overseas to Asia, Europe and the Pacific, we trusted Jim and Donna to help keep our house in Carlsbad rented with reliable and respectful tenants for over 10 years. Naturally, when the time came to sell our beloved Carlsbad home to pursue a rural lifestyle in retirement out of California, we could think of no better team to represent us than Jim and Donna. They immediately went to work to update our house built in 2004 to current-day standards and trends — in 2 short months they transformed it into a literal modern-day masterpiece. We trusted their judgement implicitly and followed 100% of their recommended changes. When our house finally came on the market, there was a blizzard of serious interest, we had multiple offers by the third day and it sold in just 5 days after a frenzied bidding war for 20% above our asking price! The investment we made in upgrades recommended by Jim and Donna yielded a 4-fold return, in the process setting a new high water mark for a house sold in our community. In our view, there are no better real estate professionals in all of San Diego than Jim and Donna Klinge. Buying or selling, you must run and beg Jim and Donna Klinge to represent you! Our family will never forget Jim, Donna, and their whole team at Compass — we are forever grateful to them.Trustindex verifies that the original source of the review is Google. WeI had the pleasure of working with Klinge Realty Group to sell our home in Carmel Valley, and I cannot recommend them highly enough! Jim and Donna demonstrated exceptional professionalism, offering expert guidance on market conditions and pricing strategy, which resulted in a quick and successful sale. Communication was prompt and we were well-informed throughout the entire process. For anyone looking for a dedicated and knowledgeable real estate team, look no further! ---Trustindex verifies that the original source of the review is Google. Donna and Jim Klinge of Klinge Realty Group have our highest possible recommendation. From Donna and Jim’s first visit to our house through closing their advice and counsel was candid and honest in all dealings. They kept us fully informed throughout the process. The house sold less than three days after listing with a two-week closing. My wife and I have sold several houses during our lives. This was by far the best experience. Klinge Reality is a premium service realtor. You can’t make a better choice for someone to sell your home fast and for top dollar.Trustindex verifies that the original source of the review is Google. Donna and Jim provided exceptional support and professionalism throughout the entire process. We couldn't have been happier with their efforts. They made our house shine, and thanks to their expertise, it sold above the listing price in the very first weekend! Truly a fantastic experience from start to finish.Trustindex verifies that the original source of the review is Google. This year has been difficult on our family, mainly due to having to sell our home. Thankfully we knew God had a plan for us and working with the Klinge team was a key part of it. It was an obvious decision to work with them again after such an amazing experience when purchasing the same home we needed to sell. The challenge was, how will we do this in so little time with so much going on? Jim and Donna held our hand every step of the way. Whenever an unexpected issue arose they found and provided a solution. Never once did we feel pressured to make a decision and the Klinges were always reassuring after providing the information that the decision was ours to make. Despite the curve balls, they never panicked and exemplified the “can do” attitude, making us feel optimistic and taken care of. Their expertise and professionalism was superb. But of all the reasons to work with the Klinges, the most impactful and valuable is their compassion and genuine care for their clients. We pray that we can one day purchase our forever home and you better believe that Jim and Donna will be representing us - as long as they will have us of course. Thank you again Klinge team! Your execution, experience, and care are unmatched.Trustindex verifies that the original source of the review is Google. Jim and Donna were fantastic! Jim understanding my needs, recommending potential places, pointing out the pros and cons of each property was invaluable. Then when the offer was accepted Donna’s organized guidance through the inspections, paperwork etc made the whole process seem effortless. So grateful that I had them on my side!Trustindex verifies that the original source of the review is Google. We first found Jim through his blog at bubbleinfo.com, which really showcased his knowledge of SoCal real estate. Since then we've done three transactions with Jim and Donna, and they are an incredible full service agency, with Jim's deep market insight and Donna's deft contract and project management. We trust them implicitly in their analysis and strategy, which is based on years of experience. They're always available and on top of things, and we strongly recommend them to anyone.Trustindex verifies that the original source of the review is Google. The Good The Klinge Realty Group operates like a finely tuned machine, with a very personal touch. We contacted them on a Sunday and they were talking to us about our family and our needs on our living room couch the following day. They carefully listened to us and worked with us to identify the best and quickest path to listing within 2 weeks to take advantage of the low inventory conditions in our South Carlsbad neighborhood. They knew our tract specifically and had many previous sales there over the years - they came prepared with a thorough analysis of comparative sales and recommended a pricing strategy that they felt confident would yield offers the first weekend on the market. The Great Over the next two weeks Donna coordinated a range of vendors who she knew from experience could get the preparation to list work we needed done on time and with high quality. Our light tune-up involved excellent experiences with their stagers, landscapers, contractors, electricians, and plumbers. Throughout this period Donna's daily communication was clear, concise, and responsive. Any time we had questions Donna picked up the phone or texted immediately - but almost always, she answered our questions before we even knew we had them. The Outstanding We had a tricky situation with a shared fence that could have delayed our escrow. Donna used superb mediation skills to negotiate the terms of replacement and was personally on site with the fence contractor to make sure everything went smoothly. The fence looks great and escrow closed on time. The Truly Exceptional Our house came on the market on a Wednesday and between then and Monday morning Jim was personally at all three open houses. He was in constant communication explaining potential buyer reaction and strength. As he predicted offers began to come in on Saturday and each one was incrementally higher than the last. At the end we had 5 offers, 4 of which were over list, and the final accepted offer was $100,000 over list. In addition to being over list it included rent back terms that met our needs. The Recommendation For all of these reasons we would strongly recommend The Klinge Team to anyone wanting to sell in North County Coastal San Diego. I had been reading Jim's bubbleinfo.com blog for 15 years and knew when the time came to sell that he would be our first call. Jim Klinge is not your standard realtor. He is keenly aware of market conditions and sales strategies. And, works his tail off - though not as hard as Donna . At this point he's gone from realtor to friend and I plan to have him over to grill and chill at our new place to talk real estate, but also just about life and raising kids in San Diego. He's more interested in relationships than his sales numbers - and that's why his sales numbers are so high. We have already recommended the Klinge's to some close friends and another successful sale is on deck right around the corner...Trustindex verifies that the original source of the review is Google. We recently had the pleasure of working with Jim and Donna from Klinge Realty Group to sell our house, and we couldn't be more satisfied with the experience. From the initial meeting, they listened attentively to our needs and provided invaluable guidance on specific improvements to get our home market ready. Their responsiveness throughout the entire process was truly impressive. Anytime we had questions or concerns, they were quick to address them, ensuring we felt comfortable and informed every step of the way. What stood out the most was their team and extensive network of tradespeople, which made addressing any necessary repairs or updates seamless and stress-free. Thanks to their expertise and dedication, our house sold quickly and at a great price. We highly recommend Jim and Donna to anyone looking to buy or sell a home. They are a fantastic team who truly care about their clients and deliver exceptional results.Load more

Every lender does rate buydowns, so if today’s 5.25% at no points isn’t good enough, any buyer or seller can pay to get a better rate.

The cost?

It’s roughly 1% of the loan amount to lower the rate by 1/4%.

Get the seller to pay 2%, and save 1/2% in rate!

Oct 29 2018, 4:22PM

Mortgage rates didn’t move today, despite a fair amount of underlying market volatility. Rates are able to weather the sorts of storms you hear about in the stock market in part due to the diminishing returns of stock market drama on the bond market. Along those same lines, the bonds that underlie mortgages specifically don’t tend to react to stocks as much as mainstream bonds like US Treasuries.

Holding steady today means that rates remain at their lowest levels in just over 2 weeks. That sounds like a good thing, but the catch is that we really haven’t moved too far from recent highs during that time, and those are the highest highs in more than 7 years.

The rest of the week keeps the volatility potential high. There are several important economic reports, culminating in Friday’s big jobs report. Earnings season remains in full swing with bigger name companies reporting toward the end of the week. Beyond that, the end and beginning of the month is typically a more active time for bond traders. All of that adds up to the risk that we could see bigger swings in rates than we have seen in recent weeks.

Loan Originator Perspective

Bonds gave back a portion of last week’s gains today, while remaining near the best levels since early October. It looks like our mini-rally may be losing steam, I’m locking loans closing within 30 days and discussing locks for those within 45 days. We COULD see some month end demand (which would help pricing) over the next few days, but I’m not banking on it. -Ted Rood, Senior Originator

In my opinion it’s a good time to lock in the recent pricing gains. Not seeing a lot of impetus right now for rates to push lower. -Timothy Baron Licensed Loan Originator, NMLS #184671

Today’s Most Prevalent Rates

30YR FIXED – 4.875-5.0% (no points)

FHA/VA – 4.5%

15 YEAR FIXED – 4.5%

5 YEAR ARMS – 4.25%-4.75% depending on the lender

http://www.mortgagenewsdaily.com/consumer_rates/882088.aspx

Not making much sense, with such a sharp rate rise, how can MSP still be increasing, I know I can’t pull an extra $2-300/mo outta my butt, what were these buyers doing last year than they think now with an even higher payment that the house still makes sense…

Buyers just get less for the money.

It keeps the pressure on. Those who are watching daily see each house get listed for more than the last one.

It is a turbo-charged merry-go-round. Grab on at your own risk.

This was five years ago. Today is 10/29/2023 and the rates are: 30 Year Fixed: 7.88%, 30 Year Jumbo: 8.01% War in Ukraine/Russia and war in the Middle East, Israel/Hamas and The Fed doing QT to fight record high inflation after a global pandemic in 2020. Let’s see what happens in the next five years!