We have known Jim & Donna Klinge for over a dozen years, having met them in Carlsbad where our children went to the same school. As long time North County residents, it was a no- brainer for us to have the Klinges be our eyes and ears for San Diego real estate in general and North County in particular. As my military career caused our family to move all over the country and overseas to Asia, Europe and the Pacific, we trusted Jim and Donna to help keep our house in Carlsbad rented with reliable and respectful tenants for over 10 years.

Naturally, when the time came to sell our beloved Carlsbad home to pursue a rural lifestyle in retirement out of California, we could think of no better team to represent us than Jim and Donna. They immediately went to work to update our house built in 2004 to current-day standards and trends — in 2 short months they transformed it into a literal modern-day masterpiece. We trusted their judgement implicitly and followed 100% of their recommended changes. When our house finally came on the market, there was a blizzard of serious interest, we had multiple offers by the third day and it sold in just 5 days after a frenzied bidding war for 20% above our asking price! The investment we made in upgrades recommended by Jim and Donna yielded a 4-fold return, in the process setting a new high water mark for a house sold in our community.

In our view, there are no better real estate professionals in all of San Diego than Jim and Donna Klinge. Buying or selling, you must run and beg Jim and Donna Klinge to represent you! Our family will never forget Jim, Donna, and their whole team at Compass — we are forever grateful to them.

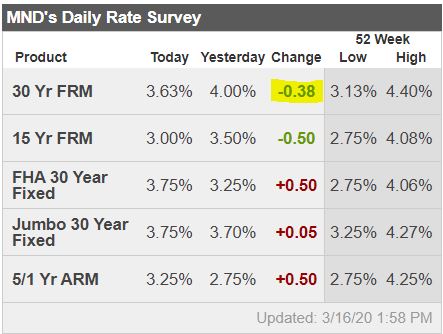

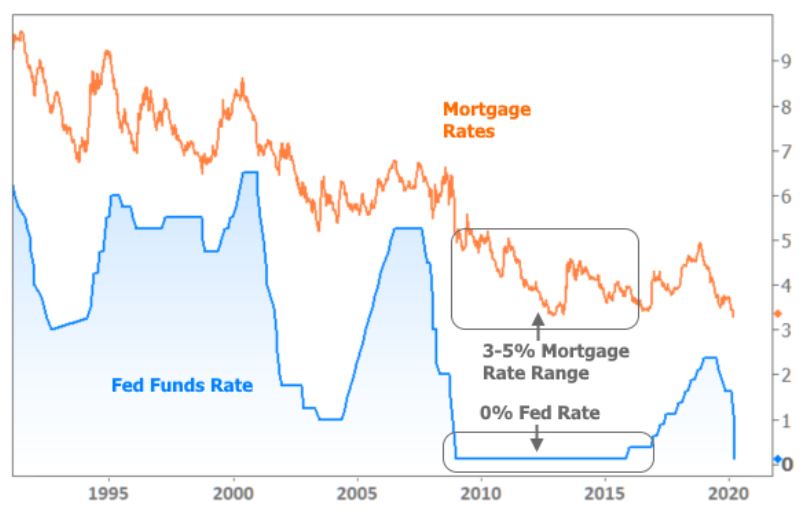

If you need a piece to hand out to people who don’t understand what this actually means for mortgage markets (or if that’s you, which is OK too), read this: http://www.mortgagenewsdaily.com/consumer_rates/938844.aspx.

If you don’t click links (and you should make an exception with the above if you said “yes” to either question), here’s the gist:

The Fed was going to cut rates to zero this Wednesday and announce a QE package, but they did it via emergency meeting/announcement on Sunday

The QE package included plenty of Treasury purchases, but also threw a bone to MBS with $200bln of new MBS purchases + $20bln in reinvestments from portfolio proceeds (these had been going into Treasuries).

That might sound like a lot of MBS, but it’s not even 2 months’ worth in this environment (assuming the pace of origination would be maintained… not a given). It is, however, extremely helpful for the ability of the mortgage market to keep pace (better pace, anyway) with Treasury benchmarks.

That said, I wish the Fed would have merely offered reassurance about potential MBS purchases and waited to pull the trigger for a few days so we could have seen how this morning would have traded without them. Clearly, buyers have the money and the ability to bring prices back up because prices are already close to 2 full points higher from Friday and the Fed buying doesn’t start until later this morning.

If we had to guess what the effects of a Treasury rally + big, guaranteed buying from the Fed would do to the chaos seen in MBS last week, we very well may have pinned the tail on this donkey somewhere better than halfway back to the recent highs. It feels logical from a “warm bowl of porridge” standpoint. And doesn’t warm porridge always just sound so great?

I was barely 15s into reading the article before I snoozed off.

Here is my response to the Fed and market conditions:

give us our rightfully deserved cheap money right now or we won’t buy jack squat!!

I can wait.

Hello Jim,

Just a little FYI on the shock that everyone is going through right now that hasn’t resonated into the buying public but will very soon. The Corona virus will come and go and will be with us forever just like the regular flu but a little bit more deadly than the flu is. That’s not the real problem here. What the world will probably not recover from for quite possibly the rest of an average age persons lifetime is the now unfolding economic carnage of the “End of Work”. Many closing businesses, factories, shops, dealers, restaurants, airlines, tourism etc…. will never recover or re-open. Massive bankruptcies loom very large on our horizon. Market capital and credit destruction/disruption on this scale will take decades to heal from. Confidence collapse alone is enough to keep millions away from ever trusting anyone wearing a suit and tie or a power dress ever again. We are all still in shock. The breakdown takes days to weeks just like an accident takes seconds to occur. It’s the weeks and months of healing and therapy the accident victim goes through that changes everything. That’s what I’m saying here. We will never be living the way we were for the rest of our lifetimes. That’s how much damage is being done right now.

Thanks Terry!

To those who have a viable product or service, hang in there!

But I think what you are saying is those who provide a marginal or useless product or service will be exposed in a very non-friendly way.

Realtors are on that list, especially with disrupters trivializing our contributions. They make it sound like buyers & sellers don’t need help – all you need is an app. Their app.