We’re doing fine here at headquarters – how about you?

We’ve primarily worked out of the house for the last 17 years, so we aren’t experiencing any disruption just because we’re stuck at home. We’re still having two listings being prepped for market, and haven’t had any escrows fall out yet. So far, so good.

Our boss suggested that we don’t do open houses for the foreseeable future, and to use gloves and sanitizer for individual showings. Tours via FaceTime or Skype are encouraged as well.

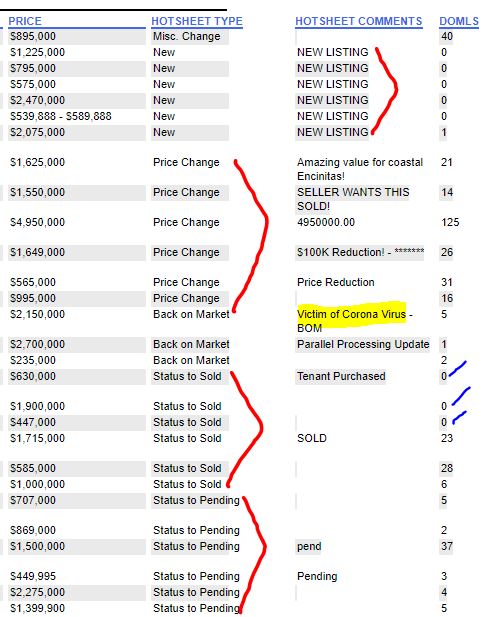

Here’s a snapshot of my hotsheet this morning – an equal compliment of new listings, price changes, solds, and new pendings (six each):

The volume will be light, but as long as we keep seeing new pendings, the market is working!

From the big boss in NYC:

From this evenings Goldman Sachs call (attended by over 1500 companies):

“50% of Americans will contract the virus (150m people) as it’s very communicable. This is on a par with the common cold (Rhinovirus) of which there are about 200 strains and which the majority of Americans will get 2-4 per year.

70% of Germany will contract it (58M people). This is the next most relevant industrial economy to be effected.

Peak-virus is expected over the next eight weeks, declining thereafter.

The virus appears to be concentrated in a band between 30-50 degrees north latitude, meaning that like the common cold and flu, it prefers cold weather. The coming summer in the northern hemisphere should help. This is to say that the virus is likely seasonal.

Of those impacted 80% will be early-stage, 15% mid-stage and 5% critical-stage.

Early-stage symptoms are like the common cold and mid-stage symptoms are like the flu; these are stay at home for two weeks and rest. 5% will be critical and highly weighted towards the elderly. Mortality rate on average of up to 2%, heavily weight towards the elderly and immunocompromised; meaning up to 3m people (150m*.02).

In the US about 3m/yr die mostly due to old age and disease, those two being highly correlated (as a percent very few from accidents).

There will be significant overlap, so this does not mean 3m new deaths from the virus, it means elderly people dying sooner due to respiratory issues. This may however stress the healthcare system.

There is a debate as to how to address the virus pre-vaccine.

The US is tending towards quarantine. The UK is tending towards allowing it to spread so that the population can develop a natural immunity.

Quarantine is likely to be ineffective and result in significant economic damage but will slow the rate of transmission giving the healthcare system more time to deal with the case load.

China’s economy has been largely impacted which has affected raw materials and the global supply chain. It may take up to six months for it to recover.

Global GDP growth rate will be the lowest in 30 years at around 2%.

S&P 500 will see a negative growth rate of -15% to -20% for 2020 overall.

There will be economic damage from the virus itself, but the real damage is driven mostly by market psychology. Viruses have been with us forever. Stock markets should fully recover in the 2nd half of the year.

In the past week there has been a conflating of the impact of the virus with the developing oil price war between KSA and Russia. While reduced energy prices are generally good for industrial economies, the US is now a large energy exporter, so there has been a negative impact on the valuation of the domestic energy sector. This will continue for some time as the Russians are attempting to economically squeeze the American shale producers and the Saudi’s are caught in the middle and do not want to further cede market share to Russia or the US.

Technically the market generally has been looking for a reason to reset after the longest bull market in history.

There is NO systemic risk. No one is even talking about that. Governments are intervening in the markets to stabilize them, and the private banking sector is very well capitalized.

It feels more like ?9/11? than it does like 2008.”

> We’re doing fine here at headquarters – how about you?

Chance for spring cleaning in the Dawghaus. Mrs. Dawg is managing/supervising her therapists from Redding to OC (~600 miles) from the couch. Her scheduled road trip “meet and greet” similar to a brokers tour has been canceled. Our little one is doing her tele-ed to Cal State Fullerton from here. The campus is closed to all unessential. I’ve just stopped going to the Goodwill Outlet. We’ve got plenty of beer wine and gin along with non-essentials like food.

While your big boss makes some good points, especially “9/11” vs “the financial crisis” he glosses over the problems with large interconnected economies. One sector stopping cascades into other sectors and it takes far longer to restart than to stop. He’s also incorrect (oversimplifying) about the oil price war. The US is a modest net exporter of petroleum products but consumes so much domestically that low prices help everyone except marginal (expensive) producers (sands/shale) and perhaps stockholders.

This is a fall on your face moment not a stumble while running.

Ok – and that is Goldman Sachs commenting – the big boss was taking notes.

We’ve got plenty of beer wine and gin along with non-essentials like food.

LOL 🙂

“We’re doing fine here at headquarters – how about you?”

Mahalo for asking, Jim. We’re still toasting you after locking in a 2.875%/30 fixed last week. (We know it may go lower but we’re ecstatic nonetheless.)

We’re newlyweds! Of course, we’re happy! 🙂 The fridge is packed but I’m out of essential emergency food like Trader Joe’s chocolate. “Husbandy” says he’ll do his best to find them.

As far as the RE market here, some say we’re back to being the hottest market in the U.S.

Here are the stats, and it’s shocking to me. I don’t know if listings were removed because of the concern of strangers walking through your house, or if the market is REALLY this hot. Never seen it like this in 10 years.

Boise: 579 listings (includes land), 327 SFH, only 7 open houses this weekend.

Meridian: 470 listings, 409 SFH, 23 open houses this weekend. Even when the inventory was very tight I remember the numbers were more like 989+ available.

*Wink* Please tell Donna I love her t-shirt. If you have an extra, I promise a batch of my world-famous chocolate chip cookies–sometime in the future. And yes, thanks Rob_Dwag for the chuckles!