Prices dropping in the ‘low single digits’ doesn’t sound like a frozen or desperate market. Their first story is about a guy who is looking at homes in Florida priced at $15 million? That’s relevant to the national housing market?

Jim Morris is on the hunt for a South Florida mansion, at a bargain price. He’s got money to spend and few competitors house-shopping during a pandemic. He just needs to find a motivated seller willing to make a deal.

This is what’s left of the U.S. housing market. With stay-at-home orders canceling open houses and social distancing requiring no-touch closings, most buyers and sellers are deciding to just wait.

That leaves opportunistic buyers like Morris, whose food-packaging company has shifted into high gear. With Americans hunkered down at home, stocking up on frozen foods and other essentials, his revenue shot up 300% in March, he said.

“If your house is on the market a buyer is going to assume it’s a sale by necessity,” said George Ratiu, senior economist at Realtor.com. “If you don’t have to sell right now, why would you? There will still be transactions, but the number will be so low.”

Already, there’s been a dramatic pullback in listings at a time of year when they’re typically increasing. The number of homes pulled from the market doubled in the week ended April 3, according to Redfin.

As sales slump, home prices will fall later this year and early next in the “low single digits” nationwide, according to Mark Zandi, chief economist at Moody’s Analytics. The declines may be more pronounced in West Coast markets, which were already overvalued relative to incomes, he said.

The housing market, typically 15% to 18% of the economy, has all but shut down. Forget the key spring selling season, the real estate equivalent of Christmas for retailers. Even the summer may be a bust. For the deals that do happen, closings can look like a scene from “All the President’s Men.”

Over the next several months, millions of homeowners will double up with friends and family because of the financial impact of the coronavirus, said Ed Pinto, the director of the Housing Center at the conservative American Enterprise Institute.

While listings will plunge, demand will fall faster, eventually creating a glut of available homes that will give buyers even more of an upper hand, he said. Nationally, Pinto sees home values slipping 1% to 2% in May from a year earlier, and as much as 4% to 6% by the end of June.

“We’re going to get to a point in June or July where we’re going to have 10 months of supply,” Pinto said. “At 10 months of supply, housing prices get impacted pretty substantially.”

The New Jersey market, for example, is about to get crushed.

Home sales in the state, second only to New York in coronavirus cases, may fall as much as 45% this year from 2019, while prices will drop as much as 12%, according to Jeffrey Otteau, president of Otteau Valuation, a real estate consultant in Matawan, New Jersey.

“People will be taking homes off the market and in spite of that, this will be a buyer’s market, with low inventory,” Otteau said. “It’s unusual.”

Distressed Sellers

So far, sellers aren’t racing to lower their prices. The median asking price across the U.S. rose 1% to $309,000 in the week ended March 29, from a year earlier, Redfin data show. The peak of $330,000 was a month ago.

Only 52 listings in Manhattan made price cuts in the period between March 22 and April 6, compared with 663 in the same two-week period last year, according to a study by New York listings data website UrbanDigs.

Still, some sellers are adjusting their expectations. Sadie Mackay, a 29-year-old product manager for Amazon.com Inc. who recently bought a single-family home in Seattle, is getting ready to list her one-bedroom condo close to the company’s headquarters. Its location, also near Google and Facebook Inc. offices, will help. Even so, Mackay said she’s not planning to price her condo aggressively.

“It’s going to become a hot potato if I can’t sell it for a few months,” she added.

To prevent a full-blown foreclosure crisis, the government is allowing borrowers to pause mortgage payments with no penalty. The Federal Reserve, which dropped its benchmark lending rate to near zero, has pledged to buy unlimited amounts of mortgage bonds. That should help to keep mortgage rates low.

Homeowners who take advantage of enhanced unemployment insurance ideally won’t be forced to sell properties at fire-sale prices, according to Lawrence Yun, chief economist at the National Association of Realtors.

The experience of Michelle Medina Bunting, 34, and her husband, Tim, 35, who rent on the Upper West Side of Manhattan, suggests that sellers are in a mood to discount.

The couple last month made a $990,000 offer on a renovated two-home property in Jersey City that was listed for $1.3 million. After some negotiation, they couldn’t reach agreement and moved on.

“Now, that agent has been calling us and saying, ‘Do you want to make another offer?’” Michelle Bunting said.

Morris, who’s still looking for his Florida mansion, considered a nine-bedroom Fort Lauderdale property with a six-car garage and boat dock before coronavirus shut down the economy. The owner insisted he was firm at $15 million. But last month the owner called him to knock off 20%.

“I am expecting more of that — there are going to be distressed situations and distressed situations lead to opportunities,” Morris said. “I don’t want to overpay because we don’t know what the new market will look like when this is all over. What may look like a bargain today may actually be too high.”

The Fed is doing a fantastic job supporting lower mortgage rates, and if the less-motivated sellers and buyers wait it out, then fine – we will have fewer sales. The homes that do sell will be at prices around the recent comps.

Buying a home during the virus will be the new badge of honor, like bank-owned properties were last time. We sold the REOs for full retail – there were very few deals.

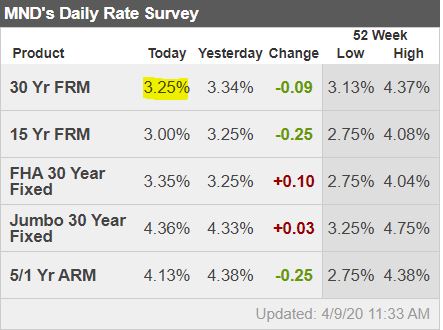

for us in CA, how does one get a hold of those non-jumbo 30 yr FRM rates?

It varies by county – our FNMA loan limit is $510,400, and with good credit and 20% down you should be able to find 3.25% at most places.

It’s just a matter of the costs – the rates published by MND are supposed to be with no points.

This just sold for almost 150K over asking. The house is very well done, has a lot of character, and located on a wonderful street in University Heights but even in a typical market that seems to be pushing it.

https://www.redfin.com/CA/San-Diego/4727-Panorama-Dr-92116/home/5254862

This went pending on March 10th so the corona was on the front page by then – and still sold for $38,000 over list for a split-level:

https://www.redfin.com/CA/Del-Mar/14256-Pinewood-Dr-92014/home/4433236

(LP = $1,749,000)

The market has legs…

Was told that University Heights property had 7 offers and the winning bid was all cash with 14 day escrow!

It sure would be nice if NAR, CAR or other industry titans would step up to the microphone.

Instead, we get TV flippers being called “experts” who are just talking their book:

https://www.ccn.com/sell-now-real-estate-guru-warns-housing-market-collapse-is-coming/

Jim, any idea when the non-qm loans will come back? How long did it take last time after the 08 crash?

The mortgage business needed re-construction last time.

This time?

The big banks should be fine going back to 10% down payments as soon as they see prices are stable. Maybe for the 2021 selling season?

Somebody needs to buy those alt-doc jumbo loans that qualify the self-employed by their bank statements (which is a great way to judge actual income….and expenses). There will be many mortgage companies that won’t survive this – wholesale and retail.

More doom – she left out the U.S. being hit by an asteroid:

https://www.bloomberg.com/opinion/articles/2020-04-10/coronavirus-fallout-u-s-housing-prices-will-tumble

The capping of deductions at $10,000 has already led to a 10% to 25% discount on home prices in high tax states relative to their lower-tax counterparts. Anticipated increases in property taxes to offset collapsing state and municipal budgets will amplify the damage inflict on those on fixed incomes.

A complete unknown that could increase the coming surge in supply is the pool of single-family rentals. About eight million landlords who own between one and 10 properties accounting for half the nation’s rental properties, according to Avail, a software company that caters to landlords. Financial duress will come swiftly for those carrying multiple mortgages. Also, a small cohort of institutional investors own roughly 250,000 of the roughly 16 million pool of rental homes, according to ATTOM Data Solutions.

Making matters worse is the crash in demand for jumbo mortgages, which are those over the $510,400 conforming loan ceiling. Wells Fargo & Co. recently announced that it was halting the purchase of jumbo mortgages that originate from other lenders. Investors are sticking with government-backed loans which have greater security given payments will still be received even if borrowers have been granted forbearance. In the last downturn it took almost five years to close the premium charged to attain a jumbo mortgage over rates on conforming mortgages.

And finally, there are more than nine million second homes in the U.S. that may or may not be financially viable given the depth of the current recession. Lending standards tightened dramatically in the last recession as the unemployment rate crested at 10%. It’s difficult to imagine the challenge prospective homebuyers will face in the coming years given we know a 10% jobless rate is not a best-case scenario.

It’s also impossible to quantify how Americans will perceive homeownership given the hardship so many will endure. If frugality is embraced as it was after the Great Depression, homes will once again be viewed as a utility. The McMansion mentality is at risk of extinction.

The reason why the collapse in the subprime mortgage market hit the housing market so hard was because the lead up was predicated on the fact that there had never been a nationwide decline in home prices. But now for the second time in a little more than a decade, Americans are poised to witness the impossible.

We are rolling today – from the all-time doom master, the guy who has called eleven of the last two housing crashes. Here he suggests that seniors will both dump on price and be happy to pay capital-gains tax:

https://www.mhanson.com/4-9-hanson-housing-market-already-at-the-event-horizon/

I am not exactly sure how where this all goes because the playing field is different than the last time the economy hit extreme turbulence. But, there are risks in housing and mortgage markets that are flashing bright red, which I will identify, track and do my best to stay ahead of while this all plays out over a longer period of time than I think most expect.

My immediate concerns for US housing and prices isn’t from millions of Main Street foreclosures like last time, because there’s clearly no political appetite for that, and no such thing as Fed “moral hazard” this time.

Rather, the risk comes from plunging owner-occupied, organic sales volume across every house price band. Of course, volume precedes price, a huge headwind. But, when owner-occupied, high-leverage Government loans to buy houses goes away – not to mention jobs — so does the ability to buy and over-pay. Remember, in 2008, house prices didn’t “crash” in a vacuum. They simply followed the earnings and purchasing power of the dominant buyer cohort much lower.

Bottom line, if buyers can afford 20% less using the most prevalent mortgage financing, then that’s where prices will go, fast. And if house prices gap down 20%, then it brings into play all sorts of credit risk and plumbing issues we encountered in the GFC. But, that’s for a different note.

Back to the point of this note…”mix-shift”. Fewer organic transactions “increase” the share and weight of distressed, fear-driven, liquidity-motivated, and strategic transactions, which trade at a discount.

For example, the little-known cohort of MILLIONS of small, “ma and pa” independent landlords – many with lots of equity – are a huge risk to house prices. They fit into the all the buckets…distressed, fear, liquidity and strategic. Many bought from bag holders in the ashes of the GFC and have lots of equity. Their default plan was to do an easy sell to their tenants, but that’s out the window. Now, they are afraid of being the bag holders. Right now, millions of them are pondering, “humm, let’s sell quickly before the rush, lower our exposure, raise capital, pay cap gains, and have optionality to buy other stuff on big sale later this year and next. First loss is best loss!”.

With the “comparable sales approach” to valuation, all it takes is a few houses in a one-mile radius to sell – at perhaps a nice gain to the seller, but a 15% or 25% discount to present comparables — to set off a cascading effect.

This is only one immediate risk to house prices I have identified. There are many more and will put forth data and insight on those to follow.

Risk 1) 20 Million, 1 to 4 family rentals owned by nearly 9 Million small, independent landlords, of which two-thirds have little to no access to liquidity.

Single-fam landlords with of 20M properties with 48M residents are staring at a surge of unemployment, missed rental payments and unknowable property values in the near and mid term

There is no bailout program for them

Eviction moratoriums are in place in many states

Exit strategy was to sell to tenants when time is right but that’s out the window

55% of renters said they recently lost a job in a recent survey from Avail

They have 65% equity on average, many can sell quickly at a haircut, and raise capital for other investment like an Opportunity Zone or cheap stocks.

Many bought in the ashes of the GFC from bag holders and know they are at risk of being the bag holders.

Risk 1a) 22 Million multi-family units in 700k buildings owned largely professional investors, institutions, REIT’s, etc.

Headlines with datapoints of the hurricane coming at housing of all types including Ma and Pa landlords.

A) Small landlords struggle as renters either can’t or choose not to pay amid coronavirus layoffs

More than half (54%) of the renters said they had already lost their jobs due to the coronavirus outbreak, and of those, about a third said that if they couldn’t afford to, they would simply stop paying rent.

B) Over 30% Of US Renters Didn’t Pay April Apartment Rent

nearly one-third of apartment renters in the US didn’t pay any of their April rent during the first week of the month (The properties included are considered investment grade with a tenant base that may skew higher-income than the median renter.)

C) A massive wave of evictions is coming. Temporary bans won’t help

At the end of March that 44 percent of New Yorkers expected to have trouble making their April rent.

D) Americans Not Making Their Mortgage Payments Soar By 1064% In One Month

Overall, the MBA reports that total forbearance requests grew by 1,270% between the week of March 2 and the week of March 16, and another 1,896% between the week of March 16 and the week of March 30.

E) Purchase Index was 33 percent lower than the same week one year ago

F) Banks tighten lending to nervous homeowners hoping to tap equity

…led Bank of America to aggressively tighten its standards for home equity lines of credit, or HELOCs. Wells Fargo has taken similar actions, and JPMorgan may change its policies, too

PRIVATE MA AND PA LANDLORDS PRESENT A HUGE RISK TO HOUSE PRICES

My sister-in-law in Irvine is having people lining up to pay $3.4 million for her house. Latest offer is full price and stay until September.

But the doomers keep coming – where are the real estate industry titans to speak about the reality?

http://www.doctorhousingbubble.com/housing-market-has-come-to-a-crashing-stop-1-3-of-tenants-not-paying-rents-great-park-in-irvine-drops-to-almost-no-sales-and-socal-housing-collapses-to-6-year-lows/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+DrHousingBubble-HowILearnedToLoveSocal+%28Dr.+Housing+Bubble+-+How+I+learned+to+Love+SoCal%29