We have known Jim & Donna Klinge for over a dozen years, having met them in Carlsbad where our children went to the same school. As long time North County residents, it was a no- brainer for us to have the Klinges be our eyes and ears for San Diego real estate in general and North County in particular. As my military career caused our family to move all over the country and overseas to Asia, Europe and the Pacific, we trusted Jim and Donna to help keep our house in Carlsbad rented with reliable and respectful tenants for over 10 years.

Naturally, when the time came to sell our beloved Carlsbad home to pursue a rural lifestyle in retirement out of California, we could think of no better team to represent us than Jim and Donna. They immediately went to work to update our house built in 2004 to current-day standards and trends — in 2 short months they transformed it into a literal modern-day masterpiece. We trusted their judgement implicitly and followed 100% of their recommended changes. When our house finally came on the market, there was a blizzard of serious interest, we had multiple offers by the third day and it sold in just 5 days after a frenzied bidding war for 20% above our asking price! The investment we made in upgrades recommended by Jim and Donna yielded a 4-fold return, in the process setting a new high water mark for a house sold in our community.

In our view, there are no better real estate professionals in all of San Diego than Jim and Donna Klinge. Buying or selling, you must run and beg Jim and Donna Klinge to represent you! Our family will never forget Jim, Donna, and their whole team at Compass — we are forever grateful to them.

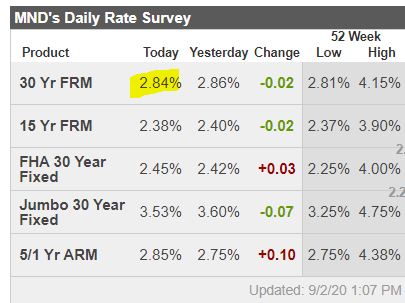

Rates at my credit union this morning:

-1.875% (15-yr Fixed Purchase)

-2.750% (15-yr Fixed Refinance)

-2.375% (30-yr Fixed Purchase)

-3.250% (30-yr Fixed Refinance)

Wish we could buy another house, Jim, but not much inventory out there! 🙂

Who ever thought we’d see mortgage rates lower than the inflation rate?????

Mortgage rates have improved noticeably in the past few business days, largely due to the delay of a new fee announced earlier this month.

Ironically, that same fee is the reason rates are about to move higher, just as many lenders are back within striking distance of all-time lows.

The fee applies to all refinances sold to the housing agencies Fannie Mae and Freddie Mac on or after December 1st. That may seem like a long time from now, but those sales tend to take place weeks after a loan actually closes. In fact, several lenders have already reintroduced the fee on loans locked for 60 days or more. For other lenders, it’s only a matter of time. Most lenders will announce their game plan for reintroducing the fee, but at least a few will just flip the switch with no advance notice.

How do you know if the fee applies to you? Simply put: it applies to almost every conventional refinance (not FHA/VA, Jumbo, or any other loans that don’t meet Fannie/Freddie guidelines).

Exceptions include loan amounts under $125k as well as HomeReady/Home Possible programs. And yes, there’s technically an exception if you’re refinancing a construction loan to long-term financing, but let’s be real. That’s only really a refi on a technicality.

The initial announcement of the fee sent shockwaves through the industry due to its heavy-handed implementation (i.e. it retroactively punished lenders to the tune of hundreds of millions of dollars on loans that were already locked). Unsurprisingly, lenders responded defensively as far as rates were concerned–raising costs to offset the big unexpected expense at the end of the month. After the delay was announced, things have steadily moved back in the right direction.

Does this mean rates won’t ever get back to all-time lows? Not at all. That’s almost exactly as possible as it was before the fee was announced. The only difference is that rates will have to drop roughly 0.125% (one eighth of one percent) farther than they otherwise would have.

http://www.mortgagenewsdaily.com/consumer_rates/953791.aspx