The prognostications are coming in about the direction of home prices.

It’s easy to predict that the market won’t be as hot as it’s been (or will it?).

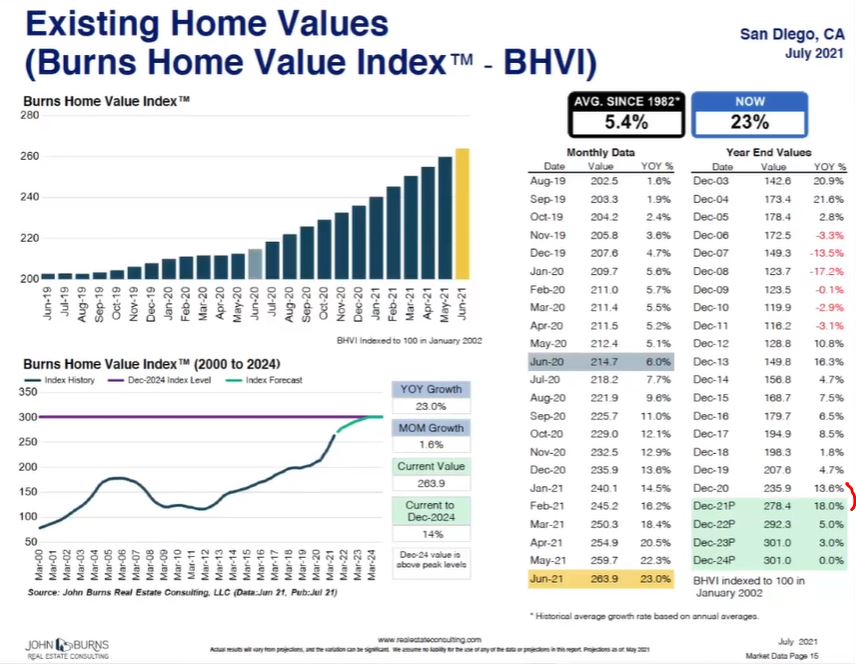

The Burns forecast will be as good any of the guesses, and don’t be surprised if all of them end up predicting a goose egg over the next 1-3 years as we pull in Plateau City. Sellers shouldn’t mind much, because they picked up a whopping 31.6% increase during the 2020-2021 Greatest Real Estate Frenzy of All-Time.

There will be some potential sellers – probably those who don’t need to move, have plenty of time, and aren’t going to give it away – who are waiting for the market to top out.

You can’t blame them. It’s been a hellava party over the last year, and they don’t want to leave any money on the table. They will be the sellers who provide the extra inventory that will help moderate the pricing.

But I’m going to take the OVER.

There are two things that can cause moderation; sales and pricing.

It’s likely that one of these two things will happen:

- Either sales will drop due to ultra-low inventory, and prices keep rising, or

- Inventory does increase a bit, which boosts sales – but causes prices to flatten.

The 31.6% increase in pricing did put a dent in the affordability, but homes were already expensive and available only to the affluent anyway. They will still have the horsepower to pay a little more in 2022 and 2023, but they will be more picky than ever about what they are willing to buy.

I’m taking #1, and guess that sales will drop, but sellers who can find a buyer will be getting a premium.

They are predicting that the BHVI will go up 5% next year, and 3% in 2023.

I think the BHVI will rise 10% next year, and 6% in 2023 – and agree with their 0% in 2024.

> Inventory does increase a bit, which boosts sales – but causes prices to flatten.

The Supply (low) / Demand (high) formula is so out of balance that a lot more inventory and a lot less demand will be necessary to flatten prices. At that, I doubt prices flatten so much as lesser houses sit longer while the prime properties continue their torrid pace. Now that people have adjusted to SALT caps even moderate interest rate increases may not be a damper. Frankly for the people who can buy houses there isn’t much else investmentwise to do with the money.

Agree, and there are more variables.

Just the adjustment by realtors to the post-frenzy environment will take a year to take hold. You know the sellers won’t believe they can’t get comps+10% until they try it for a while, and most agents have never seen anything but a good-to-great sellers market. It’s been 11 years now!

We will have frenzy pricing through the next selling season for sure. If you were on the market but didn’t sell in 2H21, you can always blame it on the variant.

> Agree, and there are more variables.

That’s why you pay me to post comments here. 😉 j/k

Remember taking the truck to listings to clear out the debris left behind?

I’d bet 3/4ths of the agents never even heard those stories.

Yes. The new “the dog ate my homework” is the “variant.”

Remember taking the truck to listings to clear out the debris left behind? I’d bet 3/4ths of the agents never even heard those stories.

Ahhh yes those were the days!

https://youtu.be/Q5ebxEaeMJQ

It sold for $187,000 in 2008. Zestimate is now $614,100.

https://www.zillow.com/homedetails/1027-Rhea-Pl-Vista-CA-92084/16632204_zpid/

Biodisco, high density neighbors, loud street and now $614k today. Even idiots like me could have made bank. And the step-side Chebby. Memories.