The folks at realtor.com think the San Diego-Carlsbad market will appreciate 4.8% next year. We’ll do that much in the first quarter! They expect inventory to rebound, and our sales to increase 0.2%.

The run on home prices is almost over.

At least that’s what economists at Realtor.com are projecting.

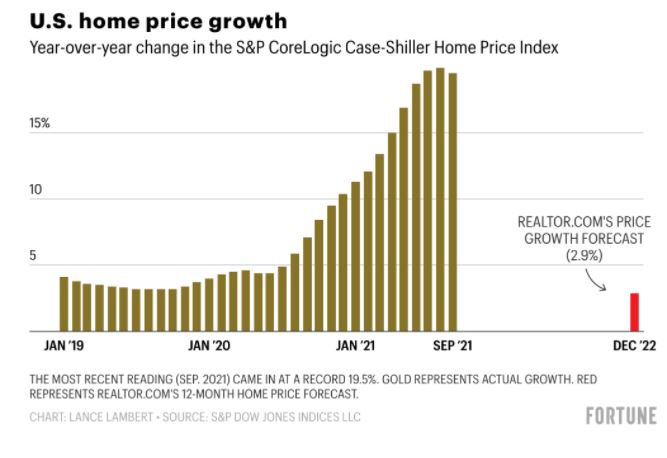

The real estate listing site, which is owned by News Corp, forecasts median existing home sales prices will rise 2.9% over the coming 12 months.

That would mark a substantial slowdown from the S&P CoreLogic Case-Shiller index’s latest reading of year-over-year U.S. home price growth (up 19.5% between September 2020 and the same month this year). If Realtor.com’s projection comes to fruition, it would also be the slowest 12-month rate of price growth since 2012.

No, this wouldn’t be a housing correction or crash. However, slower price growth would provide buyers a bit of breathing room. Less bidding. More time to search for homes. And maybe even a chance for some buyers to finally save up for a down payment.

“After years of declining, the inventory of homes for sale is finally expected to rebound from all-time lows…Homebuyers will have a better chance to find a home in 2022, but fierce competition and affordability continue to be a challenge,” wrote Realtor.com researchers in their outlook.

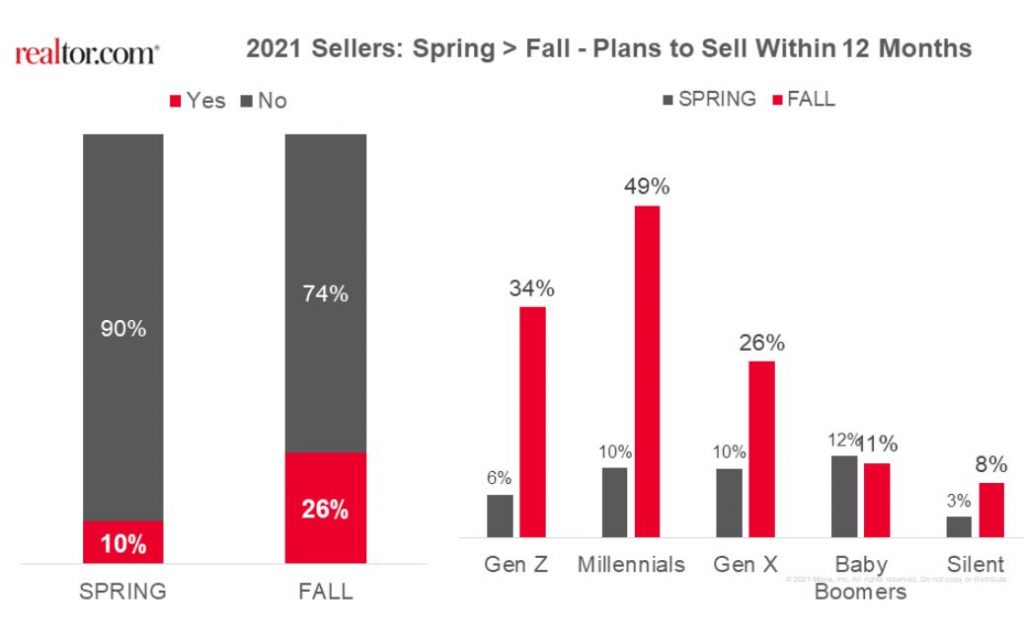

Their survey indicated that more people are planning to sell, so that’s good – though our coastal region is dominated by baby boomers, so we might not be as lucky as others:

Here is their explanation on why they think inventory will increase:

With homes selling and continuing to do so quickly, inventory will remain limited, but we expect to see the market rebound from 2021 lows. Inventory is expected to grow 0.3% on average in 2022. While buyers have been eager in the last 2 years, sellers have been on and off. A rising share of homeowners this fall reported planning to sell a home in the next 12 months could signal an improvement in this trend that has been a major challenge for the housing market. With 28% of homeowners choosing not to sell indicating that the reason for doing so is because they can’t find a new home to buy, a pick-up in inventory could be self-reinforcing, drawing out other potential sellers as they find homes to buy. Rising new construction will eventually feed into this positive trend as well, but first, builders’ pipelines catch up to the usual balance of already-completed vs. under construction vs. not yet started homes. Completed new homes have recently made up half their usual share of all new homes for sale while homes not yet started are twice as prevalent as usual. In other words, new homes are in many recent cases only a viable option if you can wait for the construction process to finish

The country’s housing market is expected to cool in 2022, as mortgage rates tick up and inventory grows, a panel of experts said at the National Association of Real Estate Editors conference on Thursday.

Home sales and prices are still expected to rise, but that growth will likely be much less than in 2021, CoreLogic Chief Economist Frank Nothaft, National Association of Realtors Chief Economist Lawrence Yun, and John Worth, executive vice president for research and investor outreach at Nareit, said at NAREE’s annual conference, held in Miami. The panel was moderated by Reno Gazette-Journal reporter Jason Hidalgo.

Yun said the residential market has experienced the strongest price appreciation in recorded history, adding, “Are we in a bubble?”

The states that are expected to see the highest price increases next year are Florida at 10.7 percent, South Carolina at 8.9 percent, and Maine at 8.6 percent, according to CoreLogic data. Louisiana, at 2.9 percent, and New York and Wyoming at 3.6 percent, each, could see the smallest growth in home prices.

“We are still down on inventory, but with each passing month, the decline appears to be less,” Nothaft said.

Sales growth will slow “due to rising anticipated mortgage rates and increased supply,” Yun of NAR said. While home sales increased by about 15 percent on average this year, they are only expected to rise by 2.8 percent in 2022, according to NAR data. Refinance activity is expected to drop by $1 trillion, or 50 percent, and the average credit score of those borrowers could also be lower than average.

It’s a hot December… I can’t imagine it being a cool selling season and omg what’s a 0.3% increase in inventory??

3/2, single story, no HOA, detach, Chula Vista… 7 houses.

That number shoots all the way to a MASSIVE 19 houses south of the 54.

Feels very hard to compete against.

This of course filters out townhomes (i’m in one, why would i move to another one?) and the new Village System of new soulless homes. I just can’t