One of the primary questions? How are the kids going to be able to buy a home?

If prices just stay at this level, it will be near impossible for local kids to save the down payment and afford the monthly nut when starter homes are selling for around $1,200,000.

Plus, there is the incentive now for seniors to hang onto the family homestead and then let one of the kids live there so they can keep the old property-tax basis. For kids who never left, they will live in the same home their whole life!

But if you have more than one kid, then what? It used to mean selling the family homestead and dividing up the loot, but today’s heirs probably own their current home too. Tomorrow’s heirs? Not so sure, which means more homes will stay in the family when the parents die, and fewer homes will be coming to market.

The tight inventory could get worse.

Because the majority of homes being purchased today are ‘forever’ homes and will be owner-occupied for generations, it narrows down the list of probable sellers to those who have owned their home for longer than 12 years, AND are selling for one of the Big Three reasons (death, divorce, and job transfer).

And the baby boomers are going to decide the outcome.

Baby boomers are:

- Still relatively young, and living longer than ever.

- Aging-in-Place, rather than pay the imposing tax penalty for selling before you die.

- Hoping a kid will inherit the house and live in it.

There may be a boomer-liquidation surge in the future, but it will be at least 5-10 years before it could happen on a larger scale. In the meantime, seniors will live comfortably in their old family homesteads, and probably be joined by as many kids as can fit.

The seniors who do move will be from these categories:

- Those buying a one-story house.

- Those buying a multi-gen house so kids can help with senior care.

- Those moving to assisted living.

- Those who will rent, at least for now.

Some may have to move out-of-town, but at least their pockets will be full of cash.

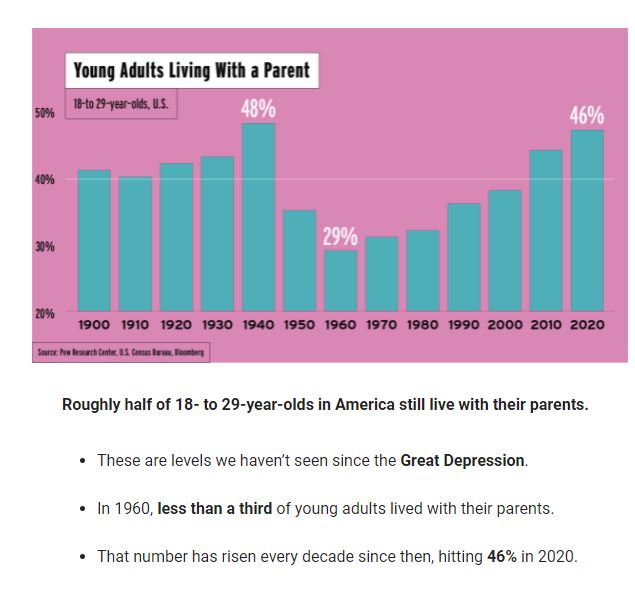

Once they take care of themselves, boomers are going to focus on their kids – many of whom are still hanging around the house!

It means the entry-level markets will be full of younger buyers backed by affluent parents and grandparents – and they are loaded. There is also the multi-gen buyers who are looking for larger homes that will suit the whole family – or they will buy the one-story home for the folks, and then leave the old house for the kids.

There really should be an extra premium available for those home types when they sell, given the demand. If you are going to sell one of those (entry-level, multi-gen, or one-story), then list your home with me, and I’ll make sure you get all you deserve!

Jim, I own over a dozen houses. I want to sell but I don’t want to pay the capital gains tax. Do you think in the future they will ease up on the capital gains tax because I know I would sell everything if they would waive it or reduce it significantly and that would open up a lot of inventory for others. And I don’t want to do a 1031 exchange

Do you think in the future they will ease up on the capital gains tax because I know I would sell everything if they would waive it or reduce it significantly and that would open up a lot of inventory for others.

Only if the politicians were forced to solve the housing crisis. It would be the #1 thing on my list on how to balance supply and demand within months.

#2 would be to expand the $500,000 tax-exempt benefit to $1,000,000 or more for the 2-out-of-5-year sellers.

Boomers are a rather selfish generation. Don’t expect them to be so willing to help their children. Not to mention with a second and third marriage, estates can get messy. Boomers on both coasts are banking on their home equity to get them through retirement. Many east and west coast boomers do not have enough liquid assets to make it through retirement without taping home equity.

I agree and I’ve predicted 5 of the last…..oh wait, we haven’t had a boomer liquidation event yet!

The local market is just for the affluent now. They have enough dough to help their kids out.

I am hopeful that those boomers who are closer to the edge will pack it up this year.

It would be an awesome frenzy if we just have 20% to 30% more listings than last year!

However, my hopes and dreams will go unanswered.

Today’s NSDCC 2022 listings count? 117. We’re going to be lucky to get to 200.

Last year there were 155 listings between Jan 1-15.