The Good

The Klinge Realty Group operates like a finely tuned machine, with a very personal touch. We contacted them on a Sunday and they were talking to us about our family and our needs on our living room couch the following day. They carefully listened to us and worked with us to identify the best and quickest path to listing within 2 weeks to take advantage of the low inventory conditions in our South Carlsbad neighborhood. They knew our tract specifically and had many previous sales there over the years - they came prepared with a thorough analysis of comparative sales and recommended a pricing strategy that they felt confident would yield offers the first weekend on the market.

The Great

Over the next two weeks Donna coordinated a range of vendors who she knew from experience could get the preparation to list work we needed done on time and with high quality. Our light tune-up involved excellent experiences with their stagers, landscapers, contractors, electricians, and plumbers. Throughout this period Donna's daily communication was clear, concise, and responsive. Any time we had questions Donna picked up the phone or texted immediately - but almost always, she answered our questions before we even knew we had them.

The Outstanding

We had a tricky situation with a shared fence that could have delayed our escrow. Donna used superb mediation skills to negotiate the terms of replacement and was personally on site with the fence contractor to make sure everything went smoothly. The fence looks great and escrow closed on time.

The Truly Exceptional

Our house came on the market on a Wednesday and between then and Monday morning Jim was personally at all three open houses. He was in constant communication explaining potential buyer reaction and strength. As he predicted offers began to come in on Saturday and each one was incrementally higher than the last. At the end we had 5 offers, 4 of which were over list, and the final accepted offer was $100,000 over list. In addition to being over list it included rent back terms that met our needs.

The Recommendation

For all of these reasons we would strongly recommend The Klinge Team to anyone wanting to sell in North County Coastal San Diego. I had been reading Jim's blog for 15 years and knew when the time came to sell that he would be our first call. Jim Klinge is not your standard realtor. He is keenly aware of market conditions and sales strategies. And, works his tail off - though not as hard as Donna . At this point he's gone from realtor to friend and I plan to have him over to grill and chill at our new place to talk real estate, but also just about life and raising kids in San Diego. He's more interested in relationships than his sales numbers - and that's why his sales numbers are so high. We have already recommended the Klinge's to some close friends and another successful sale is on deck right around the corner...

The vast majority aren’t going to transfer their tax basis. They are leaving entirely. A very long time neighbor is selling. The tax bill will go from $558 per year to $1100 per month.

If you are going to leave paradise, you need to go far enough that it’s a home run.

Results may vary!

When people leave CA, I tell them don’t sell your house. If you do, you are never coming back because you will be priced out. I can’t tell you how many people have thanked me . Several people did not heed my advice and now are stuck in TX and AZ. Keep you CA house pull some equity if you have to and rent it. CA RE has been a great inflation hedge ver the decades.

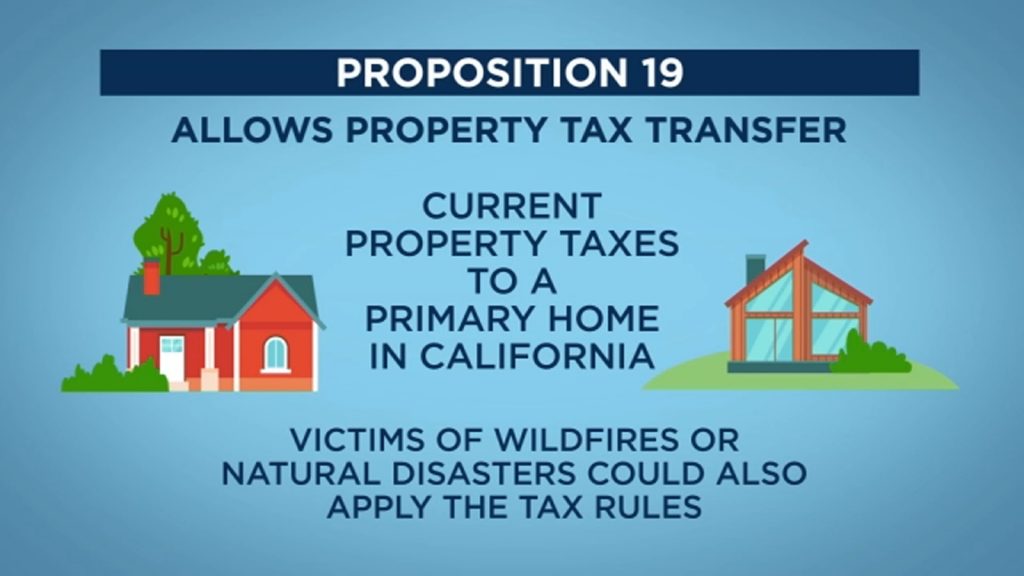

What if I sell my existing house. Shift into my low priced (low prop tax) rental for 2 years. Then buy a more expensive house. Can I transfer that low tax base to the new house??

Yes

Prop 19 is a blessing for those 55+ want to buy a more expensive home and have a current low tax basis primary property. Do you think that Prop 13 will be overturned some day and if so when? Thanks.