Of course the current conditions look worse when comparing to the hottest real estate market ever. Having bidding wars on 21% of homes for sale sounds great to me.

The discouraging part about Bill’s post today is how the realtors have bought into the negativity.

This is the first downturn to be affected by amateurs on social media, and realtors can either price ’em high and repeat these same negative talking points seen everywhere now, or they can get better at their craft, price their listings attractively, and be part of the solution:

#Houston, TX: “Home prices have most first-time home buyers priced out of home ownership. It’s even worse with the higher interest rates decreasing what the buyers can qualify for.”

#Denver, CO: “Cost of living [and] interest rate [increases] are keeping most buyers from buying.”

#Baltimore, MD: “The market is transitioning. Inventory is still low and the number of buyers looking is less due to rising interest rates. Buyers are qualifying for less, so they are pulling back. [I am] seeing less as-is sales, more home inspections, and negotiations overall.”

#Sarasota, FL: “I’ve had numerous buyers looking but the prices are much higher than they want to spend. Many pulled back waiting for the market to go down.”

#LosAngeles, CA: “Skyrocketing interest rates are pushing buyers out of the market (they can no longer afford homes that were in their price range just a few months ago) and making homes more difficult to sell for sellers and their agents.”

#Phoenix, AZ: “Buyers are very nervous about making a decision.”

#NewYork: “Open house attendance is weaker than usual, and sales take longer.”

#Minnesota, MN: “Still seeing a fair number of cash sales as competition to financed sales.”

#StLouis, MO: “Things are slowing down slightly, but I have found that the good properties are still moving quickly with multiple offers and going above ask.”

#Barre, VT: “Our local market in Lamoille County is very flat and challenging. Local working families are outpriced by the prices and interest rates. The neighboring resort town has slowed but there are still cash buyers for the million plus market.”

#OrangeCounty, CA: “Interest rates have put the brakes on the market.”

I did sign up to be on their realtor-comments list!

https://open.substack.com/pub/calculatedrisk/p/interest-rates-have-put-the-brakes

Realtors need to get smart and realize that they don’t make $$$ on the perceived “value” of XYZ property. They make $$$ on each transaction.

What I’m saying is that as an industry you shouldn’t be pushing prices to go up or down. What you should be pushing for is that the number of transactions continues to go up.

https://www.youtube.com/watch?v=04KKWEOwgnM

That would assume realtors want to work diligently every day to be an expert on the market conditions and advise their clients accordingly – and when someone asks for a quote, they have something powerful to say.

But you can tell with these answers that they are being pushed around by the same soundbites as the non-experts.

The reason I highlighted the “bookie” angle in Trading Places where Eddie Murphy points out that Commodity trading is just like running a sportsbook.

Realtors are the same way…

This is why as an industry you should be pushing for foreclosures when the market goes down to keep the number of sales up.

Again, Realtors make $$$ on the transaction not the perceived value of the property. If a buyers is able to flip and make $$$ great. If a Seller gets scalped and needs to sell at a loss great. You win either way.

I feel like many Realtors aren’t really exclusive to the industry of being a Realtor. They’re often investors that are tied to prices going up. This clouds their vision + sets off the panic bells when markets go down because they’re $$$ isn’t being derived from being a true Realtor only.

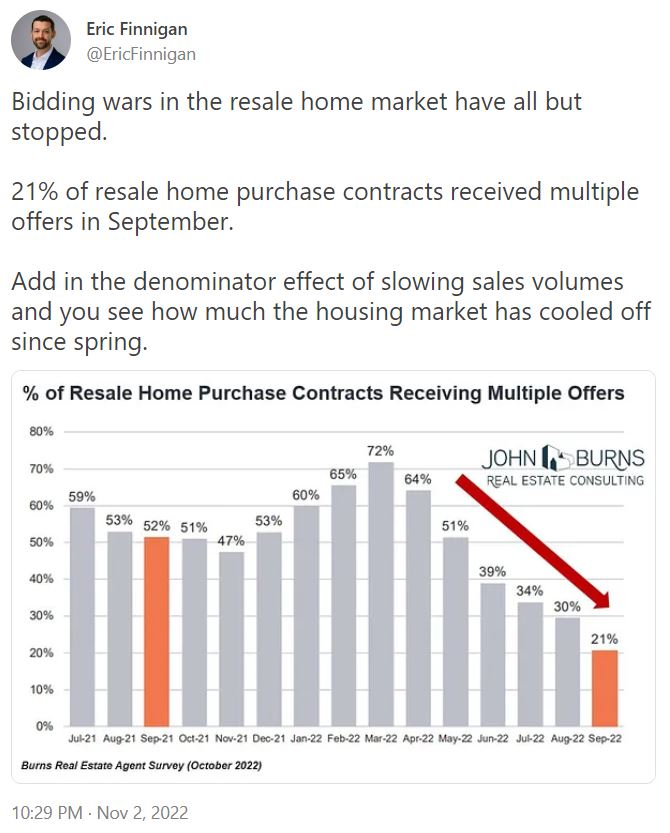

Don’t we really need to compare current conditions to pre-pandemic 2019? Who actually thought that what we’ve seen since the beginning of 2020 was anything other than temporary?

Absolutely, and it is really lazy of reporters to ignore it.

The frenzy wasn’t a blip. Prices rising 30% to 40% in two years was the most abnormal thing that could ever happen.