Here are four tepid responses to the question on whether home prices will drop this summer:

https://www.cbsnews.com/news/will-home-prices-finally-drop-this-summer-heres-what-experts-say/

The lame last paragraph sums it up:

The bottom line

The real estate market seems unlikely to experience significant price decreases nationally this summer, but it’s possible that in specific local markets, there will be dips. Still, until conditions change, like with more housing inventory, it could be tough for prices to decrease. Even then, it could take time for pent-up demand to temper, but it’s possible that overall affordability at least increases, such as if mortgage rates drop.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~`

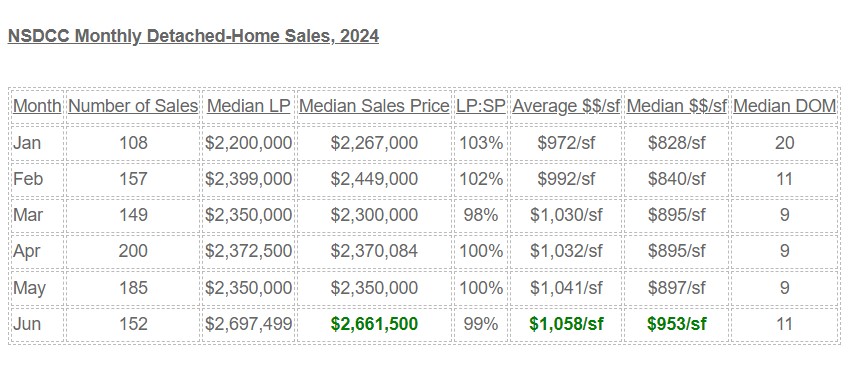

You can’t come to much of a conclusion about summer pricing in July, but let’s check the data! How we measure the pricing has been strong all year between La Jolla and Carlsbad:

The world is too crazy for something not to give. My opinion of the pricing trend above is that the higher-priced superior homes are gaining in market share (who wants to buy a dump in this environment?) and it’s providing a head-fake that disguises the truth.

What’s going to give is the number of sales – we may not see 152 monthly sales the rest of 2024.

The commission debacle will be discouraging to the marketplace, mortgage rates aren’t going down enough to make a difference, and the political firestorm will get worse. The only way a buyer will ignore all of that and keep buying is if they see the perfect home.

There will be some nice deals for those who are willing to dig them out.

But I think by the screwy ways we measure it, the NSDCC pricing will look fairly strong, but the best precursor of the future – the number of sales – will be dropping the rest of the year, which will create even more softness. Buyers won’t feel confident about the price they are paying unless they have some decent comps to rely on, and those will be few and far between.

Fixers don’t pencil because interest rates are “high” comparable to 5 years ago.

Even people adding something like a pool doesn’t make sense because who wants to refi out of a 2.5% mortgage into 7% just to pull out a couple of 100k?

This is why completely redone houses are selling.

It will be interesting to see if construction businesses lower their prices to stimulate sales. An easy way to determine this is when the construction industry is hot you can’t find a contractor. When the industry is cold contractors are ringing doorbells looking for work.

Intensely remodeled flips won’t slow until there is blood on their sidewalk. Sad.

“Open Concept” won’t slow until so many structural walls are removed that the roof sags.

Prices will drop relative inflation adjusted. No solace to either buyers or sellers.

Eventually.. I have see.n prices drop in areas with high fire insurance .