From MND:

We publish daily coverage of mortgage rate movement and have done so for nearly 20 years now. It’s a great place to quickly check in on rate trends and to get a sense of what’s true and what matters.

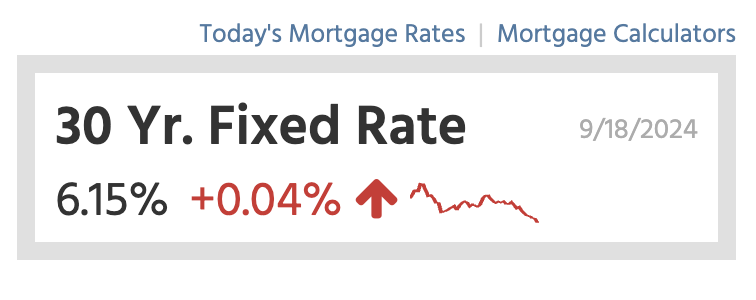

If you’d been checking in at any point in the past few days/weeks, you likely saw one of several attempts to remind readers that today’s Fed rate cut not only had absolutely no implication for lower mortgage rates, but indeed that mortgage rates have often moved higher on the same day that the Fed cuts.

That’s what happened today.

Interestingly enough, mortgage rates were already slightly higher than yesterday BEFORE the Fed announcement came out. The bonds that dictate mortgage rates are actually pointing to even higher rates tomorrow unless there’s a decent improvement overnight.

https://www.mortgagenewsdaily.com/markets/mortgage-rates-09182024

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

It is smart for realtors to tell their buyers that lower rates in the future are unpredictable, and buying the right house at the right price is much more important. Also, any future rate improvement will be noticed by home sellers too, and they will want to push pricing – offsetting any benefit to buyers.

So the realtor industry should unite in our message to buyers about not waiting for…………..oh crap, here’s our head cheerleader telling buyers there will be six to eight rounds of further rate cuts!

Larry, Larry, Larry you’re supposed to be on our side!

Somewhere in the middle gundlach says he does not know what is going to happen to housing. Jim, You should call and tell him. You have the pulse of the market and could give him very good insight. Keep up the great work ! Cheers !

https://youtu.be/HRYryMNiEt0?feature=shared