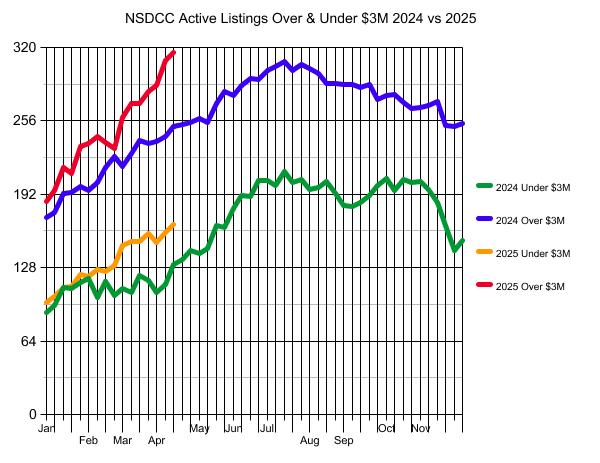

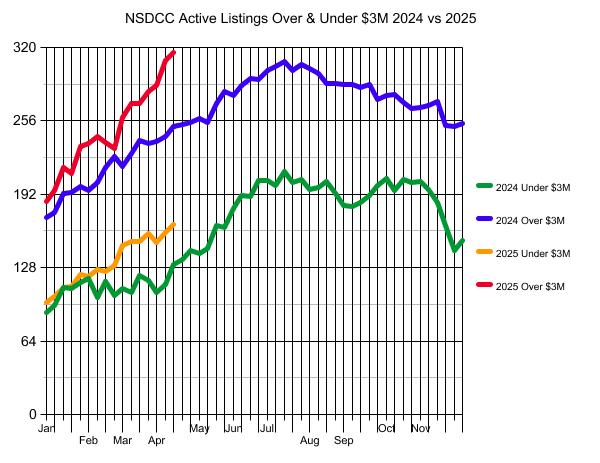

We have more higher-end active listings than any time in 2024 – and it’s only April!

Will the accompanying sluggishness turn into a slugfest? Probably not.

Sellers are reluctant to lower their price now because it’s too early in the season. Maybe in a month or two, but I’m not going to give it away.

By then, lowering the price by 5% isn’t going to impress any buyers. They will be expecting that much of a discount, and more.

I have no expectations of a big price war this year that would drive down prices rapidly. A guy told me that prices are down 10%, so I asked him to qualify it. He said, “Well, at least they are in my neighborhood”. Exactly – you might see an occasional neighborhood price adjustment, but for the most part, sellers won’t be intimidated today by no showings or a giveaway nearby.

Maybe next year?

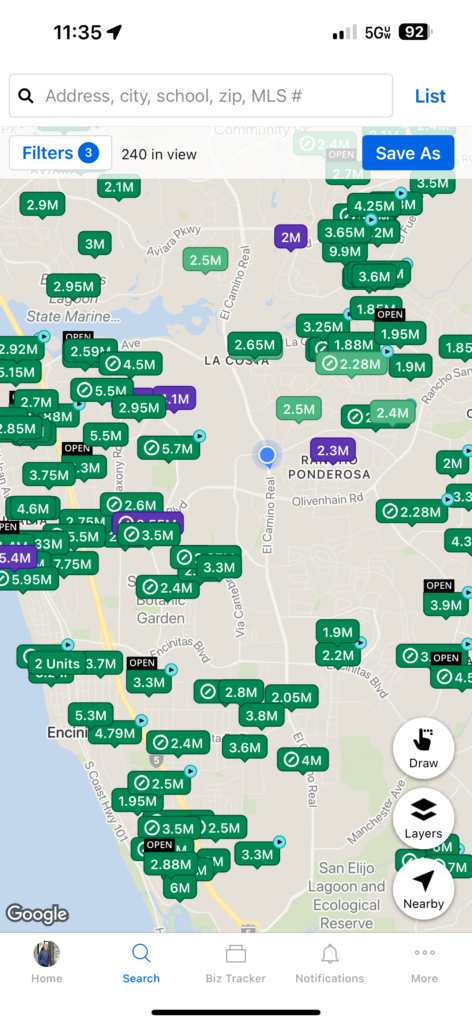

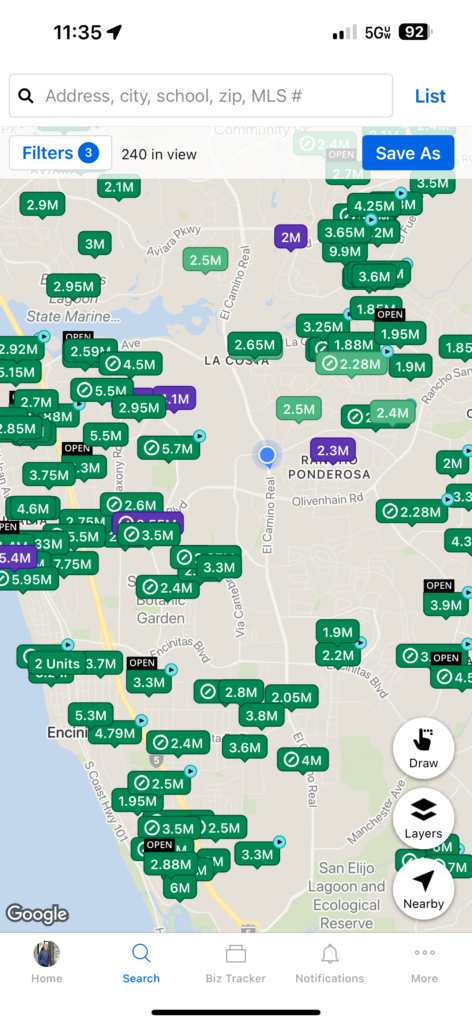

Active listings in green, coming-soons in purple

The $0 – $2,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

43 |

$918/sf |

63 |

27 |

| Jan 13 |

45 |

$936/sf |

53 |

22 |

| Jan 20 |

47 |

$908/sf |

54 |

25 |

| Jan 27 |

48 |

$904/sf |

48 |

32 |

| Feb 3 |

51 |

$914/sf |

47 |

41 |

| Feb 10 |

45 |

$935/sf |

46 |

45 |

| Feb 17 |

45 |

$916/sf |

46 |

46 |

| Feb 24 |

45 |

$958/sf |

48 |

40 |

| Mar 3 |

50 |

$950/sf |

37 |

42 |

| Mar 10 |

55 |

$908/sf |

36 |

45 |

| Mar 17 |

53 |

$891/sf |

35 |

50 |

| Mar 24 |

53 |

$898/sf |

30 |

51 |

| Mar 31 |

58 |

$878/sf |

35 |

44 |

| Apr 7 |

56 |

$867/sf |

30 |

43 |

| Apr 14 |

63 |

$906/sf |

32 |

40 |

| Apr 21 |

59 |

$936/sf |

35 |

37 |

The $2,000,000 – $3,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

55 |

$1,029/sf |

66 |

36 |

| Jan 13 |

58 |

$990/sf |

63 |

31 |

| Jan 20 |

64 |

$1,018/sf |

57 |

26 |

| Jan 27 |

64 |

$1,025/sf |

53 |

31 |

| Feb 3 |

71 |

$1,009/sf |

50 |

31 |

| Feb 10 |

75 |

$1,005/sf |

46 |

36 |

| Feb 17 |

81 |

$1,015/sf |

44 |

39 |

| Feb 24 |

80 |

$1,012/sf |

38 |

52 |

| Mar 3 |

80 |

$1,034/sf |

33 |

49 |

| Mar 10 |

92 |

$1,029/sf |

37 |

44 |

| Mar 17 |

98 |

$1,015/sf |

39 |

44 |

| Mar 24 |

98 |

$1,008/sf |

41 |

52 |

| Mar 31 |

100 |

$997/sf |

44 |

54 |

| Apr 7 |

94 |

$940/sf |

43 |

54 |

| Apr 14 |

96 |

$962/sf |

42 |

53 |

| Apr 21 |

107 |

$1,000/sf |

43 |

53 |

The $3,000,000 – $4,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

44 |

$1,091/sf |

82 |

19 |

| Jan 13 |

46 |

$1,122/sf |

77 |

19 |

| Jan 20 |

52 |

$1,156/sf |

70 |

16 |

| Jan 27 |

49 |

$1,197/sf |

67 |

20 |

| Feb 3 |

56 |

$1,182/sf |

55 |

21 |

| Feb 10 |

58 |

$1,158/sf |

51 |

25 |

| Feb 17 |

58 |

$1,179/sf |

54 |

24 |

| Feb 24 |

56 |

$1,168/sf |

52 |

24 |

| Mar 3 |

51 |

$1,147/sf |

56 |

31 |

| Mar 10 |

56 |

$1,240/sf |

61 |

34 |

| Mar 17 |

60 |

$1,209/sf |

61 |

36 |

| Mar 24 |

60 |

$1,209/sf |

62 |

39 |

| Mar 31 |

62 |

$1,158/sf |

64 |

34 |

| Apr 7 |

68 |

$1,208/sf |

59 |

34 |

| Apr 14 |

79 |

$1,193/sf |

55 |

26 |

| Apr 21 |

85 |

$1,230/sf |

54 |

28 |

The $4,000,000+ Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 6, 2025 |

160 |

$1,822/sf |

105 |

27 |

| Jan 13 |

156 |

$1,868/sf |

105 |

31 |

| Jan 20 |

170 |

$1,936/sf |

95 |

29 |

| Jan 27 |

180 |

$1,877/sf |

90 |

31 |

| Feb 3 |

189 |

$1,884/sf |

85 |

31 |

| Feb 10 |

189 |

$1,864/sf |

88 |

29 |

| Feb 17 |

192 |

$1,875/sf |

90 |

32 |

| Feb 24 |

195 |

$1,869/sf |

91 |

34 |

| Mar 3 |

200 |

$1,860/sf |

87 |

34 |

| Mar 10 |

213 |

$1,811/sf |

83 |

36 |

| Mar 17 |

208 |

$1,755/sf |

85 |

30 |

| Mar 24 |

211 |

$1,800/sf |

86 |

25 |

| Mar 31 |

213 |

$1,784/sf |

90 |

32 |

| Apr 7 |

219 |

$1,777/sf |

90 |

33 |

| Apr 14 |

230 |

$1,790/sf |

87 |

35 |

| Apr 21 |

231 |

$1,792/sf |

87 |

32 |

NSDCC Weekly New Listings and New Pendings

| Week |

New Listings |

New Pendings |

Total Actives |

Total Pendings |

| Jan 6 |

27 |

11 |

298 |

108 |

| Jan 13 |

38 |

26 |

301 |

101 |

| Jan 20 |

55 |

16 |

328 |

95 |

| Jan 27 |

60 |

32 |

337 |

113 |

| Feb 3 |

72 |

28 |

363 |

123 |

| Feb 10 |

50 |

34 |

364 |

135 |

| Feb 17 |

50 |

29 |

373 |

140 |

| Feb 24 |

58 |

38 |

374 |

148 |

| Mar 3 |

60 |

31 |

378 |

152 |

| Mar 10 |

60 |

30 |

411 |

156 |

| Mar 17 |

49 |

37 |

413 |

157 |

| Mar 24 |

57 |

39 |

414 |

164 |

| Mar 31 |

47 |

27 |

425 |

162 |

| Apr 7 |

52 |

31 |

431 |

162 |

| Apr 14 |

70 |

28 |

462 |

153 |

| Apr 21 |

58 |

24 |

478 |

148 |

NSDCC List Price Quartiles

| Week |

1st Quartile |

Median List Price |

3rd Quartile |

| Jan 6 |

$2,685,000 |

$4,472,500 |

$7,995,000 |

| Jan 13 |

$2,499,000 |

$4,250,000 |

$7,750,000 |

| Jan 20 |

$2,695,000 |

$4,300,000 |

$7,767,000 |

| Jan 27 |

$2,795,000 |

$4,498,000 |

$7,995,000 |

| Feb 3 |

$2,695,000 |

$4,350,000 |

$7,499,000 |

| Feb 10 |

$2,799,000 |

$4,299,000 |

$7,695,000 |

| Feb 17 |

$2,695,000 |

$4,200,000 |

$7,750,000 |

| Feb 24 |

$2,699,500 |

$4,250,000 |

$7,645,000 |

| Mar 3 |

$2,550,000 |

$4,375,000 |

$7,497,000 |

| Mar 10 |

$2,500,000 |

$4,200,000 |

$7,250,000 |

| Mar 17 |

$2,500,000 |

$4,000,000 |

$6,995,000 |

| Mar 24 |

$2,595,000 |

$4,047,500 |

$7,275,000 |

| Mar 31 |

$2,499,000 |

$4,000,000 |

$7,300,000 |

| Apr 7 |

$2,500,000 |

$4,000,000 |

$6,995,000 |

| Apr 14 |

$2,500,000 |

$3,999,000 |

$6,995,000 |

| Apr 21 |

$2,590,000 |

$3,995,000 |

$6,799,500 |

Unfortunately for the fence sitters home owners are still flush with $$$. High levels of equity, retirement accounts, and banks aren’t foreclosing.

This will translate into stagnation on prices.

Trump is trying to jawbone the fed into lowering interest rates. This might allow some at the current prices to sell. But more likely will just delay prices from going down.