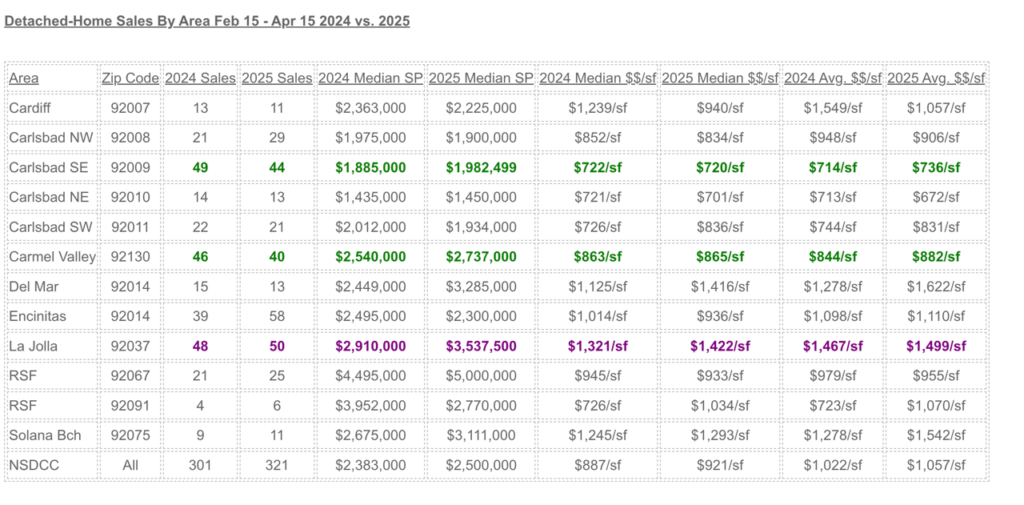

The NSDCC sales and pricing looks a lot like it did last year, which is the definition of Flat City. It gives us some assurance that the market is steady, at least in the rear-view mirror.

But let’s break it down into the individual areas to see if there are any concerns.

In green (above) are the two most homogeneous neighborhoods full of typical tract houses. Their sales and pricing statistics are virtually identical year-over-year, and their median and average $/sf are very close too which means there aren’t many if any outliers. Two areas where sellers would find it easier to get their price right, and where buyers can feel comfortable justifying the pricing.

La Jolla is phenomenal. For a higher-end area to have such solid stats all the way across is very impressive and a place where you can buy with confidence. Rancho Santa Fe is right in there with them but the sales counts are low.

There aren’t any areas that have any big concerns, mostly because the sales counts look healthy and are similar YoY (sales are a sign of what’s ahead for pricing).

If there was a big concern, it’s the uncertainty ahead, and the likelihood that the first quarter of 2025 will end up being the best quarter of the year.

0 Comments