Let’s gather the forecasts for 2022 – here’s a start:

| Forecaster | ||

| Fannie Mae – USA | ||

| Freddie Mac – USA | ||

| MBA – USA | ||

| NAHB – USA | ||

| NAR – USA | ||

| CAR – Calif | ||

| Zillow – SD | ||

| CoreLogic – SD | ||

| JtR – NSDCC |

I had guessed that the NSDCC sales would be +10% this year, and +10% in pricing.

The final 2021 numbers should end up around +7% for sales and +28% in median sales price.

Bill mentioned (below) that if inventory stays low, there will be a larger increase in prices. Conversely, if inventory increases significantly, there will be less price appreciation.

I’m guessing the NSDCC market will enjoy a third option, where the inventory increases just enough to boost the sales AND pricing at the same time.

It is a sweet spot where more inventory doesn’t scare off buyers, and instead soaks up the pent-up demand and provides the comps for a solid 1% to 2% pricing increase per month.

My final guess for 2022: NSDCC will have +5% YoY in sales, and +15% in median sales price.

What do you think? Leave your guess in the comments section!

Click here for the research:

From Bill at CR:

The key in 2022 will be inventory. If inventory stays extremely low, there will be more housing starts and a larger increase in prices. However, if inventory increases significantly, there will be fewer starts and less price appreciation.

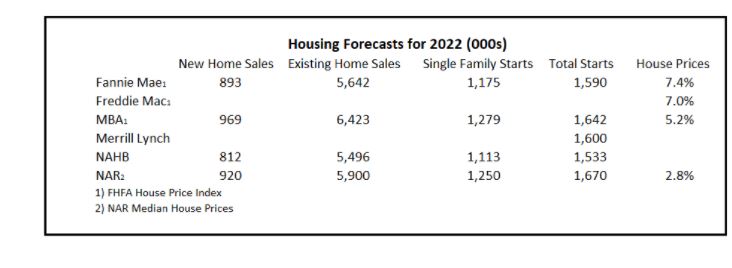

Towards the end of each year I collect some housing forecasts for the following year.

For comparison, new home sales in 2021 will probably be around 800 thousand, down from 822 thousand in 2020, but up from 683 thousand in 2019.

Total housing starts will be around 1.58 million in 2021, up from 1.38 million in 2020, and up from 1.29 million in 2019. Existing home sales will be around 6.1 million in 2021 , up from 5.64 million in 2020, and 5.34 million in 2019.

As of August, Case-Shiller house prices were up 19.8% year-over-year!

The table below shows a few forecasts for 2022:

https://calculatedrisk.substack.com/p/2022-housing-forecasts-first-look

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

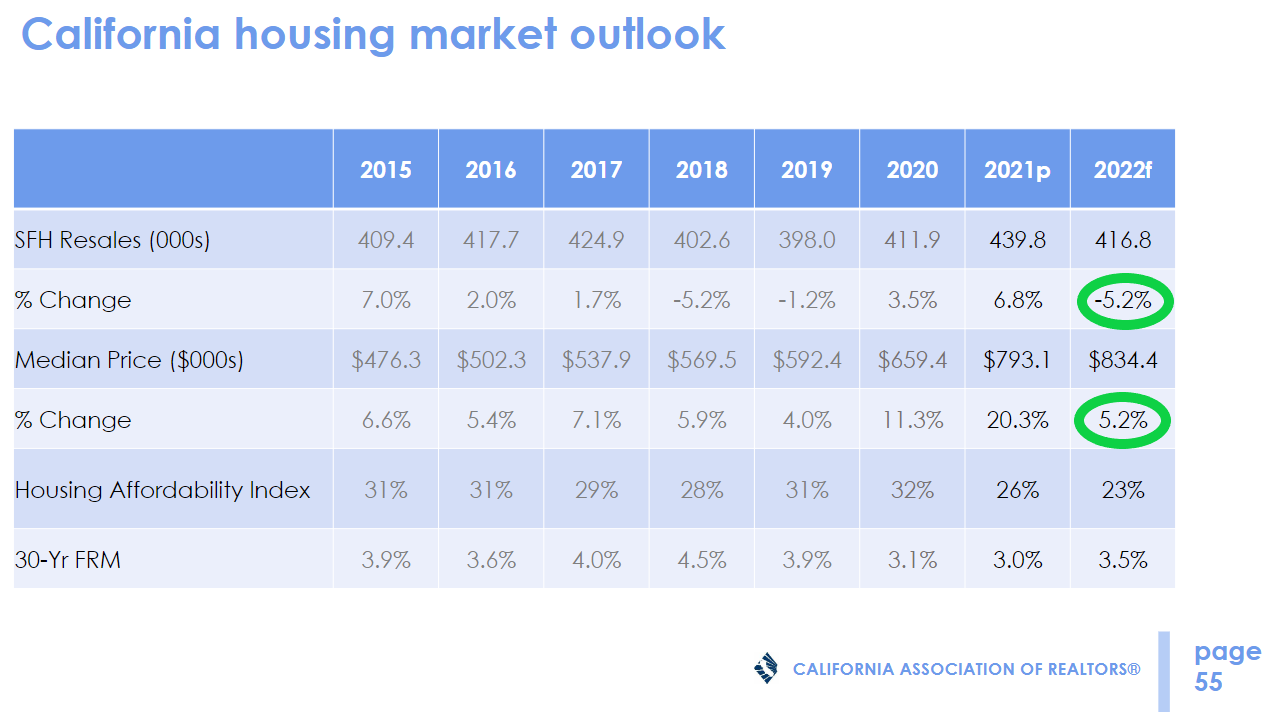

We also have the C.A.R. forecast:

A CAR consumer survey showed, for example, that 35% of home sellers are moving out of state and fewer than 15% were moving to a home in the same county as their last residence.

“I think that pressure to migrate out of the state is going to be just as strong, if not stronger, as housing affordability gets worse,” CAR Chief Economist Jordan Levine said. “I think that this is a housing-driven phenomenon, and we don’t have a lot of relief in terms of housing affordability.”

The 2022 median price of a California house, or the price at the midpoint of all sales, will be $834,400, up a mere 5.2% from this year’s projected median of $793,100, according to next year’s forecast.

Price gains have been in the double digits for the past two years, rising 11.3% in 2020, with a projected gain this year of 20.3%. The median price of an existing single-family home has risen more than $200,000 during the past two years, or almost $2,000 a week.

Sales are forecast to decline 5.2% next year, with a total of 416,800 houses changing hands, the forecast said.

Even though sales will go down, next year’s transaction volume should still be the second-highest of the past five years. And it will be slightly higher than the average of 414,000 transactions a year since the housing market began its recovery from the Great Recession in 2012.

“We can’t call this a cool market by any stretch of the imagination,” Levine said. “I would say that it’s gone from white-hot to this kind of a plain old, run-of-the-mill boring red-hot (market) that California usually has, (with) too much demand and not enough supply.”

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Plus these local 2022 guesses for the San Diego-Carlsbad metro area (where the typical home value in San Diego has appreciated by 118% since 2012, according to Zillow):

Zillow: +21.3%

Core-Logic: +2.2% (August to August)

Jim, are you suggesting that 2022 will be just like 2021, making it the longest, hottest real estate frenzy in the history of mankind?

Yes, you are reading me correctly.

We have no other option – it will just be a matter of how hot.

Oh wait, oh wait, mortgage rates are going to go up! Or we could have an earthquake? Or 10,000 insurgents come across the border at once? Or the sky could fall?

The market is entirely dependent on the craziest buyers who don’t care about anything except See house, Like house, Buy house.

The dumbing down of real estate is here. This is what it looks like.

I like your number but now we know why Zillow is shooting higher;)

My guess for 2022: NSDCC will have flat YoY in sales, and +17.5% in median sales price. I think increases in interest rates may temper some sales and owners hold off on selling their houses for more favorable prices in the coming 2-3 years. NSDCC price/sqft has plenty of upside to go compared to the SF Bay Area.

I think JtR is basically right but I’ll guess that sales stay flat.

Overall we’ve got a great quality of life here in NSDCC, so not many want to leave but many want to move here. Prices will rise modestly due to low inventory and steady demand.

Locally it’s still not easy to trade up so inventory/sales will be flat.

Interest rates will rise which may impact those who are borrowing and diminish the Buyer pool at the middle tier price point but many new Buyers don’t seem to need as much or any financing.

Very, very limited new residential construction. I house in the Coastal Zone commonly takes 3 years from start to finish let alone a new residential development, (5 years?).

I also think about inflation as an overall element to the economy which first took hold in real estate a while back and which will continue to be reflected in price increases but not necessarily more money in your pocket.

If sales are flat in 2022, it will be considered a win because 2021 sales were so great – and probably a new record, or close.

My +5% guess is optimistic because I think it’s time for the new higher pricing to lure more locals who may not have thought about moving previously.

Let’s be clear. These are guesses.

Units +7%. Median +15%. Average +22%.