Numerically, the inventory isn’t getting any better yet:

NSDCC New Listings between March 1-15:

2018: 228

2019: 277

2020: 221

2021: 199

2022: 120

There will be a few more added to this year’s total but the homedemic continues – without additional inventory, the market will struggle to pick up momentum. The intensity of the fight over the quality homes could increase while other buyers have a hard time keeping their chops up, and become disinterested.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The $0 – $1,500,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

9 |

$832/sf |

35 |

36 |

| Jan 10 |

9 |

$766/sf |

28 |

29 |

| Jan 17 |

13 |

$773/sf |

26 |

27 |

| Jan 24 |

9 |

$818/sf |

15 |

29 |

| Jan 31 |

14 |

$752/sf |

14 |

31 |

| Feb 7 |

13 |

$774/sf |

12 |

32 |

| Feb 14 |

11 |

$826/sf |

12 |

35 |

| Feb 21 |

7 |

$889/sf |

17 |

38 |

| Feb 28 |

12 |

$888/sf |

17 |

33 |

| Mar 7 |

9 |

$1,017/sf |

21 |

33 |

| Mar 14 |

14 |

$847/sf |

18 |

31 |

| Mar 21 |

8 |

$912/sf |

26 |

36 |

The $1,500,000 – $2,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

8 |

$842/sf |

52 |

36 |

| Jan 10 |

13 |

$751/sf |

28 |

29 |

| Jan 17 |

16 |

$736/sf |

33 |

27 |

| Jan 24 |

16 |

$801/sf |

17 |

27 |

| Jan 31 |

15 |

$696/sf |

14 |

34 |

| Feb 7 |

15 |

$765/sf |

17 |

34 |

| Feb 14 |

10 |

$726/sf |

19 |

38 |

| Feb 21 |

19 |

$715/sf |

15 |

39 |

| Feb 28 |

9 |

$660/sf |

12 |

46 |

| Mar 7 |

16 |

$789/sf |

15 |

46 |

| Mar 14 |

17 |

$837/sf |

8 |

44 |

| Mar 21 |

18 |

$867/sf |

11 |

43 |

The $2,000,000 – $3,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

18 |

$1,080/sf |

127 |

43 |

| Jan 10 |

23 |

$1,038/sf |

85 |

37 |

| Jan 17 |

26 |

$1,044/sf |

80 |

41 |

| Jan 24 |

28 |

$1,015/sf |

37 |

42 |

| Jan 31 |

22 |

$949/sf |

38 |

47 |

| Feb 7 |

26 |

$919/sf |

29 |

42 |

| Feb 14 |

22 |

$997/sf |

37 |

49 |

| Feb 21 |

21 |

$966/sf |

33 |

54 |

| Feb 28 |

26 |

$905/sf |

32 |

57 |

| Mar 7 |

29 |

$922/sf |

28 |

57 |

| Mar 14 |

20 |

$852/sf |

26 |

58 |

| Mar 21 |

17 |

$928/sf |

26 |

60 |

The $3,000,000 – $4,000,000 Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

19 |

$1,230/sf |

90 |

26 |

| Jan 10 |

22 |

$1,210/sf |

76 |

25 |

| Jan 17 |

19 |

$1,207/sf |

86 |

23 |

| Jan 24 |

17 |

$1,129/sf |

92 |

24 |

| Jan 31 |

21 |

$1,172/sf |

70 |

22 |

| Feb 7 |

19 |

$1,169/sf |

67 |

25 |

| Feb 14 |

19 |

$1,234/sf |

65 |

28 |

| Feb 21 |

21 |

$1,279/sf |

69 |

28 |

| Feb 28 |

22 |

$1,214/sf |

64 |

25 |

| Mar 7 |

27 |

$1,295/sf |

60 |

24 |

| Mar 14 |

27 |

$1,201/sf |

65 |

27 |

| Mar 21 |

23 |

$1,282/sf |

69 |

31 |

The $4,000,000+ Market:

| Date |

NSDCC Active Listings |

Avg. LP/sf |

Avg. DOM |

# of Pendings |

| Jan 3, 2022 |

100 |

$1,884/sf |

128 |

30 |

| Jan 10 |

105 |

$1,864/sf |

113 |

29 |

| Jan 17 |

109 |

$1,763/sf |

110 |

34 |

| Jan 24 |

105 |

$2,130/sf |

114 |

42 |

| Jan 31 |

102 |

$2,114/sf |

118 |

53 |

| Feb 7 |

109 |

$2,000/sf |

108 |

50 |

| Feb 14 |

108 |

$2,005/sf |

109 |

47 |

| Feb 21 |

113 |

$2,008/sf |

103 |

43 |

| Feb 28 |

111 |

$1,991/sf |

101 |

47 |

| Mar 7 |

115 |

$1,904/sf |

91 |

39 |

| Mar 14 |

121 |

$1,893/sf |

95 |

43 |

| Mar 21 |

116 |

$1,905/sf |

97 |

44 |

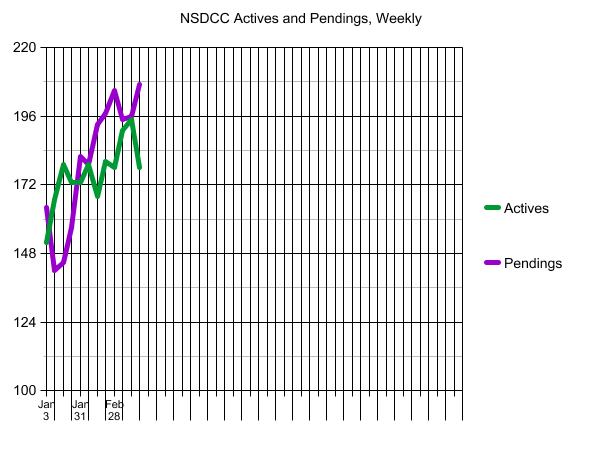

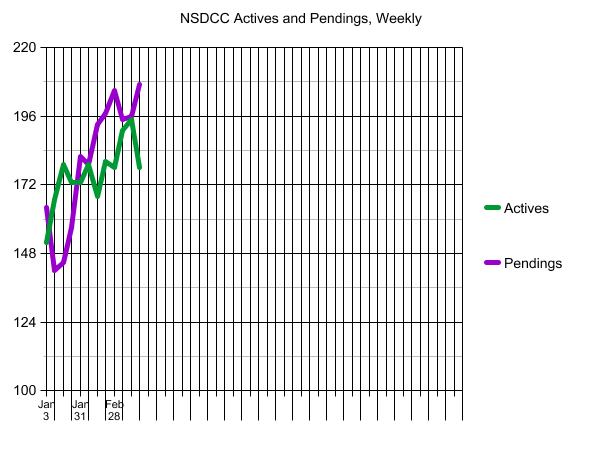

NSDCC Weekly New Listings and New Pendings

| Week |

New Listings |

New Pendings |

Total Actives |

Total Pendings |

| Jan 3, 2022 |

17 |

14 |

152 |

164 |

| Jan 10 |

39 |

18 |

167 |

142 |

| Jan 17 |

34 |

29 |

179 |

145 |

| Jan 24 |

41 |

40 |

173 |

157 |

| Jan 31 |

43 |

40 |

173 |

182 |

| Feb 7 |

43 |

38 |

179 |

179 |

| Feb 14 |

44 |

49 |

168 |

193 |

| Feb 21 |

51 |

38 |

180 |

197 |

| Feb 28 |

39 |

39 |

179 |

205 |

| Mar 7 |

54 |

37 |

191 |

195 |

| Mar 14 |

48 |

51 |

195 |

196 |

| Mar 21 |

39 |

46 |

178 |

207 |

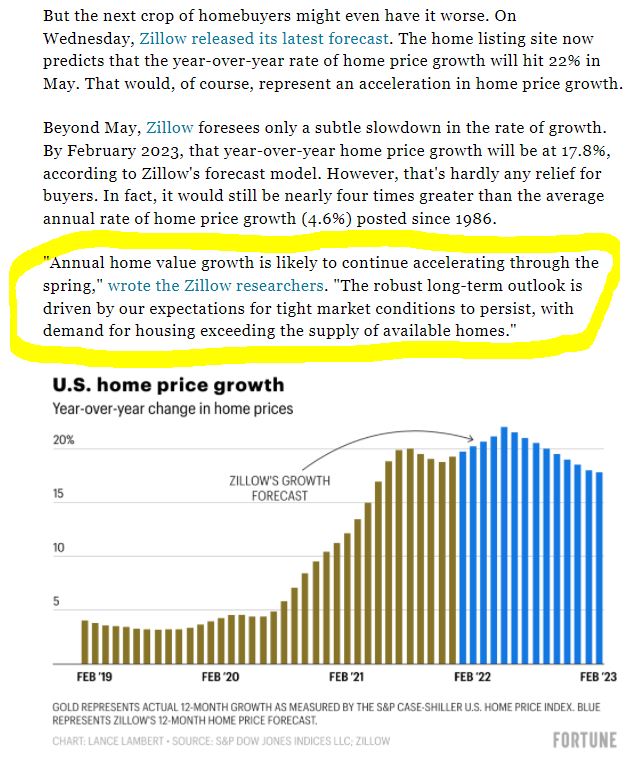

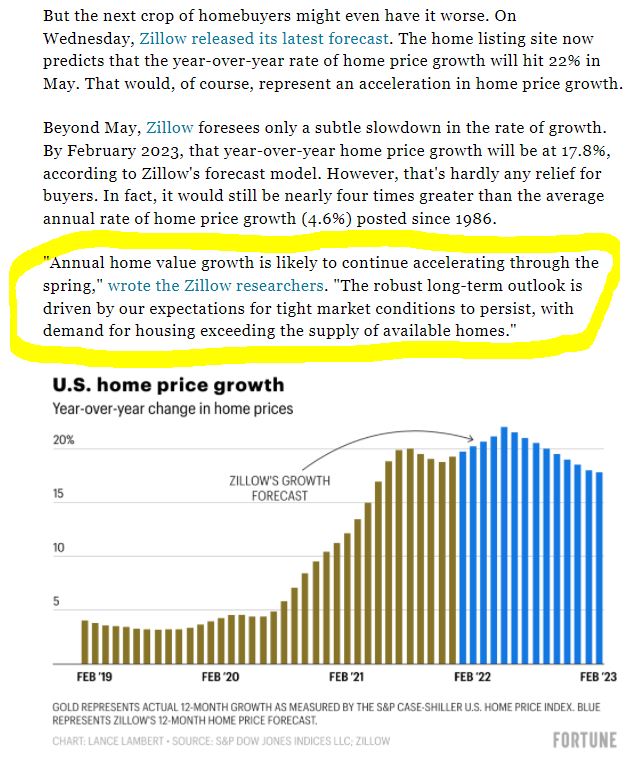

I got yet another cold call asking us to sell one of our rentals. I just laughed and told the poor guy from Fontucky (Fontana) that he was fooled by the Zillguess. He laughed and we hung up.

The Zilldoes have one of our properties so mis-priced this is becoming a weekly occurrence. 2 blocks away at half the size, much older, is seeing interest at roughly 3x the comparable Zillguess for our rental.

Do NOT rely upon web numbers.

Do NOT rely upon web numbers.

I think it’s too late.

Sellers think their automated estimates are fact and tout them with gusto……unless they think the guesses are too low.

Their guesses are way too low in La Jolla. Zillow is forced to raise their GUESS by $1+ million in many cases and they do so only AFTER the house sells for the current market price.

The best recent example of Zillow’s GUESS-timate being way off in La Jolla was the recent sale of 5836 Waverly in the Upper Hermosa neighborhood (where as of today there are currently 0.0 houses available for sale). Zillow had the value of 5836 Waverly at $5.3 million in December 2021 (check their graph to confirm).

The house was listed for Dale on 1/19/2022 for $5.998 million. It was pending sale after a bidding war on 1/27/22 and closed ALL CASH on 2/8/22 for $6.776 million. Zillow raised the value to almost $7 million recently for the house, but then backed it down back to the original asking price of about $6 million.

Thanks Michael.

Every seller who thinks their zestimate is the actual value will get what they have coming. Most will leave hundreds of thousands on the table.