If the reason the housing frenzy stalled was due to higher mortgage rates – and then mortgage rates come down – shouldn’t it ease the concerns? Unfortunately, the national doom-and-gloom is heavy and persuasive, and reliance on ivory-tower guesses can become a self-fulfilling prophecy.

Shiller once again thinks the U.S. housing market is headed for trouble.

“Home prices haven’t fallen since the 2007–09 recession. Right now things look almost as bad,” Shiller said. “Existing home sales are down. Permits are down. A lot of signs that we’ll see something. It may not be catastrophic, but it’s time to consider that.”

A drop in home prices, Shiller says, looks very possible.

“The Chicago Mercantile Exchange has a futures market for home prices…That’s in backwardation now; [home] prices are expected to fall by something a little over 10% by 2024 or 2025. That’s a good estimate,” Shiller told Yahoo Finance. “The risks are heightened right now for buying a house.”

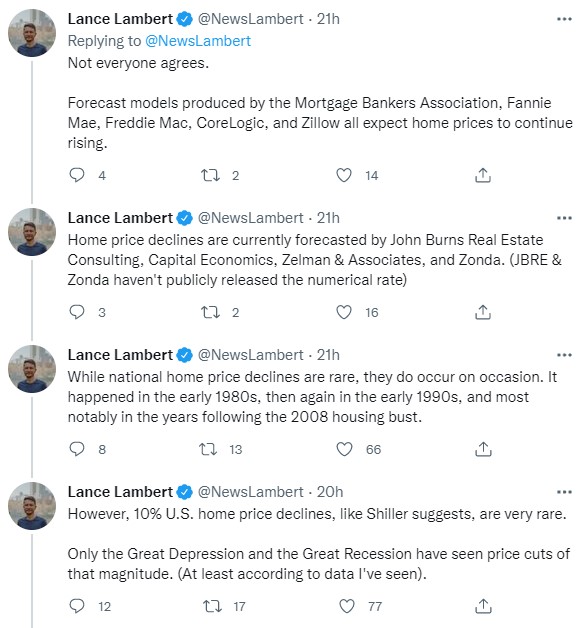

While Shiller thinks a double-digit decline in home prices is possible, many in the industry don’t agree. Over the coming year, home prices are expected to rise. That’s according to forecast models produced by the Mortgage Bankers Association, Fannie Mae, Freddie Mac, CoreLogic, and Zillow. Meanwhile, modest home price declines are currently being forecast by John Burns Real Estate Consulting, Capital Economics, Zelman & Associates, and Zonda.

Why do some industry insiders think home price declines are unlikely? For starters, the country outlawed the subprime mortgages that sank the market a decade ago. Not to mention, homeowners are less debt-burdened this time around. Back in 2007, mortgage debt service payments accounted for 7.2% of U.S. disposable income. Now it’s just 3.8%.

There’s another reason some firms refuse to get bearish on home prices: a historic undersupply of homes.

“Our economists have been chiming in on this for a bit now: The market is slowing down, but homes aren’t getting cheaper anytime soon. Price growth will slow/flatten (when compared to the breakneck start of the year), but the lack of supply is a fundamental pressure that will keep values aloft,” Will Lemke, Zillow’s spokesperson, tells Fortune.

In the eyes of housing bears, firms like Zillow are underestimating the possibility of oversupply. In their view, there’s a chance all those spec homes under construction could see markets like Atlanta, Austin, and Dallas get oversupplied in 2023. If that happens, it would put downward pressure on home prices.

“Housing is believed to be structurally undersupplied, but we run the risk of finding more homes on the market than buyers in the near term due to cyclical factors. I think there’s full awareness that in some markets, an increase in inventory may hit at a bad time—a time where demand has notably pulled back,” Ali Wolf, chief economist at Zonda, tells Fortune. “We are not under the belief that home prices only go up…Our forecast calls for a modest drop in housing prices.”

https://fortune.com/2022/08/09/housing-bubble-2022-call-robert-shiller-housing-market/

Robert Shiller says a 10% nominal house price decline through 2024 is possible. pic.twitter.com/Jzr67ERFiY

— Lance Lambert (@NewsLambert) August 9, 2022

Sales may plummet, but sellers will find a way to cope with staying put in San Diego a little longer, rather than dump on price.

Prices won’t drop more than single digits without foreclosures. Foreclosures don’t happen when owners have skin in the game.

I stand to profit when home prices go up but I hope they will collapse so the young get a chance at home ownership and all investors get taken to the cleaners. Homes should not be a speculative asset.

Either live in it, rent it or pay punishing taxes.

Why is 9% inflation bad yet when houses go up its “growth” and good?

Nobody here said the frenzied over-paying for houses was good.

It was the worst thing that could ever happen to anyone in the middle-class who doesn’t own a home already.

My guess is 2 years and the old OMG I have to get a house at any cost returns…………

2023 is going to be interesting!

I want to say homeowners had skin in the game in the early ’90’s, yet I believe foreclosures spiked pretty significantly in connection with the recession, and I think per Case-Shiller San Diego saw about a 16% reduction in prices between the peak around ’90 and the bottom around ’95. Jim may recall better.

Agree with Jim that this meteoric run-up has been terrible for the middle class, and arguably pretty bad for the upper middle class around these parts who have older kids that are priced out and have to relo out to more affordable areas. I’ve already seen some of this.

Agree with Jim that this meteoric run-up has been terrible for the middle class, and arguably pretty bad for the upper middle class around these parts who have older kids that are priced out and have to relo out to more affordable areas. I’ve already seen some of this.

Yep, and the best hope now for a major boomer liquidation event is for the grandparents to leave here to go live near the grandkids. It’s probably the only thing powerful enough to get the boomers comfortable with paying six-figures in taxes!