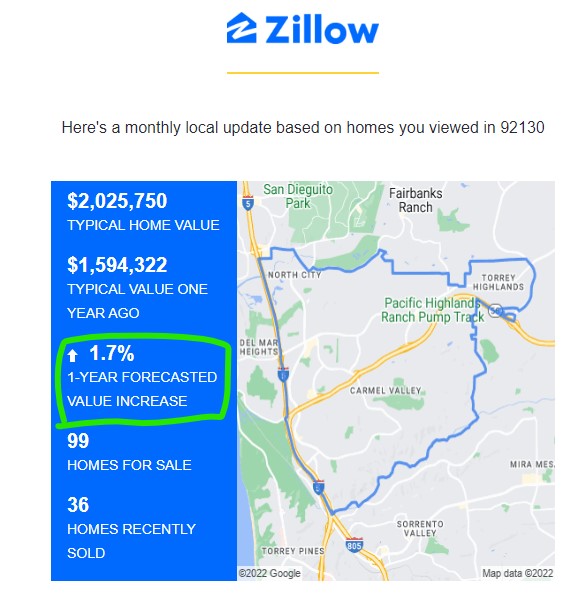

After my blog post yesterday publicizing the confidence Zillow has in our local markets, guess what arrived today. Yep, their first installment of their next round (it usually takes 2-3 weeks to receive the full set):

At the end of July, their prediction for Carmel Valley was for a 12.9% increase in values over the next year. Today, their forecast is for +1.7% appreciation over the next year for one of the strongest markets in the county. It means that many other areas are going to have a negative number.

On July 11th, Rob Dawg said:

Don’t panic.

If you do panic, panic first.

I can get your home on the market today!

Wouldn’t be the first time I was just a little bit early.

Recall back in 2006 when my biweekly housekeeper said she had bought a house in Oxnard for 3x the Dawghaus? I immediately sold all our real estate except the primary residence for good money. Paid for some colleges. Eventually bought back twice as much for less than half peak prices. Might have bought more if I didn’t have to pay off a lost bet. A bet that was just a month early as I recall.

A bet that was just a month early as I recall.

It was dam good coffee though, thanks!

Click here and scroll to the bottom and check the comments on my 2006 prediction that superior properties would only fall 5% to 10% in value, while inferior properties get hammered as much as 50% – making a blended 33% decline by the time we hit bottom. Rob Dawg’s bet is in the comments:

https://www.bubbleinfo.com/category/coffee-bet/

The history of the San Diego Case-Shiller Index:

Nov 2005: 250.3 which was the peak for the SD Case-Shiller Index last time.

Sep 2006: 246.6 and the month we made the famous coffee bet.

Apr 2009: 144.4 the last bottom and 41% lower than the index was for the September bet. Rob was right, just early! This was also the month that Richard Morgan came aboard, and I got on the front page of the L.A. Times and had a 7-min spot on ABC News Nightline. Any correlation between these events and April, 2009 being the bottom may only be a coincidence…..but maybe not?

May 2022: 428.3 the latest SDCSI, which is almost 300% higher than it was in April, 2009.

https://fred.stlouisfed.org/series/SDXRNSA

I feel another bet re SDCSI bottom coming on…….

The difference between 2006 and 2022 is back then there were foreclosures.

Today theres very few if any foreclosures.

Foreclosures are what brings down the comps + forces sellers to be more realistic.

Exactly, and back then the accounting rules made banks sell their foreclosed properties right away……but then Bernanke & Co. changed everything.

Now we’ve seen homeowners stay in their houses for 5-10 years without making a payment.

I know another guy who didn’t make payments, then got foreclosed in 2019. The bank now owns the home, but he still lives there, three years later. How does that happen?

Are there regular home sellers who are so desperate that they will sell for a big discount? Not many, but yes, there will be some.

This is the one that dumped $550,000 off their list price, and went pending in the next week. But it fell out nine days ago, and is still an active listing:

https://www.compass.com/app/listing/1306-ravean-court-encinitas-ca-92024/1046395081589959921

There will be buyers who see that one example and decide there are big problems brewing. But it is such an inferior property (house hasn’t been touched since new, odd backyard, and road noise) that most wouldn’t touch it no matter what the price is.

Then there’s this house which got “several full price offers” already in it’s first two days on the market:

https://www.compass.com/app/listing/7741-palenque-street-carlsbad-ca-92009/1115518909411832641

Buyers want easy decisions on turnkey homes.

On Thursday, Zillow once again revised that forecast. Between July 2022 and July 2023, Zillow now expects U.S. home values to rise 2.4%. That’s down from the 7.8% forecast the company published just a month earlier. It also marks its fifth downward revision since March.

There’s nothing small about a 5.4-percentage-point downward revision in a single month. For a $500,000 home, that wipes out $27,000 in anticipated home price appreciation. A revision like that only happens if the forecast inputs have soured.

“Zillow’s outlook for home prices has been revised down significantly due to a sharp downturn in July,” writes Zillow economists. Simply put: July housing data was bad—really bad.

Are they relying on their own internal viewer data? Doesn’t seem like it by those comments.

Zillow is too smart to rely on Zillow for useful data.

Only economists and forecasters and paid to be wrong. Just make more predictions and eventually one will be right. Then erase the wrong. forecasts.

Nice reading some 13 year old history. Hopefull buyer would have more than doubled his money if he had bitten the bullet and I get to say “Told you so”

Houses in SD with fixed rate mortgages from last year will still be a hard asset (as long as you paint them)

Glad to se Rob made out in a similar fashion to me.