They are saying that in the expensive coastal markets there are fewer empty-nesters, but they base that opinion on the percentages? The San Diego metro of 3.3 million x 13% = 429,000 empty-nesters sounds significant to me!

Some have suggested that empty nest households – those aged 55 and older living with no children with at least two extra bedrooms and in place for at least a decade – could eventually flood the housing market with their homes and help make homes more affordable. However, data indicates that this demographic is unlikely to make a meaningful impact over the coming years, especially in the most expensive markets.

Nationwide, there were roughly 20.9 million of these empty nest households in 2022, up modestly from 20.2 million in 2017.

All else equal, in order for empty nest households to make a meaningful contribution to lowering house prices, their numbers must exceed the number of families that currently need their own housing and those that will want or need homes in the future. In addition, because relative affordability varies so widely across the country, this potential supply of homes would need to be concentrated in markets with the worst housing shortages to make a dent. Unfortunately, this future supply coming from empty-nest households doesn’t line up with the areas of greatest need on the map.

The number of empty nest households does exceed the number of families in need of housing: by 2.6 times.

There were 20.9 million empty nest households in 2022 compared to 8.1 million families living with non-relatives that were likely in need of their own unit, and that surplus has grown over time. From 2017 to 2022, the number of families doubling up — living with non-relatives — grew by 500,821. During that same period, the number of empty nest households increased by 703,892.

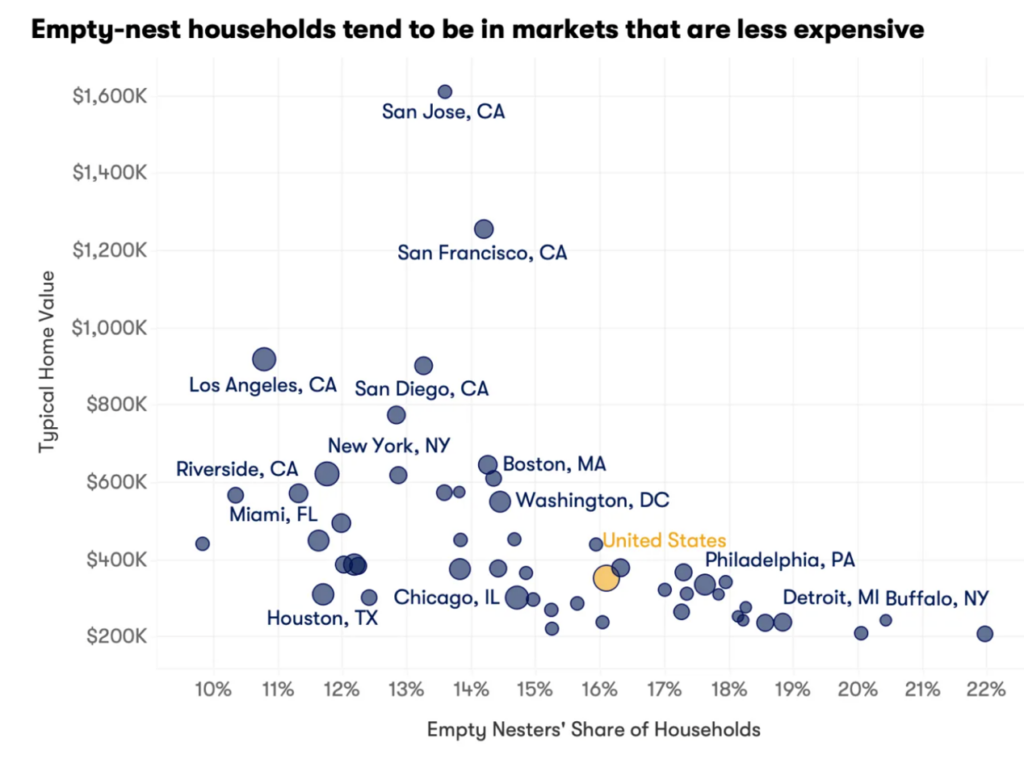

The problem: Most empty nest households can be found in already relatively more affordable markets. These are areas where housing is already more available, the rate of doubling up with non-relatives is much lower, and they’re located far from where the crush of current young workers choose to live.

A flood of currently owner-occupied homes hitting the market as their current owners pass away or otherwise vacate their homes will NOT solve housing affordability challenges, especially in high demand housing markets.

A silver tsunami is likely to have a larger impact in regions like Pittsburgh and Cleveland. Younger residents have tended to leave these areas to pursue better job opportunities elsewhere, leaving older generations to make up a larger share of those who remain. Young workers choose to live near productive job centers and on the coasts, areas that have much lower populations of older retired individuals holding back housing supply in the first place.

Among the 50 largest metropolitan areas, Pittsburgh, New Orleans, Detroit, Buffalo, Cleveland were the markets with the largest gap between the potential housing supply from empty nest households and potential demand from younger residents. But these are already relatively more affordable markets with fewer home buying age workers to begin with.

In expensive coastal markets with strong job centers where home buying age workers choose to live — like Austin, Seattle and Denver — there are fewer empty nest households to begin with.

As a result, the impact of a future increase in supply coming from the existing housing stock owned by older individuals would likely have a smaller impact on affordability in expensive high demand coastal markets. Without the promise of remote work or investments that improve work prospects and raise the desirability of Midwest markets, it is unlikely that we will see a big shift in migration patterns towards markets full of empty nesters.

Rather, the fix for affordability challenges remains a strong supply expansion coming from newly built homes. Zillow research shows that housing shortages were the most severe in markets with more land use restrictions. In addition to promoting denser construction, removing barriers to homeownership that aren’t related to income — credit assistance programs, down payment assistance or help with closing costs, for example — would likely improve access to homeownership.

https://www.zillow.com/research/empty-nesters-affordability-34636/

0 Comments