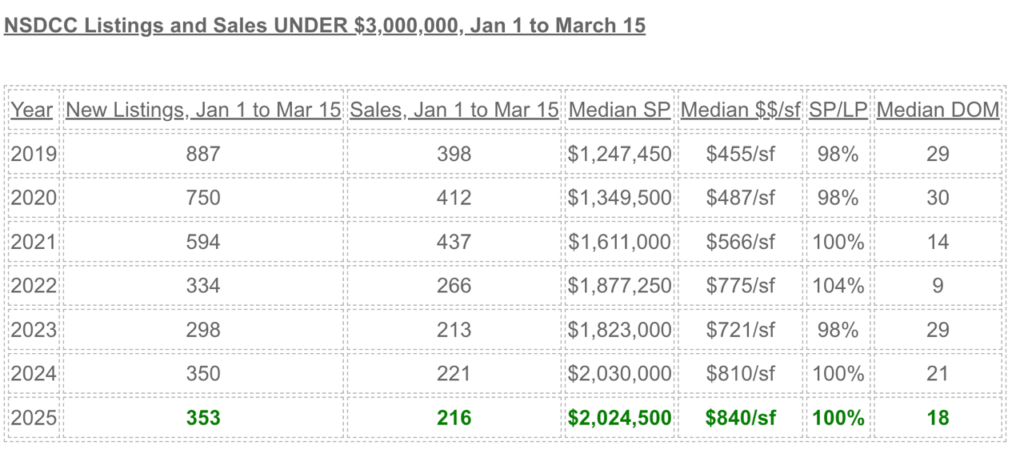

A reader asked to split the market at $3,000,000 and take a look around.

They made a good point.

All that matters is what’s happening in your neighborhood of interest.

Analyzing larger samples can only give us suspicious facts. I keep saying how another 15% to 20% increase in inventory is going to make buyers pause, but who cares. When trying to get a read on your favorite neighborhood, do the inventory/sales across town matter? Probably not, and they won’t matter to those buyers & sellers in your neighborhood either.

But until you hire me to discuss your favorite area, we gotta talk about something.

Main point: The Under-$3,000,000 market remains a hot ticket.

NSDCC Active Listings Under $3M: 156

Actives Median LP = $2,200,000

Actives Median LP/sf = $878/sf

NSDCC Pending Listings Under $3M: 98

NSDCC 2025 Sold Listings Under $3M Per Month: 86

There is only a two-month supply, the pricing metrics of the actives are close to the sold metrics, the actives-to-pending ratio is under the 2.0 healthy mark, and half of the recent sales have found their buyer within 18 days.

We can say that’s a hot market in 2025!

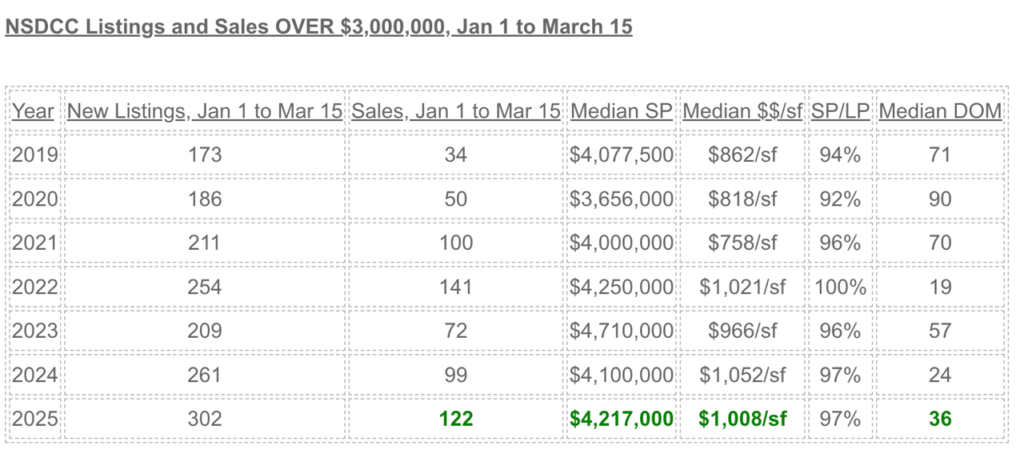

However, the Over-$3,000,000 market is a different story:

Over-$3,000,000 market is sluggish, and will likely remain that way.

NSDCC Active Listings Over $3M: 271

Actives Median LP = $5,995,000

Actives Median LP/sf = $1,230/sf

NSDCC Pending Listings Over $3M: 66

NSDCC 2025 Sold Listings Over $3M Per Month: 49

There is a SIX-month supply, the pricing metrics of the active listings are +20% to +40% over the sold metrics, the 4.1 actives-to-pending ratio is pushing the unhealthy zone, and even though the median days-on-market of the solds is a remarkable 36 days, two-thirds of the active listings have been on the market longer that that.

What’s the point? General assumptions are only good for trolling on twitter!

Super helpful, thanks for splitting the data.