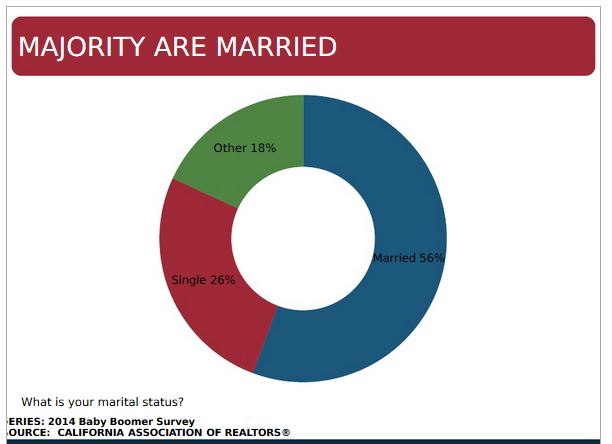

This survey is dated 2014, and they should update it every year – or at least until I’m right about having a boomer liquidation sale coming down the pike!

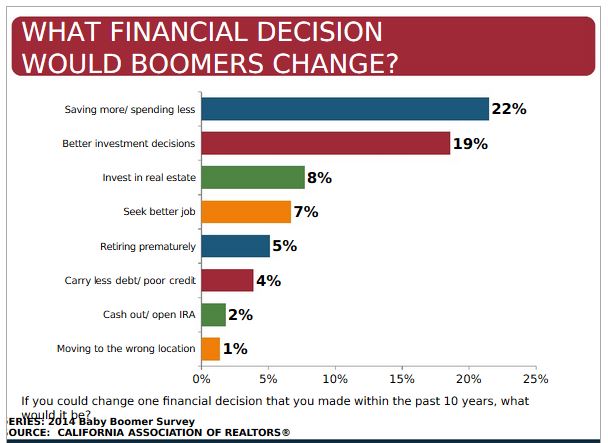

This survey asks several different questions, but notice how 20% to 30% of the responses seemed to divulge some stress or uncertainty about their future:

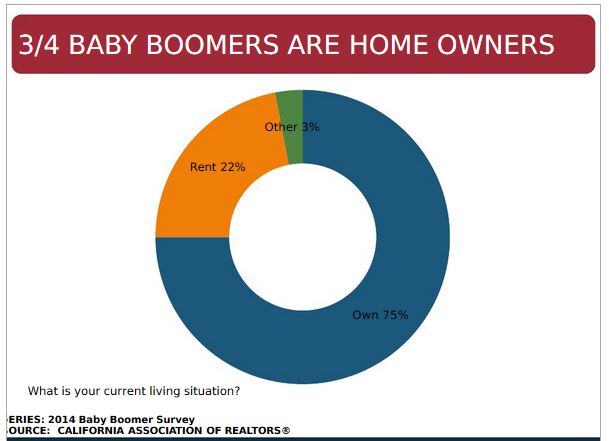

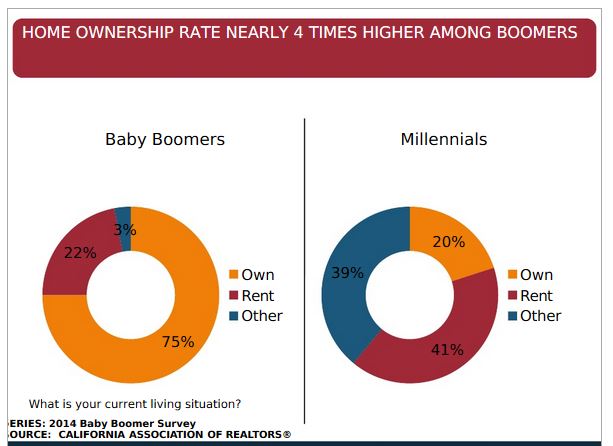

Uh-oh. It looks like this homeownership thing could be a boomer addiction:

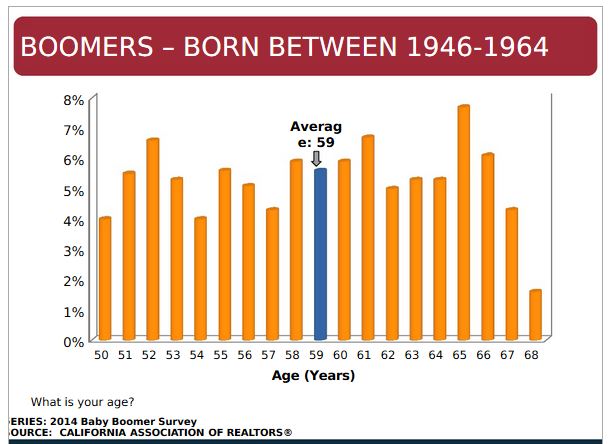

It’s still early in the game for most boomers.

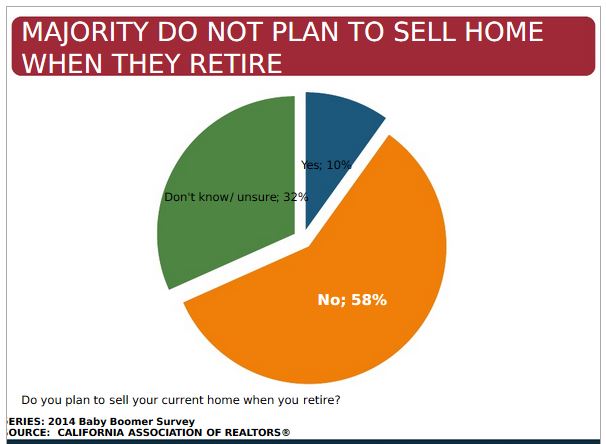

But here’s where the game changers start to come out. Only 58% don’t plan to sell? Fine, they aren’t going to make the market – it’s the other 42% that will determine our real estate future:

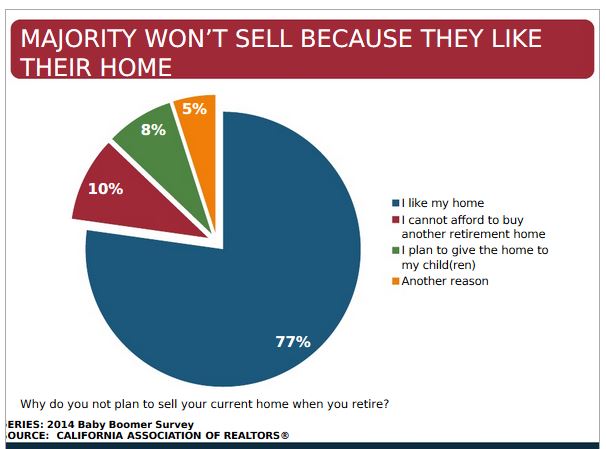

Fluff question below – of course we like our home, at least until selling it becomes a better idea:

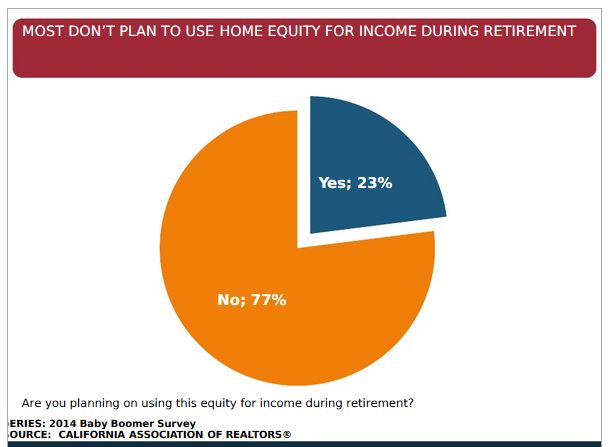

Almost a quarter of boomers know they are already short on income, and will be hitting the housing ATM. How many others who didn’t expect to use their equity in 2014 will eventually need to cash out for various reasons?

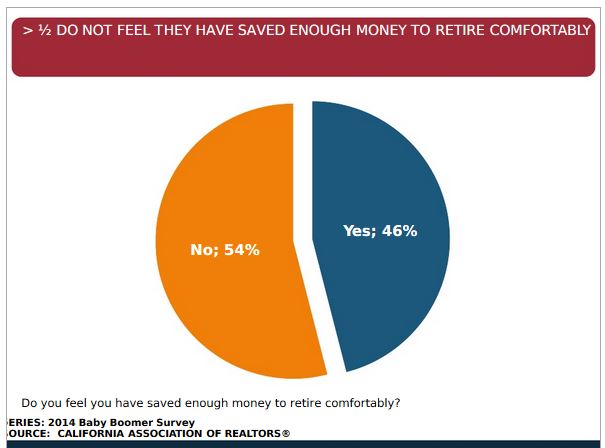

Here’s where the real trouble starts below – 46%???

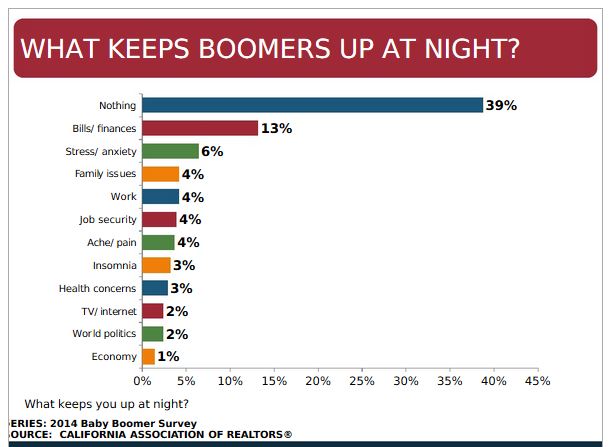

The best question towards the end of the survey once respondents have loosened up – and lo and behold, 61% of boomers aren’t sleeping that well.

If it only ends up being 20% to 30% of boomers who make a move, that’s still at least 15 million people in America who will be deciding our market!

The biggest concern?

Elderly folks who haven’t moved in a generation (or two), who know their money is running out and happen to see a couple of lower-priced sales nearby. In a effort to bank as much equity as possible, they hit the panic button and grab the first realtor they find who then dumps their house for 95% of value.

It’s a downward spiral that could pick up steam quickly.

It is a myth that the boomers are unprepared for retirement when in fact they are the best prepared generation in history.

Unlike NY most retiree’s tend to age in place in SoCal (well at least at first)

Also many boomers will starting getting inheritances.

IMO the more likely scenario will be that wage inflation finally start to kick in and more millennials (the larger than boomers generation) will be ready and willing to buy them up as they are liquidated over time.

I don’t see another 2006-10 housing crash occurring again in our life times (I see that as an extremely unlikely event). Anyway IMO.

I’m already starting to see this in my neighborhood. Several of the old people are listing their property in fall of all times. A couple of these were on the soon to foreclose list. My bet is the reverse mortgage well has run dry and now they need to sell to pull out whatever’s left.

I’d expect to see this more and more. The hard part will be when the old people start organizing (old people vote) or when the news does a couple of articles on the evil banks kicking seniors out of their homes.

Another 10 years and the boomers will start dieing off. That’s when it’s going to get interesting.

average boomer 401K balance = $126k

http://blog.personalcapital.com/wp-content/uploads/2014/03/401k-average.png

I would say that there is a problem.

Average 401K balance of the previous generations was zero

Jiji, I appreciate your many contributions here over time. But there is more trouble brewing under the surface.

Admittedly, I am on the lookout. Those of us with MLS access have the tax rolls at our fingertips – and the mortgage balances OF THOSE WHO ARE SELLING ain’t pretty.

Undoubtedly, the majority of boomers will be fine. But they aren’t moving.

Of the boomers who are selling, how many are moving up? Can’t be that many – maybe 10%?

The rest are moving down or out.

The boomers making the market will be those who need to move.

For those who don’t have access to the tax rolls:

As you are looking at homes online, notice how long the sellers have owned the home.

What I see is a group who bought in 2005-2008, and long-timers.

Would have been interesting if C.A.R. asked boomers if any expect the chance of a drop in home value within a decade. Foolish to think somehow were immune to another correction.

They also forecasted continuance in appreciation even with interest rates “normalizing to 4.5%”. Not going to happen.

Thanks Brian.

And how many of those boomers who know they will be selling – need to or not – are just riding the current appreciation, waiting for the music to stop before selling?

They will all have different exit points, but it could get exciting in spot areas where a cluster of them decide it’s time to go.

Wishful thinking, Jim. Lots of gray hair in my Silicon Valley $1.2MM and up neighborhood and very few people are moving. Nowhere they want to go and the “age in place” remodeling has already started. Eventually there will be turnover of those that die, go to assisted living, or move to be near the grandkids. But that will be a trickle, not a wave.

Personally I would be more worried about gen-x’ers in CV getting laid off from QCOM or whatever Tech/Bio-Tech company that gets hit next.

(OK maybe a few boomers are in this category as well, being no boomer in his right mind would want to pay the high MR when he does not have school age kids, so I could see them wanting to exit stage right on that).

CV kind of reminds me of Irvine in a lot of ways.

I was up there about a month ago, there were for sale signs everywhere.

IMO too much money for a mc-mansion on a postage stamp lot.

I’m not talking about Silicon Valley, I’m talking about normal people.

Most will be fine across the USA. They will age in place, and enjoy the remainder – all while ignoring those stupid blogger guys.

I think it’s already happening around SD. Why would anyone move, unless they had to?

I’ll be generous – let’s say that 25% of the sellers are comfortably moving up. Want to say 50%? I doubt that many can afford to move up, but let’s say it’s 50%.

What about the other 50%? Sure, they aren’t having a problem now because the general news about our local market is that it is healthy. If they don’t sell this time, they will try again next year…..and hey, maybe we’ll get more!

The recent dispositions have been very orderly.

My point? What happens when the merry-go-round stops.

What will inexperienced and fairly naive baby boomers do?

(not the people reading this blog)

There will be plenty of realtors who will gladly take advantage of them, and spoon their slightly-under-market deal to an insider.

In some areas – not all – there will be a few sales that appear like a downward trend. Like a rush on the banks, will boomers panic? I think they will.

We won’t know it, because we aren’t in their living room watching Archie Bunker reruns.

But we will see it in their eventual sales prices.

The boomers are a small component of a larger market. I don’t think San Diego is much different than Silicon Valley and the Bay Area. People are generally more sophisticated than average and satisfied with where they live. They aren’t watching the market for the best time to sell. Bad health and death will eventually force folks out. But it won’t be in large numbers or all at once.

In other words, there is no boomer “shadow inventory.”

Am I unprepared? How long ago was it you heard from me in person that aging in place was the plan? I am not smart/exceptional/special. This busts in two directions. No increase in move up quality properties and less transaction volume.

Here’s a link to another report that might be a little less biased than the CAR survey.

Some key points:

> Four in 10 Baby Boomers have no retirement savings.

> 69 percent of Boomers have no defined benefit pension plan.

> Of Boomers who do have retirement savings, 59 percent have saved less than $250,000 and 37 percent have saved less than $100,000

> Nearly half of Boomers with any retirement savings at all earn $75,000 per year or less.

http://myirionline.org/docs/default-source/research/boomerstrategyoct2015.pdf?sfvrsn=2

Well as the boomers retire (I may be an exception as I was semi-retired at about 45 – had my FY money/cash flow entirely due to property I might add) and the kids move out the need for a home with high MR in a good school area and the necessity to live close to the job to avoid long commutes falls away. The idea could be to move further out, buy at half the price and send JTR some money either by selling to provide a lump sum of cash or renting the property. Have you considered adding a property management string to your bow Jim? Where I live the 10% of the rent monthly annuity income helps estate agents through the droughtn months.

Interesting dialogue going on here. If I may add…

The only fact outlined in these slides, as well as via some of the reader’s shared links, is that the majority of baby boomers are not financially prepared for retirement. What outcomes can come from that are conjecture.

My anecdotes, to add to conjecture: My own parents (early 70s, been retired since Dad was 52!), had every intention of downsizing their 3200 sq foot home at some point but ‘definitely by the time we are 70.’ Until one day they decided the are going to die in that house. They just up and changed their minds, and that’s that. When the rubber hits the road, I don’t think boomers ‘want’ to leave those big bombers. I applaud those who do — who clean out the garage, give away a bunch of stuff and move to a low-maint condo. I would LOVE that for my parents. But I think that type of adventuresome, progressive spirit is rare.

My parents are incredibly lucky (fed pension) and sound savers so they have that option. But they have a majority of friends who are same age, still working, supporting their adult children and just in general unable to retire! I do think if they could slip quietly into a rental (maybe sell their house and rent back, something like that), they would take it. Their friends (who still work and I have to presume, at 70 years old, cannot retire) have listed their houses on and off for years. I think they are hoping for a big fish, as they don’t HAVE to sell quite yet. But they will have to. Someday. To Jim’s point, I think they’ll hit that button at a potentially inopportune time.

Boomers have a way, by sheer population size and by owning most political seats, of owning the marketplaces in which they reside. I think they’ll revise reverse mortgage rules, get creative with lending to seniors, offer home buyback plans of some sort…they’ll find a way to keep riding high. And that is where I think Jim’s theory may not come to fruition. Much as they did with foreclosures most recently. They will hide the troubled houses until they go away. Ugh.

As someone once said to me, in describing Gen X: “Gen X: we are screwed. And we know it.”

@andrewa, boomers will only move away if they can take the best hospitals and health care with them. Boomers want nothing but the best. For themselves!

If there’s any silver lining being a GenX in regards to the Boomers is that we’re going to be the ones who make the decisions on when and who goes to the rest homes. Think about it…

The Boomers can try to take it with them but eventually control of finances will pass down to the children.

My bet is that when this happens there’s going to be a lot of grandparents living in the “basement” while the kids take care of them and take over the house. Which I don’t feel is a bad thing. Older people that cohabitate with younger children and grandchildren tend to live longer than those at retirement homes.