Some disagree with my idea that, while the majority of baby boomers will be fine, there will be a group that is financially restrained and will need to sell their house.

Richard Green is a USC ivory-tower guy, so he obviously knows his stuff. He chimed in on twitter, and cited his report that mentioned:

The massive demographic shift will not result in another housing crisis.

This is because the educational and income levels of the current and future seniors are relatively higher than before, leading them to consume more than previous generations. Also, the size of the Millennial generation will drive the growth of aggregate housing demand, although the growth of per household housing demand may be relatively modest.

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2614638

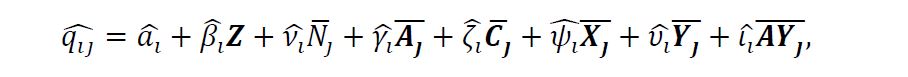

He doesn’t just make this stuff up. He also includes formulas to prove his case:

So there you go – nothing to worry about.

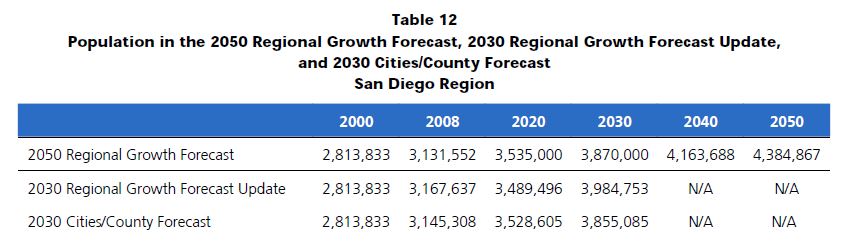

A likely scenario is that any future home sellers will get bailed out by the newcomers. According the SANDAG projections, there will be another million people moving to San Diego County! Yippee!

http://www.sandag.org/uploads/publicationid/publicationid_1490_11298.pdf

SANDAG’s growth forecasts are consistently wrong and consistently to the up side.

http://www.voiceofsandiego.org/topics/land-use/sandag-isnt-good-at-predicting-population-growth/

What ever the numbers it is fairly clear I think that SD is adding people faster than housing, so it is going to be a squeeze IMO.

And no the Suburb is not dead.

The additional population might be +/- 500,000 by 2050, but someday there will be a million more people here.

All that matters is whether or not they are ready, willing, and able to pay today’s prices or higher for those handful of boomers who need to sell.

Lower sales volume makes it harder to justify list prices because there are fewer comps. I sure hope those outsiders and millennials don’t mind paying more with less evidence to go by!

My degree in Economics says that this “theorem” is a bunch of malarkey. Looking at the doc the first data set defined was a subset of the 2000 census with a dash of 2005 and 2011 American Community Service (what is this?) numbers thrown in for good measure. 2011 seems to be the high water mark for data used. Considering that it’s 2015 now and that 2000-2011 was a highly irregular time for the housing market. How can you realistically use this data as an assessment of future trends? What would happen if 2015 date was used?

BTW this type of paper was the reason I got out of Economics. There’s so many variables that any prediction of future trends is very difficult. Because if this some Economists tend to hide behind numbers or always try to play the middle never becoming too involved one way or the other. People that are good at this tend to stay employed in gov/academic roles.

All economic models are rearward looking. That is why the majority of “economic experts” did not forecast the 2008 housing decline. Difficult to predict a change in supply and demand for something that has not occurred before.

Here is the unthinkable wildcard, ‘forced’ reform to Prop 13. How could it happen?

Tech bubble 2.0 finally pops.

Don’t underestimate good weather LOL.

have good weather and they will come.

35 years of inflation solves a lot of problems.

Even if housing prices only keep up with inflation, or even undershoot, today’s owners are going to be fine in the long run.

Oh yes my post was brougt toyo direct from golden tee in carlsbad . Cheers !

And the “good weather” is getting replaced by record breaking hot weather every year as we get more and more days that are 100+ degrees in the So Cal area!

And we moved from Phoenix to San Diego to escape the heat!

http://articles.latimes.com/2012/jun/21/local/la-me-heat-20120621