Mortgage rates have risen almost one-half percent this year, and are around 4.50% with no points today (conforming and jumbo). Because rates haven’t moved much in recent years, the half-point increase sounds dramatic, and could cause a few people to reach for the panic button.

But there’s no need to panic.

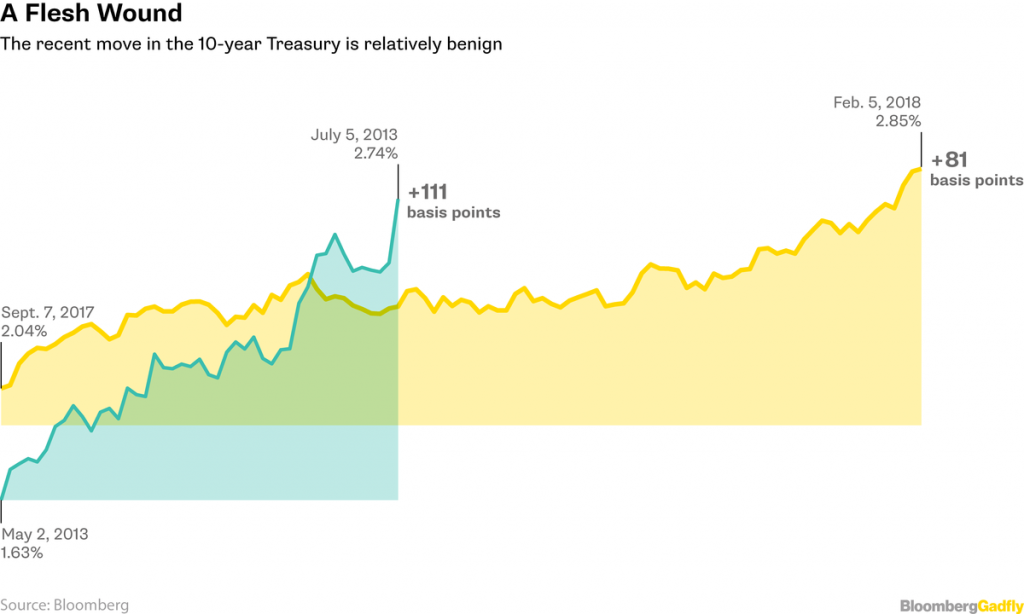

During the Frenzy of 2013, rates went up higher in less than half the time of the current increase:

But home prices didn’t back off – instead, our NSDCC median sales price has risen 40% since July, 2013!

But aren’t we closer to a new market peak now, and higher rates will just be the beginning of the end? After all, the last two readings of the SD Case-Shiller have declined month-over-month, and those are calculating county-wide sales that are generally lower priced than NSDCC.

While the higher-rates/higher-prices/tax reform/insert-your-favorite-doom will likely cause nervous buyers to pause, the market has always been made by the buyers with less caution and more horsepower.

They might be more selective going forward, which means only the cream-puffs will be selling for retail, or retail-plus – the inventory of those is too tight, and the competition will drive the sales price.

It’s the sellers of homes that are lingering unsold who might want to sharpen their pencil on their list price. Once you’ve been on the market and not selling for 2-3 months, do you really need to keep pressing for that extra 5% to 10% on top of what the last guy got – and risk not selling at all?

If higher rates do become an issue, it is a problem that is easy to fix, unlike tax reform or higher prices.

Buyers can either opt for a 5-year or 7-year fixed rate to stay under 4%, or ask the seller to buy down the rate. Sellers who are getting a 5% premium over last year’s prices shouldn’t mind paying 1% or 2% to make the deal.

Mortgage rates caught a break today, moving back near last Thursday’s levels as bonds (which underlie rates) benefited from today’s extreme market volatility.

It’s a common misconception that interest rates and stocks always follow each other. While this is often true over shorter time horizons, the opposite tends to be true in the long run. Moreover, there are numerous examples of shorter-term moves that also suggest the opposite. As recently as last week, higher rates were being blamed for stock market weakness, but today’s sharp drop in rates did nothing to soothe the significantly sharper drop in stocks.

The fact is that stocks have rallied to very high levels. They’ve been rallying for a very long time, and there’s been very little volatility recently. The longer that continued to be the case, the bigger the risk became of the sort of trading seen today. When stock markets lose this badly, money needs a place to go. Some of it found its way into the bond market. More demand for bonds results in lower rates, all other things being equal.

Unfortunately, the scope of the improvement in rates was nowhere near that of the stock market rout.

The average lender is back in line with last Thursday afternoon in terms of today’s mortgage rate quotes. Last Thursday afternoon–at the time–was still the worst day in several years.

On a hopeful note, today’s movement in underlying bond markets was big enough that it may help us find a ceiling for the unpleasant move higher in rates that’s dominated most of the past 2 months. It’s still early to assume such things, but move of today’s size bears close monitoring in the coming days.

http://www.mortgagenewsdaily.com/consumer_rates/834176.aspx

I was watching the market yesterday, and despite the point drop, the percentage drop wasn’t anything to write home about, especially with the years run. I have a trading platform, and the market, though heading down, wasn’t in a panic. It was orderly. I’ve seen panics. This wasn’t one, imo. Just good market hygiene. Nasdaq was starting to smell a little.

One thing to consider, going forward. Short of a catastrophe, the President can stop a stock market tumble in it’s tracks when he wants to. President Reagan created a committee, “the Working Group on Financial Markets,” to see to one day stock market “crashes.” They have the means to stop it, and work for the President. They met every 6 months or so until Obama took office. Then they met DAILY.

Now it’s standard procedure, instead of the move of last resort. If the stock market starts making Trump mad, he’ll step in. Whether you hate or love Trump, all can agree he hates to eat crow, and won’t/can’t allow it if he has the means to stop it. With our stock market, he has the means, just like Obama did, to squelch almost anything short of a global market seize. Like or hate Trump, the man is predictable.

That helps in the wacky currency rephasing that we’re going to have this year, as well as the stock market. The Chinese have their new “world currency” online as of January. It’s still not market-shaking, but they’ll be testing our treasuries, the more they don’t have to deal with us in global market enterprises. We’ll be hearing more about the new Chinese way of paying for things in the future. Right now, what’s important is what actor squeezed who’s butt back in the nineties, I’m sure we can all agree.