The panic ensues over the coronavirus, but people want and need to move too – especially as mortgage rates climb higher. What can we do to keep the real estate market hopping?

Here’s what can we do for home sellers.

Those who are concerned about strangers coming into their house should go ahead and move to their next home first. We can give you a Compass Bridge Loan to access up to 90% of your equity in your current home to purchase your next one, and we’ll front up to $50,000 for home improvements and staging to make selling your old home more effective. Let’s go this route on every home sold – it’s easier on you!

What can we do for home buyers?

The COVID-19 might be what finally gets agents to do video tours of homes. Selling homes by video is a real possibility, and if listing agents just walked around the house with a camera like they were showing it in person, then every potential buyer could see it from the comfort of their own home. If making a film makes you queasy, have your kids do it – they have no problem with producing videos.

This could also be the chance for home auctions to take hold. After a few days go by and/or the video reaches 100+ views, then conduct an online auction to determine the winner. Then have that buyer view the home in person, keeping traffic to a minimum.

Or have buyers submit written offers after seeing the video tour, and if the seller permits, have only those contenders view the home in person. Investment properties are regularly sold this way to minimize the impact on the existing tenants – you’ve heard the phrase, “Show with offer”.

Either way would reduce human interaction and possibly make home-selling MORE effective.

Buyers don’t necessarily need to see the home in person, either.

My buyers purchased this home and closed escrow without ever stepping foot inside. We also did a video of the home inspection, and between the two, the buyers got a full experience of what they were buying – and never saw the house in person until they owned it:

Either we can adopt new and improved ways to serve our clients and keep everyone moving, or we can sit at home watching the paranoia grow on TV. It’s your choice!

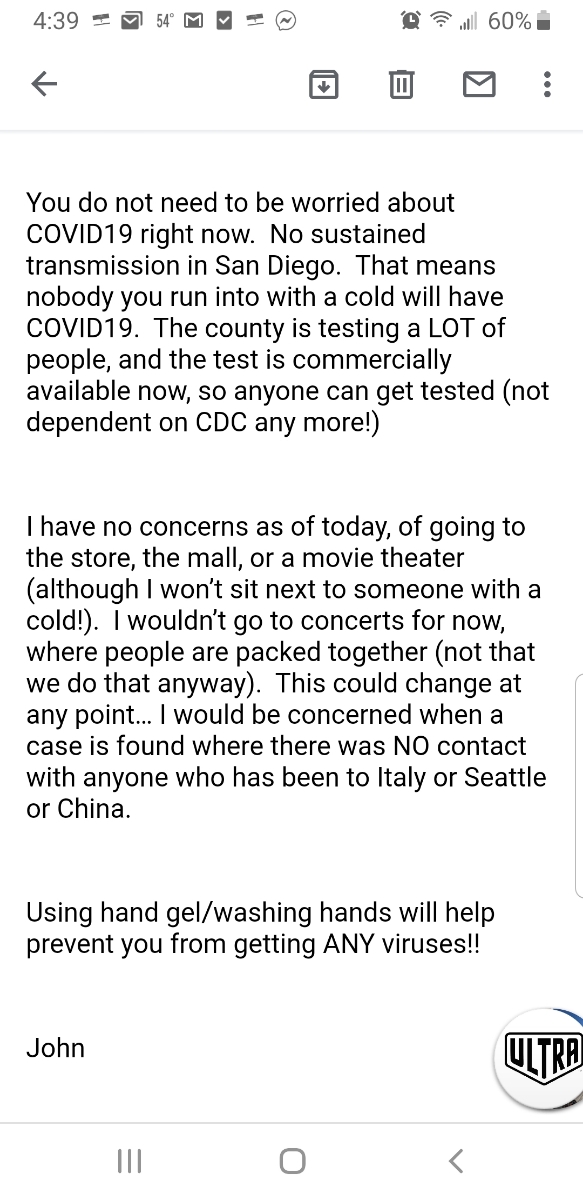

From the doctor in charge of infectious diseases at Rady Children’s hospital:

It’s over. Rates popping above 4% heading to 5%. Bankers calling mortgage brokers to get better deals than bank offers. Credit will freeze up soon. It’s gonna be ugly.

Be careful on Compass they will be out of money soon and no more VC money is available to keep the party going.

Thanks for your enthusiastic support.

http://www.mortgagenewsdaily.com/mortgage_rates/

I’m a buyer if there is another first time home-buyer stimulus. I’d imagine I’m not the only one, who in an attempt to chase any sort of yield put a good chuck of the down-payment savings into equities. Poof.

I think the severity of the recession this will cause is being understated. We’re talking about a massive demand and supply shock for at a minimum of 6-10 weeks, but this is likely to stick around for months.

We can be almost 100% certain equity markets will recover within 12 months after this health crisis if we look at recent historic precedence:

* Black Monday (8/25/87-12/4/87) – US stocks dropped 33.5% and recovered 21.4% within 12 months.

* Gulf War (7/16/90 – 10/11/90) – US stocks dropped 19.9% and recovered 29.1% within 12 months.

* Asia Monetary Crisis (7/17/98 – 8/31/98) – US stocks dropped 19.3% and recovered 37.9% within 12 months.

* Tech Bubble (3/27/00 – 10/9/02) – US stocks dropped 49% and recovered 33.7% within 12 months.

* Financial Crisis (10/9/07 – 3/9/09) – US stocks dropped 56.8%, and recovered 68.6% within 12 months.

* US Credit Downgrade (3/10/11 – 10/3/11) – US stocks dropped 19% and recovered 32% within 12 months.

* US Trade Wars (10/3/18 – 12/24/18) – US stocks dropped 19.6% and recovered 37.1% within 12 months.

Agreed on the increase in virtual house shopping.

Also believe there will soon be a marked increase in new listings, caused by slowdowns and retrenchments in many areas of the economy. Good time to sell now before people are forced to!

True, but recent rebounds were a result of massive Central Bank Stimulus. They are out of bullets. A drop in interest rates isn’t going to jump-start things this time. Additionally many companies are levered to the tilt.

The market is pricing in deteriorating credit, corona virus may have been the pin that pricked the bubble, but is not the cause of this.

https://t.co/ZO7BCxX2l1

The Fed will inject $1.5 trillion in short-term lending markets today and tomorrow on top of the already announced repos, a huge expansion in its $4.2 trillion balance sheet

“Pursuant to instruction from the Chair in consultation with the FOMC”

Damnit, Jim……I’m a scientist not a mortgage broker!

where are my low 2% re-fi rates!?!?!?

I did my best – I had my blog posts going on Monday and Tuesday. But yes, the greedy mortgage bankers denied you a shot at history.

Susie took my advice and she got 2.875% – not sure if anyone did better!

Good time to sell now before people are forced to!

An interesting concept here. People don’t need to sell if they can’t make their payments, like in previous recessions. Back then it was a scramble to the exits to sell before everyone else took whatever they could get.

But will it get to the point where homeowners sell because they need the money to eat? Or at least start over somewhere else?

Fed stimulus won’t reach those folks, and waiving the payroll tax doesn’t help people who aren’t receiving a paycheck.

The old-timers are probably fine. But those who have already faced some disruption up to this point that drained their savings (divorce, tuitions, elder-care, self-employments, etc.) could be facing the last straw with no or low paychecks for a couple of months.

They won’t panic for a few weeks while we all hope this blows over. But around May 1st will be interesting.

Yep, 2.875%! Will always be grateful to you, JtR. This is our forever home (single level) we built in October, 2018. How cool is Jim, btw? I’m not a client, don’t live in CA anymore 🙁 but I texted him a couple times and he immediately answered.

My favorite mortgage guy got us 2.875% even though rates went up the day I called. He said only 3 of his clients got that rate. We’re not going to lose ANY sleep with a 30-yr fixed with a “2” in front of it. Now the stock market crash is another matter. 🙂

@Susie

I won’t lose much sleep over my historically cheap 4.1% on a 2013 purchase price, but yeah I would really love to have another 1.3% worth of extra money to play with.

Regardless, I still think we will see those 2% rates come back again. Certainly low 3’s again.

Maybe you can get 2% on cash out re-fi’s only? is that a thing?

Yes, the Fed is meeting next week and is expected to lower again – hopefully that will trigger another opportunity for mortgage rates to drop a bit.

Subject to this:

Yes, this week sucks. The average lender raised rates well over half a percentage point and in some cases as much as .75%. They’re not pocketing your cash and gouging you. Their behind-the-scenes buyers have simply decided your loan isn’t worth as much to them as it was last week. They have PLENTY of others to choose from.

http://www.mortgagenewsdaily.com/consumer_rates/938641.aspx

Ellen Zentner of Morgan Stanley

@CNBC

just now:

Expects Fed to launch “major, open-ended” QE aimed primary at mortgage-backed securities

Massive effort to push mortgage rates down, or at least keep from spiking higher

@ just some guy

We had a 4.375%/30-year fixed from the October, 2018 build. I agree with you. Rates will come down maybe even to 2.5%/30-yr. fixed in the coming weeks/months. But, we decided to jump anyway. We’re not moving again, and our house has appreciated 17% in 16 months so refinancing made sense. We get a refinancing credit on closing costs too since our loan was less than 5 years ago. (You learn something new everyday.)

We save $371/month. Choosing to jump now was a calculated decision because recent events have been so stressful with the stock market crash for us. We didn’t need any more stress watching and waiting to see where rates went. I’m happy if others get even lower rates. I never thought I’d see a “2” in a 30-year fixed in my lifetime, so we ‘re good! Be well.