This is disconcerting – hope that homebuyer demand is getting pent-up while we’re on the couch……

Southern California house hunters were already balking at buying existing homes amid coronavirus fears and business closings before real estate agents were told to halt most selling activities.

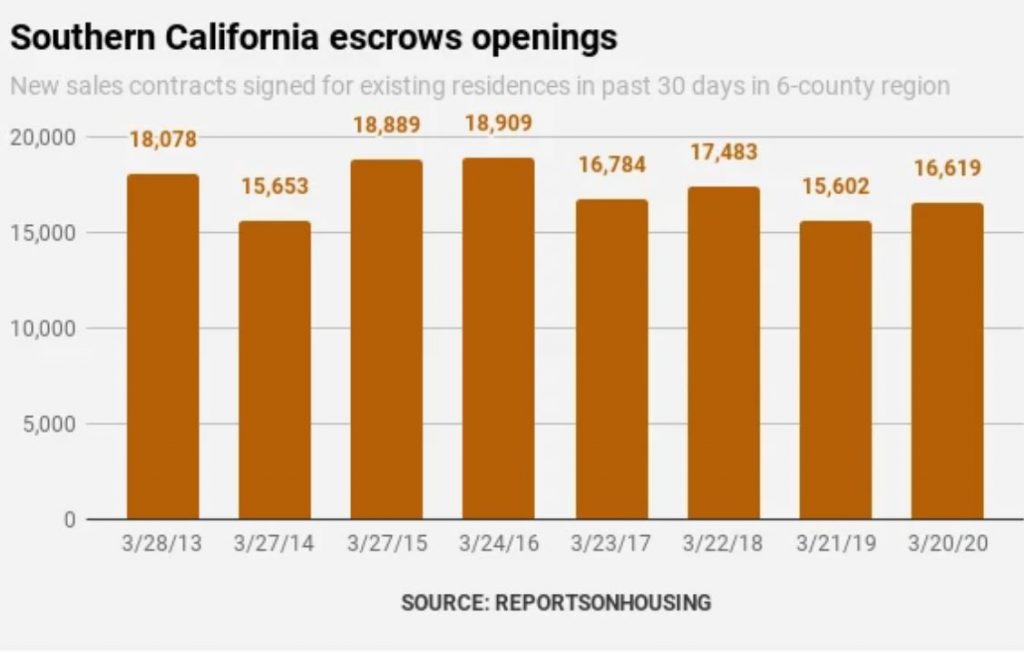

The number of new escrows in the six-county region in the 30 days ended March 19 was 16,619 — down 766 or 4% in four weeks, said ReportsOnHousing. Author Steve Thomas follows homebuying trends found in the home-selling listing services for Los Angeles, Orange, Riverside, San Bernardino, San Diego and Ventura counties.

Let’s put this sales drop into perspective. Remember, this is prime homebuying season. My trusty spreadsheet tells me in the same period in the previous five years, new escrows averaged an increase of 904 or 5%. So this was quite a reversal in fortunes for local real estate.

“Stunning but not unexpected,” says Thomas.

Numerous factors have hit the market. House hunters and owners alike have lost job security. Lenders that should have been offering cheaper mortgages balked at lower rates due to market fluctuations and a rush of business. Fears of spreading disease scared many sellers and buyers from the very hands-on homebuying process.

And this recent sales drop came before new state government mandates to limit business interactions. That forced the California Association of Realtors on Friday to tell its members to stop all face-to-face home selling.

Thomas says he expects the majority of sales in progress to close but he expects few new deals to be made and that many listings will end. “Not much you can do until we get some certainty,” he says.

Coronavirus stomped out what appeared was a solid start to the selling season: Even the depressed March 19 escrows count was up 6.5% above the year-ago level. But four weeks earlier, escrows were rising at an 18% annual pace.

ReportsOnHousing found Southern California’s supply of existing homes to buy was steady as of March 19: 29,941 homes officially listed in the region, up 282 or 1% in four weeks. That’s on par with 250 listings added on average since 2013.

Here’s how the existing-home trends run in the region’s counties …

Los Angeles County:5,006 in escrow, down 381 or -7% in four weeks; 8,650 listings, up 2 in this period.

Orange County:2,398 in escrow, down 185 or -7% in four weeks; 4,159 listings, down 2.

Riverside County:2,983 in escrow, down 157 or -5% in four weeks; 6,793 listings, up 31.

San Bernardino County:2,313 in escrow, down 109 or -5% in four weeks; 4,406 listings, up 10.

San Diego County: 3,138 in escrow, down 115 or -4% in four weeks; 4,808 listings, up 220.

Ventura County:781 in escrow, up 181 or 30% in four weeks; 1,125 listings, up 21.

Link to Article

I see a lot of parallels to 2008. A lot of people got over the head – needed duel incomes just to make the mortgage payment, believe that house prices can only go up etc.

All of those are coming back into pay.

California is going to have a gargantuan hole in their budget and pension funding as capital gains evaporate this year. Will those lead towards lower taxes or higher taxes?

How many people are confident about employment prospects in the next 6 months? How many could support mortgage payments if significant other was unemployed?

How many vacation rental owner properties can sustain no occupancy for more than a few weeks?

Prices are too high.

I got a non-parallel to 2008 for you:

Every home buyer over the last ten years had to qualify for their mortgage.

Qualify…. is it really that hard? FHA still 3% down…

Speaking for NSDCC, it’s too expensive now for FHA loans – has been for years.

All the traditional measurements of the market trends – incomes, jobs, wages, etc – all went out the window a long time ago.

The first-timer market is parents & grandparents with gift cash helping their kids get into a starter home.

Appreciate the insight! Would love your take on what’s going on in mortgage REIT’s right now

I would appreciate your take on what the effect of the mortgage forbearance provisions in the house bill might be on the housing market provided they are included in final bill (Section 108 -https://appropriations.house.gov/sites/democrats.appropriations.house.gov/files/COVIDSUPP3_xml.pdf). Ultimately I also think these provisions are much needed to revitalize the economy by increasing discretionary spending (essential spending for quite a few as well). Call me a commie but I believe in trickle up policies! Glad Kayla is home!

Hi Eliana!

The lenders are experts at loan modifications now, so they will find a way to fold those missed payments into a new mortgage agreement. Maybe they will do a fresh refinance and makes some fees too!

People miss a simple point. $500/sf for NSDCC is nowhere near expensive in comparison to equally desirable places around the world.

Where do doomsayers want ppsf? You really think Del Mar/Solana beach entry is gonna go to $300/sf instead of $500? You know how many of us are sitting on cash ready to buy at 20% off ($400/sf)?

P.s. places like CV at $300/sf will take a hit as it won’t attract the wealthy $ and will be the demographic to be most affected by job loss, cash flow, etc

Exactly – and how tight is grandma with the comps? She just waits for the call, and then sends the money for the down payment! Or the whole thing!

Grandma-funded buyers: 0-10% off retail

Owner-occupiers who need a deal to move up: 10% to 20% off

Investors/flippers: 20% to 30% off

CV at $300/sf was a long time ago – our last 88 CV sales averaged $470/sf. The last time we were around $300/sf was 2011:

https://youtu.be/tQzRgfKhD5E

Oops. Meant Chula Vista.