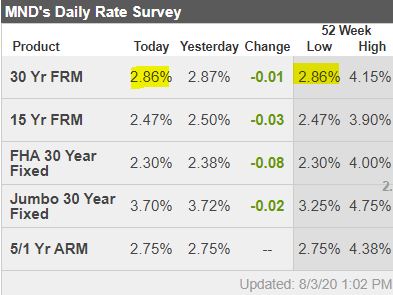

Mortgage rates hit an all-time low yesterday!

Combine the improved purchasing power with the covid-delayed selling season and the lowest inventory in recent history, and we have full-blown frenzy conditions. Look at how July wound up:

NSDCC July Sales & Pricing – Preliminary

| Year | |||||

| 2012 | |||||

| 2013 | |||||

| 2014 | |||||

| 2015 | |||||

| 2016 | |||||

| 2017 | |||||

| 2018 | |||||

| 2019 | |||||

| 2020 |

We had 342 sales, and there will be some late-reporters. Wow!

Has pricing caught up with the market conditions yet?

Eye popping rates from my credit union:

-15-year Fixed Purchase: 1 .875%

-30-year Fixed Purchase: 2.25%

-15-year Fixed Refi: 2.75%

-30-year Fixed Refi: 3.25%

After talking with JtR, we grabbed a 2.875% 30-year fixed refi about mid-May. We’ve made two payment now for July and August and still can’t believe how low our payment is. Mahalo, Jim!

Which credit union has these rates?

She is in Idaho. Maybe the Potato FCU? 🙂

Oh you’re so funny, Jim! 🙂

Tom, it’s Idaho Central Credit Union. I’ve been with them for 11 years. You do need to be a member. If you’re interested, let me know. I’ve used one guy for my last three transactions. He’s amazing!