Veranda

This sold for $2,700,000, which was $600,000 over the list price:

This sold for $2,700,000, which was $600,000 over the list price:

Imagine the pricing quagmire we are in.

The homes on the market today were priced according to comps from 1-4 months ago, which were the craziest-priced sales in the history of real estate.

To make matters worse, sellers are naturally drawn to the highest-priced sales – and today that means the ones that closed for hundreds of thousands above the list price. But there was probably only one buyer crazy enough to pay that price.

Then rates go up to the mid-5s, which to buyers feel like double what they were.

But the sellers have committed to their list price, and their ego is laid out bare for all to see – friends, family, neighbors – all are watching and waiting to see if another house is going to sell for an insanely high price.

What happens if it doesn’t sell right away?

The sellers have to be motivated enough about moving that they will address the results. Many have been on the market for weeks without selling – and have they even received an offer yet?

They didn’t get this far in life without being smart enough to know that something different is needed. But there are only three choices:

That’s it, those are the choices.

Most will add a fourth choice – it’s my agent’s fault! If my agent would only advertise more, and do more open houses, and well, heck, do whatever agents are supposed to do to sell my house for my price, then it would sell! But you can spend a million dollars on advertising, and it still won’t sell if the price isn’t right.

This is why the market won’t adjust for a long time. The gap between those crazy comps from yesteryear and what more rational buyers will pay today has never been so wide. It’s probably not 5% or 10% either.

The craziest buyers have already purchased, and left us with unattainable comps. The only question is whether there are any somewhat-crazy buyers left, or if it’s just the rational buyers.

Tip: Throw out all the sales prices of the comparable homes that have sold nearby, and just use their list prices. Those list prices were probably rooted in reality (hopefully), and then in all the commotion, one of the craziest buyers radically overpaid just to win the house. Their purchase price is unlikely to be achieved again, at least for the foreseeable future, but those list prices should be a good starting point.

The old Encina Power station site is designated for tourist uses, and open space. A seven-story hotel like this will undoubtedly be proposed – will it fly in Carlsbad? Rooms here go for $300-$2,100 per night:

A new Compass listing in South Encinitas, priced at $6,290,000:

Tucked away in seclusion, this 3606 sq. ft. 3-bedroom 3 bath New Construction Modern Hacienda masterpiece with two additional detached units exemplifies a unique combination of an ultra-modern interior and the warmth of a welcoming hacienda exterior. Nestled in the depths of Berryman Canyon, with the inviting Enclave development serving as the veritable drawbridge to the estate, this home exists as a fortress of relaxation. Upon arrival, all guests are unequivocally certain that this estate is the crown jewel of the neighborhood.

This will help to keep home prices up:

A top California lawmaker is proposing to spend $10 billion to help families buy homes in the state with some of America’s highest housing prices.

Democratic State Senate Leader Toni Atkins on Wednesday unveiled details of a proposal she’s pushing to create a revolving fund that would provide interest-free loans for up to 30% of the purchase price of a home for low- and middle-income households.

If implemented, it would be the largest program of its kind in the nation, according to the people who designed it. Proponents hope that it will be included in the state budget that must pass by June 15 and go into effect as soon as January. The aim is for it to eventually help about 8,000 families a year.

The proposal calls for the state government to share in any appreciation in the value of houses it helps purchase when they are sold and then invest those proceeds back into the fund.

“The purpose of this is to create a long-term endowment,” said Gene Slater, chairman of CSG Advisors, which advises public agencies on affordable housing and helped design the program. “We’re investing in the future value of the home so we can help other people.”

Under the proposal, California would spend $1 billion a year for 10 years. Participation would be limited to households making 150% of the median income in an area. There would be limits tied to a region’s median home price allowing home buyers in the most expensive markets such as the San Francisco Bay Area to benefit.

In Los Angeles County, households earning up to $120,000 a year could qualify for assistance, while in low-income areas like the agriculture-heavy Central Valley, that number would be closer to $107,000, according to data provided by the researchers who drafted the framework. Proponents want to target certain groups through outreach, including residents of largely Black and Latino neighborhoods and those with high loads of student debt.

The homeowner would repay the loan when they sell or refinance the home, along with a cut of the profit from any appreciation in value based on how much assistance the state provided. If the home price declines, Mr. Slater said, the state would be repaid if money is left over after the purchaser pays back their mortgage loan and recoups their portion of the down payment.

The program would be limited in scope to cover only about 2% of home sales volume statewide in an effort to avoid pushing prices higher.

Participants would be chosen on a first-come, first-served basis, with slots set aside for certain geographic areas and income brackets.

To become law, the proposal would have to pass both chambers of the Democratic-controlled state legislature and be approved by Democratic Gov. Gavin Newsom. A representative for Mr. Newsom declined to comment on the pending legislation. In a statement, Assembly Speaker Anthony Rendon praised Ms. Atkins’s work on the issue but didn’t say whether he supported her proposal.

An unlocked link to the full WSJ article:

Even though real estate is local, the homebuyer psychology tends to be similar across the country – mostly because people are people, and have similar reactions to every variable. When they see mortgage rates go from 3% to 5.5% in less than six months, it’s only natural to want to pause and see where this goes.

But the desperation among buyers – especially those who are out-of-towners and don’t own a home here yet – hasn’t changed, due to the low inventory. It is unsettling to see so few of the quality homes coming to market, and they want/need to stay in the game so they don’t miss out. It would take a flood of new listings to change that, which isn’t happening. At least not yet.

Let’s have the statistics help guide us on current market conditions.

1. We have considered the local real estate market to be ‘healthy’ when the active listings to pendings has been 2:1 ratio. Here are the detached-home listings between Carlsbad and La Jolla:

Monday:

Actives: 262

Pendings: 207

Thursday (today):

Actives: 262

Pendings: 202

The current ratio is very healthy, and the actives aren’t exploding. Last year at this time there were 330 active listings, so only having 262 homes for sale in an area with a population of 300,000+ people isn’t bad. The only startling part is that there aren’t more homes for sale!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

2. Let’s talk absorption rate, another measuring stick for the health of the market. The historic norm for a healthy market has been a 6-months’ supply of homes for sale. In recent years, a 3-month supply has seemed to be more realistic, just because the supply has been limited.

What is it today?

There were 225 sales in April, so the 262 active listings is only a 1.2-month supply. We would need 675 active listings to have a three-month supply, which sounds impossible in the current environment.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

3. How about the market time of the current pendings? Is it taking longer to find a buyer these days? Yes. The median days-on-market for homes sold in the early months of 2022 has been nine days. The current pendings have a median days-on market of 12 days, which isn’t alarming and still extremely low.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

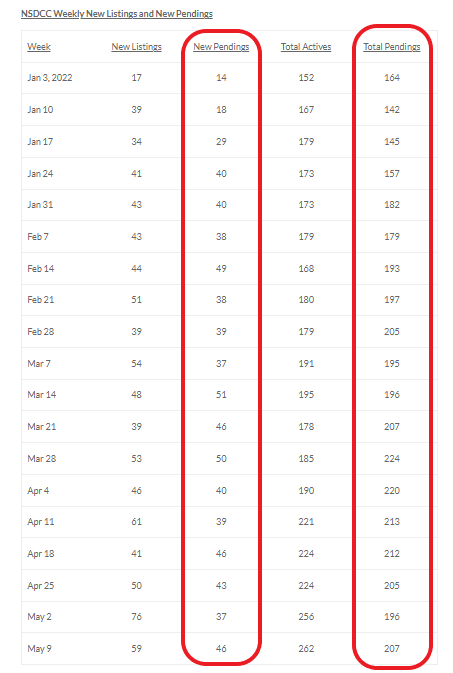

4. Have the number of actives and pendings been consistent in 2022?

Yes, especially the pendings:

So while there is talk about a shift in the market, it may just be a pause. Statistically, the market looks steady – there isn’t a surge of unsold homes, and there are still plenty going into escrow every week.

If there aren’t as many buyers looking, and there aren’t crazy numbers of offers, then it’s just going back to a more-normal market. Not normal yet, but heading that way.

The list prices have been on a rampage, and it’s probably time for them to stop going up so much every month. It was going to happen sooner or later, and that day has probably arrived – finally!

The smoke stack and the rest of the Encina Power Station have been demolished.

What does this mean for Carlsbad?

Before agreeing to support the approval of the new plant, the city negotiated an agreement with NRG and SDG&E to help ensure the project would provide the greatest local community benefit possible.

Some of the provisions of this agreement include:

A guarantee that NRG will completely decommission, demolish and remediate the old Encina Power Station site within three years of Encina’s retirement, at no cost to taxpayers.

NRG will turn over to the city several pieces of property surrounding the lagoon and the blufftop across from the plant. NRG will work with the city and the community to create a plan for the site’s future use.

What can go on the site?

The General Plan envisions redevelopment of the Encina Power Station, as well as the adjacent SDG&E North Coast Service Center, with visitor-serving commercial and open space uses to provide residents and visitors enhanced opportunities for coastal access and services, reflecting the California Coastal Act’s goal of “maximizing public access to the coast.”

The Great San Diego Blackout of 2011

The full collection of Smokestack photos:

These were my high-school days. The Best of Mountain on 8-track, and friends like this:

The part that disrupters overlook is that the people doing the work need to be really good at advising and transacting real estate sales. It’s not as easy as it looks!

Real estate brokerage REX Homes became famous in recent years for spearheading an anti-trust lawsuit against Zillow and the National Association of Realtors, accusing them of being a ‘cartel’ to edge out non-MLS participants. But it appears that as of today, the company may no longer be in existence.

Numerous staff reached out to us directly to indicate the company’s last day was Tuesday and that a companywide call on Friday outlined the end of REX Homes.

Staff at the Austin and The Woodlands offices (both in Texas) have confirmed that as of today, the doors are literally closed. It is unclear what REX’s plans are for wrapping up any current contracts that haven’t closed.

The company’s website remains live with no notification of any service interruptions and there have been no changes to the faces that appear on the staffing page.

Many Glassdoor users have begun leaving reviews asserting that operations have ceased. To thicken the mystery, we’ve already seen several recent reviews disappear, but it is unclear if that is Glassdoor or REX’s doing.

Several LinkedIn users formerly employed at REX Homes are putting their #OpenToNetwork signs up, stating the company has closed – some indicate departments dissolving, others that the entire company has collapsed.

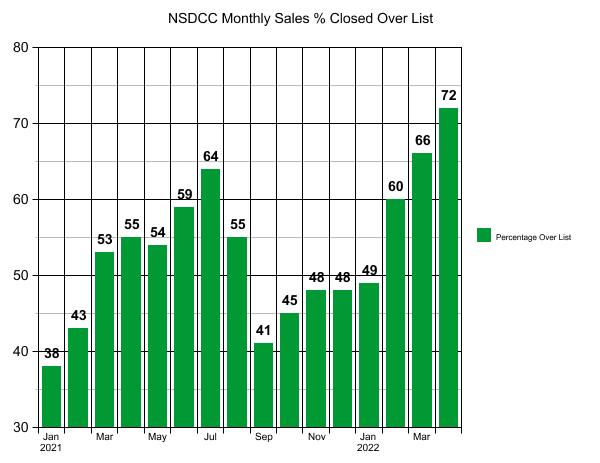

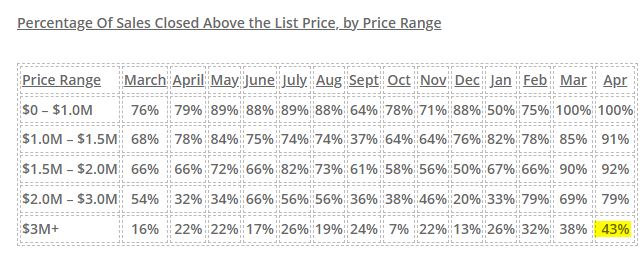

Link to ArticleWill April be the peak month of buyers paying over the list price?

NSDCC Detached-Home Sales, % Closed Over List Price

Hard to imagine that there will ever be another month where nearly three-quarters of the home buyers end up paying over the list price!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

How about those $3,000,000+ home buyers!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

NSDCC Average and Median Prices

| Month | |||||

| Feb | |||||

| March | |||||

| April | |||||

| May | |||||

| June | |||||

| July | |||||

| Aug | |||||

| Sept | |||||

| Oct | |||||

| Nov | |||||

| Dec | |||||

| Jan | |||||

| Feb | |||||

| Mar | |||||

| Apr |

Whoops – after the average sales price went up 7% MoM in January, 9% in February, and 8% in March, it dropped by 2% in April.

Same here – after the median sales price went up 4% MoM in January, 7% in February, and 10% in March, it dropped 2% in April too!

The median sales price could drop another 15% this year and still be in positive territory for 2022. Yet it would feel like a complete meltdown of epic proportions!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~