by Jim the Realtor | Apr 19, 2022 | Jim's Take on the Market, North County Coastal, Sales and Price Check |

The drastic drop in inventory seems devastating, but check out the closed sales:

NSDCC Number of Listings & Sales, First Quarter

| Year |

NSDCC Total 1Q Listings |

Median List Price |

1Q Closings |

Median Sales Price |

| 2018 |

1,230 |

$1,592,500 |

569 |

$1,323,000 |

| 2019 |

1,277 |

$1,575,000 |

536 |

$1,290,000 |

| 2020 |

1,082 |

$1,712,500 |

572 |

$1,420,500 |

| 2021 |

985 |

$1,899,000 |

663 |

$1,800,000 |

| 2022 |

704 |

$2,595,000 |

504 |

$2,418,000 |

Last year was an exceptional frenzy with 663 sales in the first quarter, but look how this year compares to previous years. The 1Q sales in 2022 are fairly close to those in 2018-2020, in spite of fewer choices!

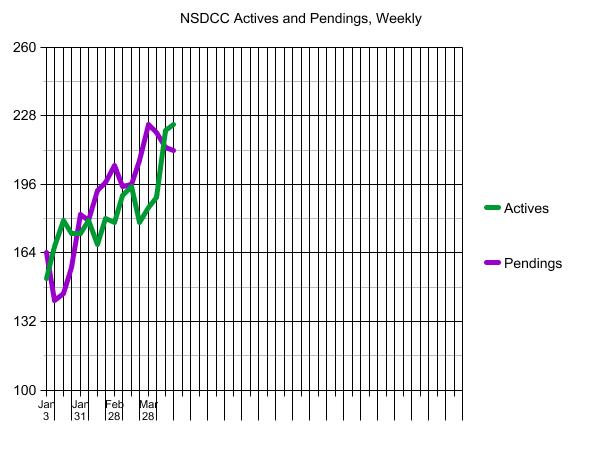

by Jim the Realtor | Apr 18, 2022 | Inventory

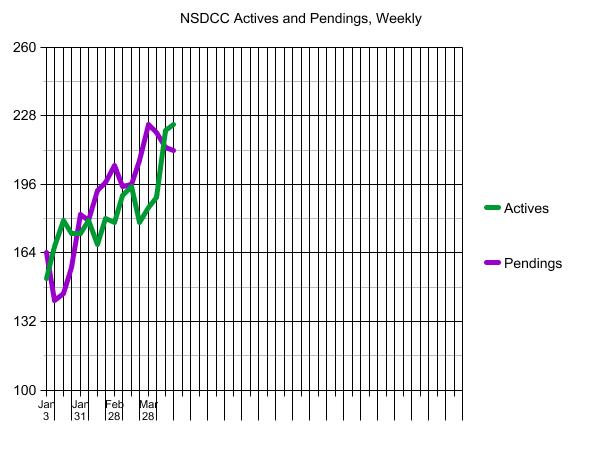

Part of the problem with trying to analyze any of the current data is that there is no precedent – any previous assumptions have little or no relevance to today’s market because of the lack of homes for sale.

We keep hoping there is going to be a surge of new listings , but it’s still not happening – we had more new pendings than new listings again this week. We would need a flood just to catch up with last year, which was less than half of what we had in the covid-affected era!

NSDCC Actives & Pendings, Mid-April:

| Year |

NSDCC Active Listings |

NSDCC Pending Listings |

| 2018 |

825 |

331 |

| 2019 |

925 |

341 |

| 2020 |

684 |

192 |

| 2021 |

335 |

358 |

| 2022 |

224 |

212 |

Plus, almost half of today’s 224 active listings are priced over $4,000,000!

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

(more…)

by Jim the Realtor | Apr 15, 2022 | 2022, Frenzy, Jim's Take on the Market |

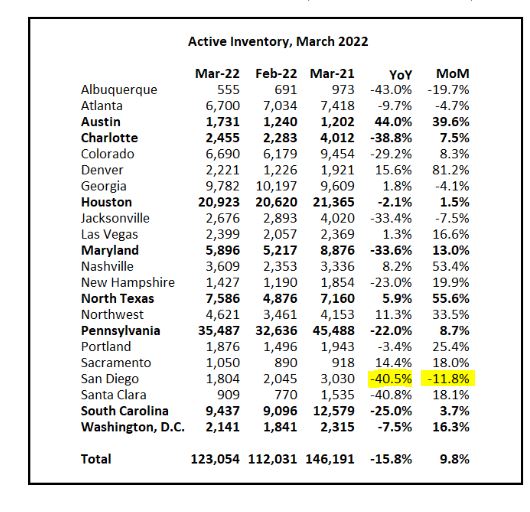

There is some some discussion among the talking heads that a moderating frenzy could cause more sellers to come to market in hopes of getting out while they can. They may be right in areas where inventory is already exploding.

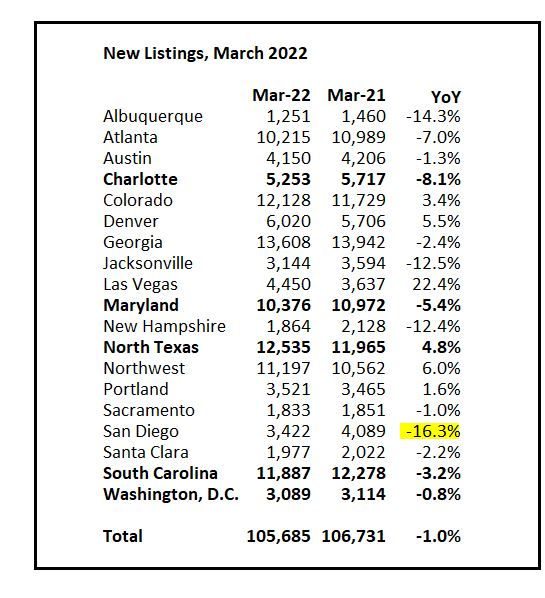

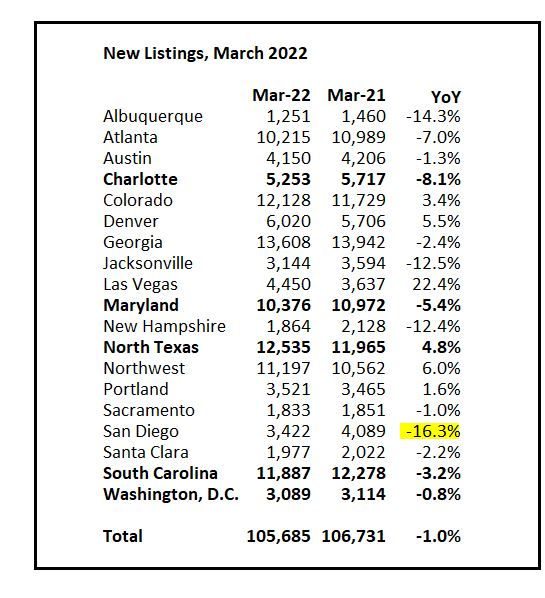

But not in San Diego, where last month the new listings dropped more than anywhere else.

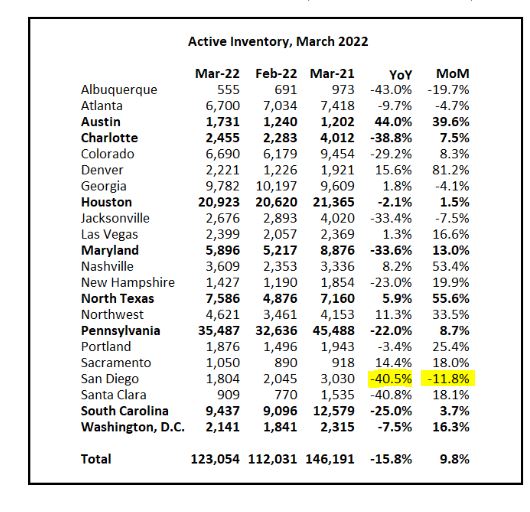

As the selling season opens up, it is normal for the inventory to rise, and below you can see that sexy destinations like Austin, Denver, Nashville, etc. experienced large increases between February and March.

But not in San Diego, where in March the active inventory month-over-month went DOWN!

No surprise that San Diego is the place where people are least-likely to leave!

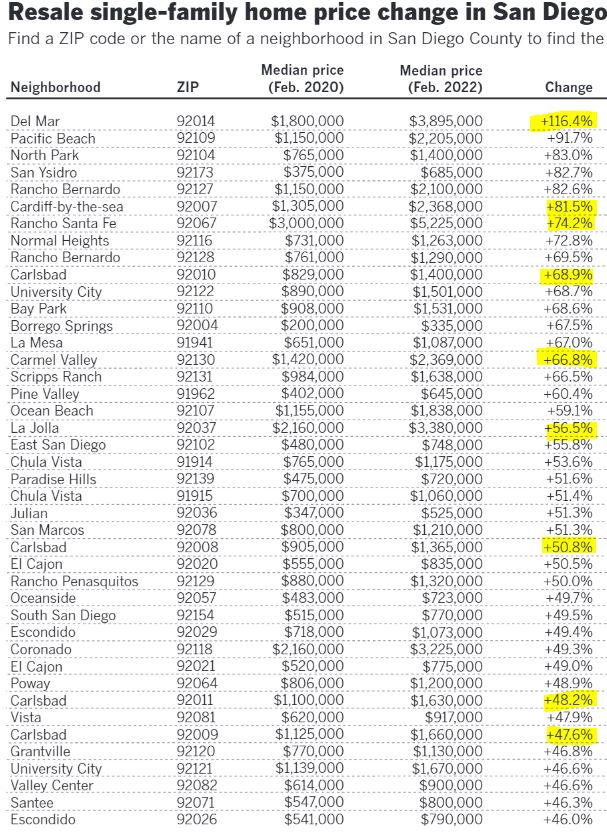

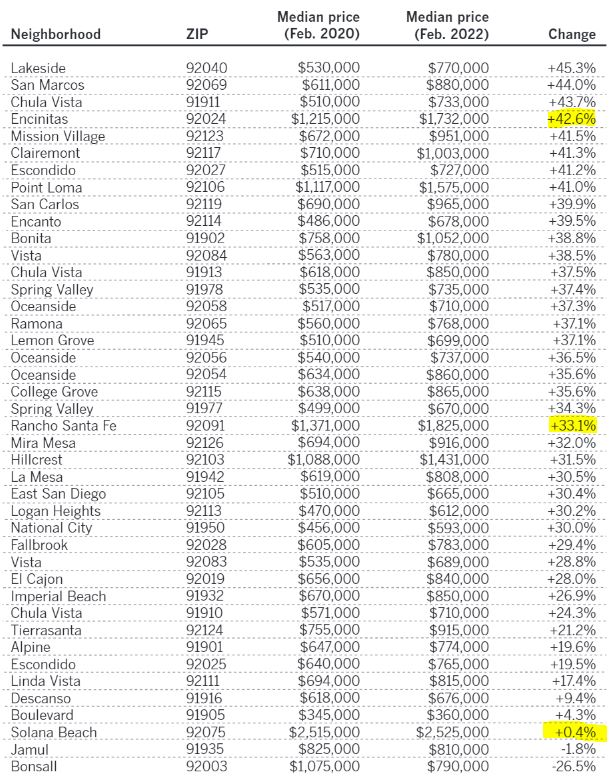

by Jim the Realtor | Apr 14, 2022 | Sales and Price Check

What a wild ride lately! It’s safe to say we’ll never see a March like this again:

NSDCC March Sales & Pricing

| Year |

March Closings |

Median List Price |

Median Sales Price |

Median Days-On-Market |

| 2015 |

300 |

$1,195,000 |

$1,115,000 |

48 |

| 2016 |

252 |

$1,162,500 |

$1,143,665 |

50 |

| 2017 |

258 |

$1,096,500 |

$1,074,000 |

45 |

| 2018 |

258 |

$1,399,000 |

$1,396,250 |

16 |

| 2019 |

211 |

$1,345,000 |

$1,299,999 |

17 |

| 2020 |

206 |

$1,492,500 |

$1,445,000 |

12 |

| 2021 |

252 |

$1,810,000 |

$1,825,000 |

10 |

| 2022 |

206 |

$2,425,000 |

$2,625,000 |

9 |

The median sales price went from $1,445,000 to $2,625,000 in two years – an increase of 82%!

Last month’s median sales price was $200,000 ABOVE the median list price (108%), and it was 10% higher than it was in the previous month.

We are going to have to live with fewer sales from now on.

by Jim the Realtor | Apr 13, 2022 | Jim's Take on the Market, Thinking of Buying? |

Like most real estate talk, half of this is horsepucky:

Don’t Let FOMO Drive You

Just because everyone is buying a house, doesn’t mean you should be too, said Donald Olhausen Jr., owner of We Buy Houses in San Diego. “I have seen many people force bad decisions because they have fear of missing out (FOMO). Forcing a bad deal will not rectify itself because there were no other options or because you felt stuck. Being patient in this market is hard, but overpaying for a faulty property will ultimately lead to more regret.”

There Are Markets Within Markets

There is not one universal housing market, but rather “many smaller micro-markets,” said Michael Shapot, Esq., licensed associate real estate broker. “Some of those submarkets are ‘hot, less hot or more hot’ and they may change week by week, or month by month.”

Elisa Uribe, a realtor with Wells and Bennett Realtors added that “real estate is hyper-local,” so consider the source. “You can withstand any market changes if you don’t have to move in a specific time frame.”

2022 Is a Slightly Better Time To Buy

Real estate experts like Marina Vaamonde, the founder of PropertyCashin, said that 2022 would be a better time to buy because, “The demand for residential real estate is still vastly overshadowing the inventory.”

Indeed, now that 2022 has arrived, experts still agree that is the case, even with decreasing inventory. According to Time, home prices will not increase as rapidly and home values will also likely increase at a less vigorous rate than the peak of 2021, which bodes well for buyers.

However, the Fed Just Raised Interest Rates

What made 2021 unique was extremely low interest rates, according to David Friedman, CEO of investment property platform Knox Financial. “There have been very few times in history when we’ve seen 30-year fixed mortgage rates hovering around 3.3% and 15-year mortgage rates slightly above 2.6%,” he said.

However, on March 16, 2022, The Federal Reserve raised rates for the first time in years by 0.25%. What this likely means, according to NerdWallet, is that mortgage rates will follow suit by increasing, meaning homebuyers will pay more in interest.

No One Can Predict the Next Drop

Despite these slight increases in interest rates, and decreases in inventory, this doesn’t necessarily mean the market is going down.

Khari Washington, a broker and owner of 1st United Realty & Mortgage, added, “No one knows if the housing market will drop and when it will drop. Most reports talk about the market slowing in 2023 but not falling. Builders have not built enough housing and interest rates remain low.”

“The right time to buy is when a person is ready,” adds Washington.

Don’t Wait for a Better Price

Waiting can be a gamble, said Jeff Shipwash, CEO of Shipwash Properties LLC. “You could be waiting to purchase with the thought of prices coming down, but…even if home prices do pull back some, if rates increase it will all be for nothing. You may be able to afford a $300,000 house at current rates. But if those rates increase by 1% while you wait, that same payment may be on a $250,000 house.”

Rents Are Sky High

If not buying means renting, consider that “the current rental market is on fire with rents skyrocketing and landlord incentives eliminated,” said Shapot. Renting will not be a cheaper option in the long run.

This Market Is Stable

Unlike the unstable market leading up to the economic crash of 2008, this market is stable, said Jennifer Shannon, a broker associate with Keller Williams Realty. “This market run-up hasn’t been driven by investors, flippers and bad mortgages. It’s been driven by legitimate buyers who are more free to determine where they live than ever.” While demand will start to slow eventually, she says there are no indicators of prices going down anytime soon.

You’re Ready When You’re Ready

“You’re ready to buy a home when you’re ready, not when there’s a frenzy,” said Tabitha Mazzara, director of operations at mortgage lender MBANC. “The frenzy is a seller’s market, so missing out on a frenzy is a good thing for buyers.”

Chase Michels, owner of Compass, The Michels Group, added, “If a client is fully committed to buying and is in the appropriate financial position to do so, then they should be looking. You may buy at a little lower or higher price at different times of year but that is typically unpredictable in a smaller market.”

Link to Article