by Jim the Realtor | Apr 1, 2025 | About the author, Bubbleinfo Readers |

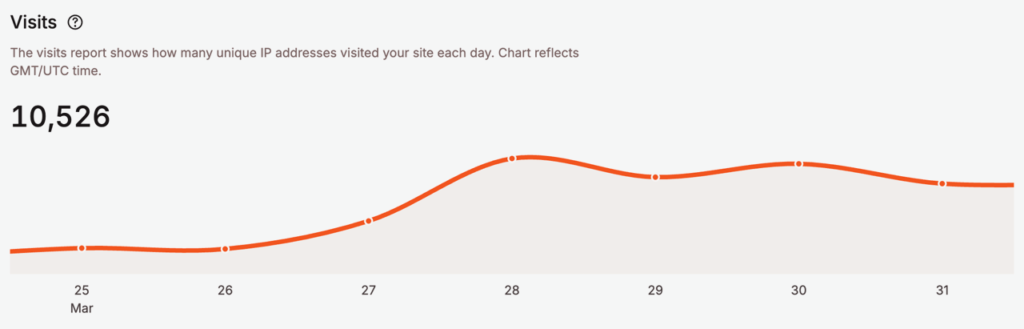

I mentioned the problems I’ve been having with the blog. I changed hosts, to no avail, and I have two sets of customer-service tech people doing their best to keep us going.

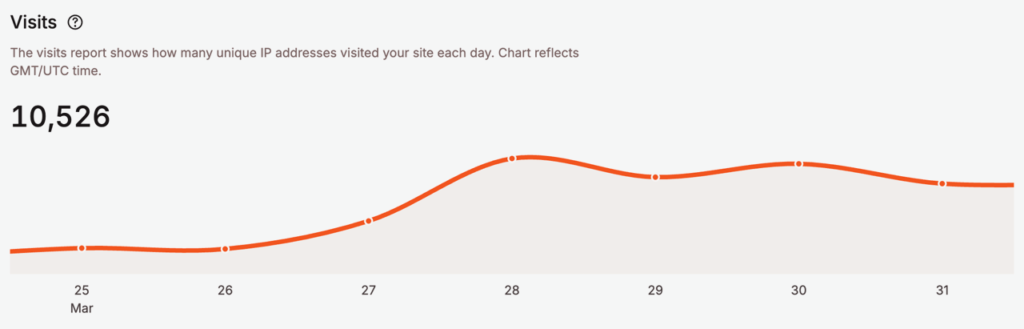

There have been 10,000+ visits per month for quite a while, but now it’s up to 10,000 PER WEEK?

The bots have descended!

We put an end to it today, and you should see improved performace from now on:

I’ve produced this blog for almost twenty years free of charge, and I’m fine with it being a resource for all. But they are burying me now – the blog has been down more in the last month than in the last 20 years combined, and it has to stop.

If you happen to search AI for real estate advice, I hope it has a familiar tone!

by Jim the Realtor | Apr 1, 2025 | Jim's Take on the Market

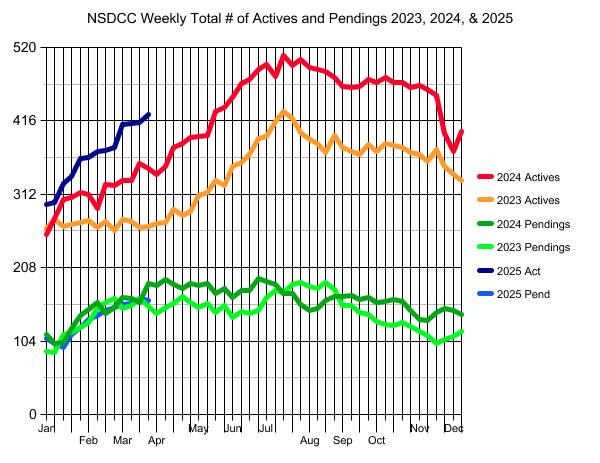

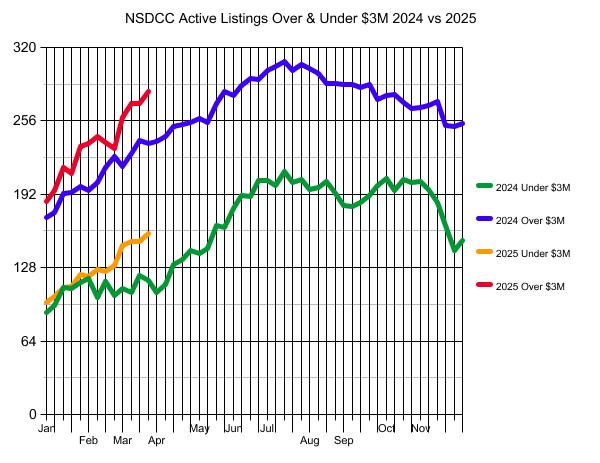

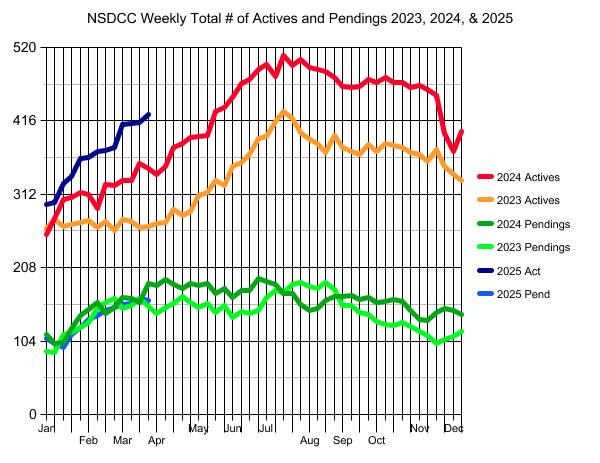

I thought the inventory surge would be heavily weighted towards the higher-end homes, but the lower end is feeling it too. Could it be that we’re just early?

If both categories end up hitting the same or similar peaks in inventory as last year, then there won’t be much impact on the buyers or to the market. It just means the new listings showed up earlier than usual.

If the surge continues, and there are 100+ more unsold listings laying around not selling in each category, then it’s going to feel somewhat bloated. But buyers are already used to ignoring the additional unsolds. They would have to think there is a panic among sellers for there to be a noticeable change in the market.

by Jim the Realtor | Mar 31, 2025 | Thinking of Buying?, Why You Should Hire Jim as your Buyer's Agent

by Jim the Realtor | Mar 31, 2025 | 2025, Inventory |

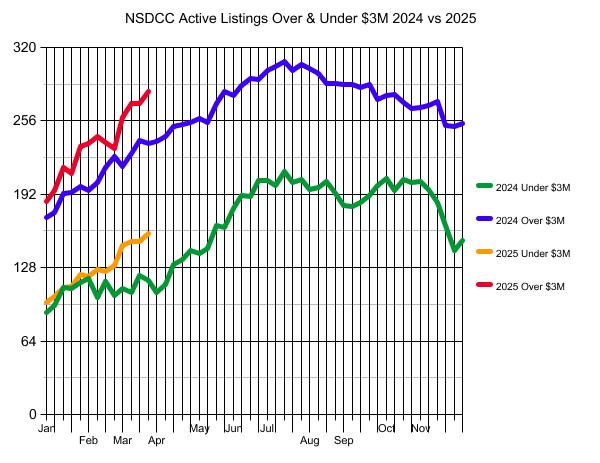

In light of the last blog post, let’s direct a renewed focus on the differences between the higher-end and lower-end markets. I have all the data going back for years, so give me a minute and I’ll split the presentations.

But we can already anticipate what’s coming just from the graph above.

The actives’ count is much higher than it has been in the last two years, but the pendings aren’t following. They’ve been steady, but now only just slightly above the number of 2023 pendings when the actives were about HALF of what they are today.

TWICE the inventory, and the same number of pendings?

But I’ll split the market this afternoon, and It’s likely we will find that it’s all driven by the high-end.

(more…)

by Jim the Realtor | Mar 30, 2025 | 2025, North County Coastal, Sales and Price Check |

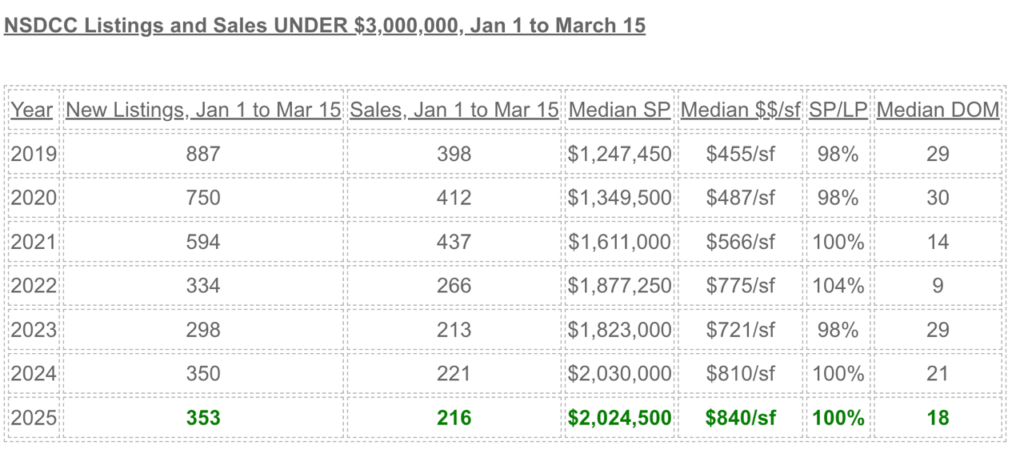

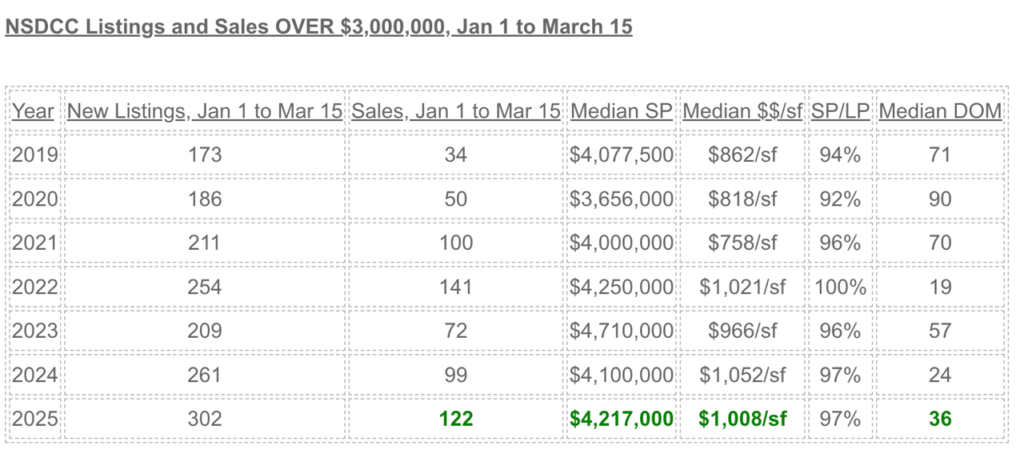

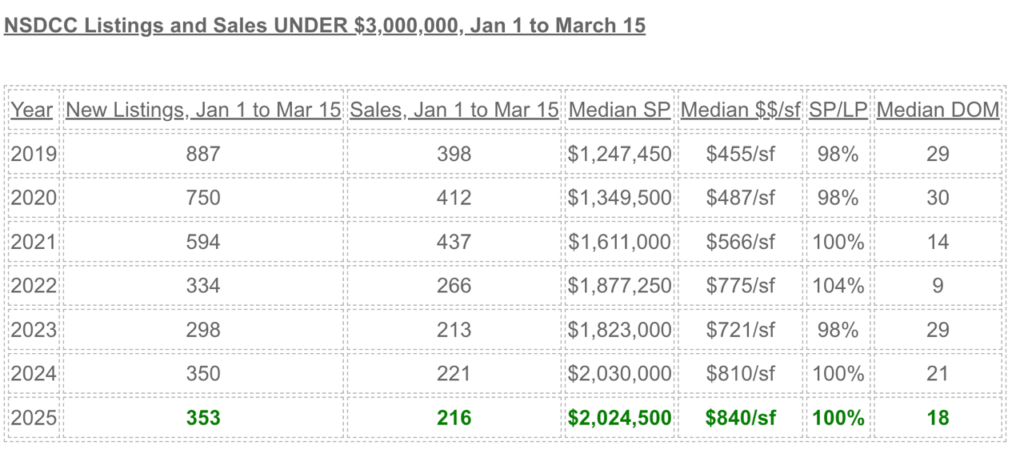

A reader asked to split the market at $3,000,000 and take a look around.

They made a good point.

All that matters is what’s happening in your neighborhood of interest.

Analyzing larger samples can only give us suspicious facts. I keep saying how another 15% to 20% increase in inventory is going to make buyers pause, but who cares. When trying to get a read on your favorite neighborhood, do the inventory/sales across town matter? Probably not, and they won’t matter to those buyers & sellers in your neighborhood either.

But until you hire me to discuss your favorite area, we gotta talk about something.

Main point: The Under-$3,000,000 market remains a hot ticket.

NSDCC Active Listings Under $3M: 156

Actives Median LP = $2,200,000

Actives Median LP/sf = $878/sf

NSDCC Pending Listings Under $3M: 98

NSDCC 2025 Sold Listings Under $3M Per Month: 86

There is only a two-month supply, the pricing metrics of the actives are close to the sold metrics, the actives-to-pending ratio is under the 2.0 healthy mark, and half of the recent sales have found their buyer within 18 days.

We can say that’s a hot market in 2025!

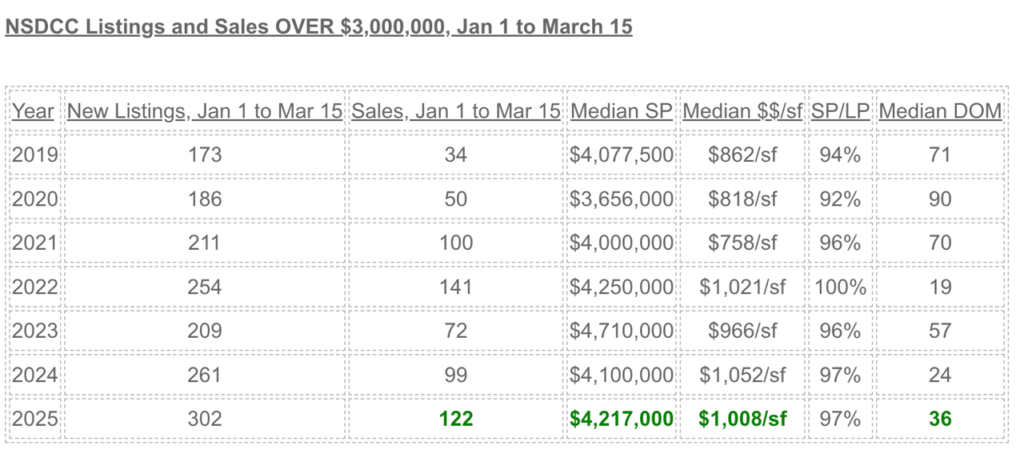

However, the Over-$3,000,000 market is a different story:

Over-$3,000,000 market is sluggish, and will likely remain that way.

NSDCC Active Listings Over $3M: 271

Actives Median LP = $5,995,000

Actives Median LP/sf = $1,230/sf

NSDCC Pending Listings Over $3M: 66

NSDCC 2025 Sold Listings Over $3M Per Month: 49

There is a SIX-month supply, the pricing metrics of the active listings are +20% to +40% over the sold metrics, the 4.1 actives-to-pending ratio is pushing the unhealthy zone, and even though the median days-on-market of the solds is a remarkable 36 days, two-thirds of the active listings have been on the market longer that that.

What’s the point? General assumptions are only good for trolling on twitter!

by Jim the Realtor | Mar 30, 2025 | Why You Should List With Jim

Most of our sellers tend to be repeat clients.

But in this case, the homeowners had never heard of us when a mutual friend recommended they consider hiring the KRG to sell their home. They had already moved to Texas, and considered this to be their second home but weren’t getting back to town much.

Might as well sell it!

Even though it was immaculate and one of the most upgraded homes we’ve ever listed for sale, Donna still recommended staging. The sellers agreed, and by the time we hit the open market, the home looked perfect to me.

There must have been 200+ people that attended my open-house extravaganza, and at least a half-dozen of them told me that they would be submitting an offer. Usually about half of those who threaten to make an offer actually do it, so the count ended up being less than I expected.

It came down to the two top offers, and it was close.

It was so close that the buyer-agent commission was making a difference.

I’m sure most listing agents wouldn’t give it a thought, and just take the highest net.

But I didn’t think it was right that a buyer-agent could win a bidding war by lowballing their own commission rate. What are they going to do once they get into escrow? Would they make it to the finish line?

I’m a big believer in transparency, so I let the other agent know that she was going to lose due to the commission rate – and gave her a chance to do something about it.

She lowered her commission paid by my seller, and the buyers made up the difference.

In a close race, I’m hoping for the best agent to win to improve our chances of closing escrow because it is what’s best for my sellers. We had already completed the highest-and-best round, and there didn’t seem to be any gas left in the tank (neither buyer went up much from their original offer).

If we’re at max money, then, in my opinion, the next decision-maker is the quality and experience of the buyer-agent. My sellers agreed, and we closed successfully!

by Jim the Realtor | Mar 29, 2025 | Where to Move

I’ve had a harrowing 24 hours dealing with blog issues but we’re up and running now!

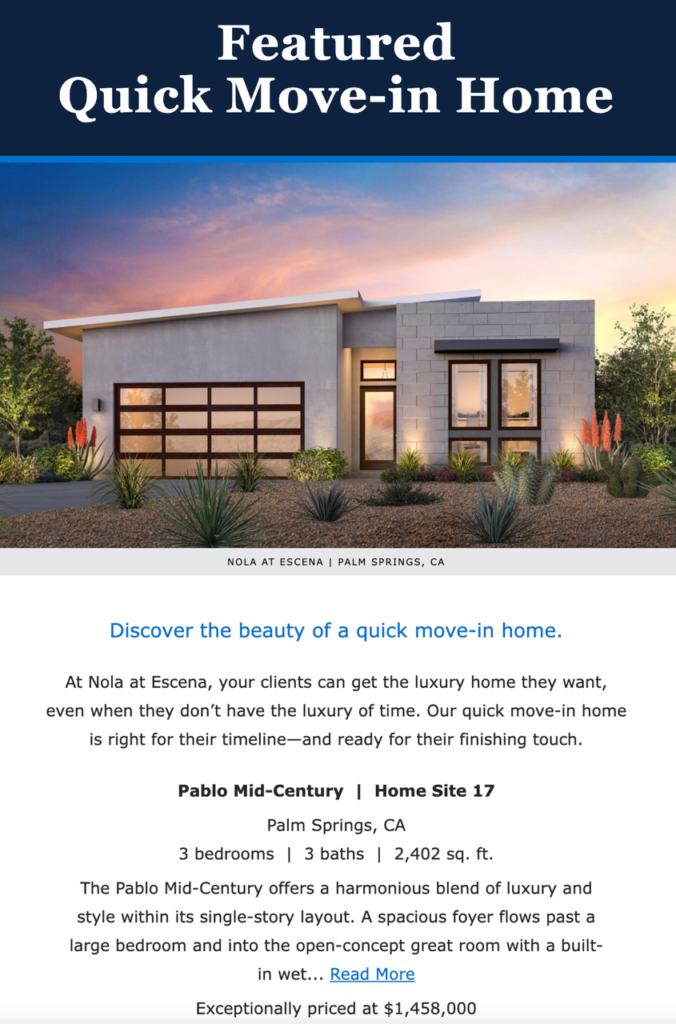

The regular feature here on Saturday mornings is Where To Move.

We saw the inexpensive new homes outside Phoenix, but it might be asking a lot to move to Arizona – although I think it’s worth considering. Then last week we saw the new homes being built by Davidson in Rancho Mirage but you may not want to plunk down $2,000,000+.

How about a blend?

A new one-story home in Palm Springs?

https://www.tollbrothers.com/luxury-homes-for-sale/California/Nola-at-Escena/Quick-Move-In/272900

by Jim the Realtor | Mar 28, 2025 | Jim's Take on the Market, Thinking of Buying?, Thinking of Selling?, Why You Should List With Jim

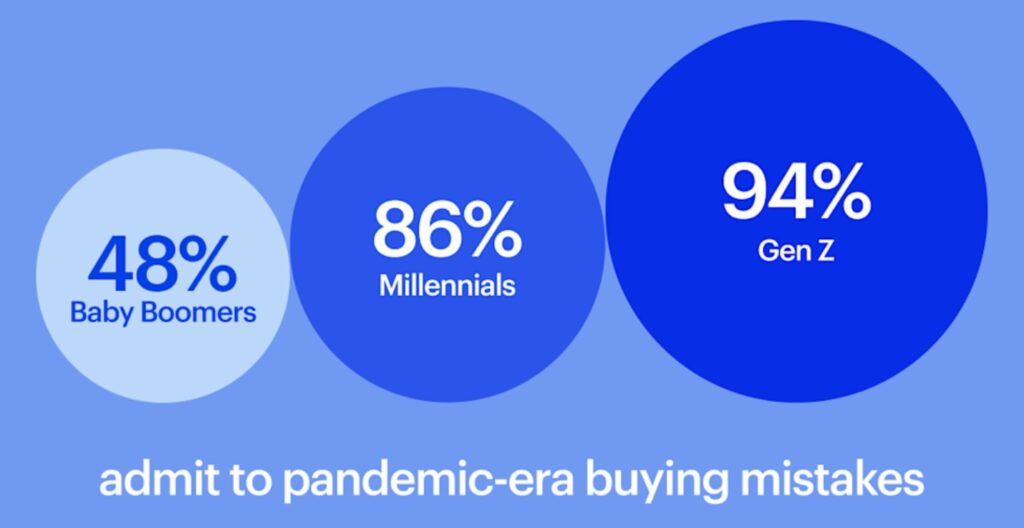

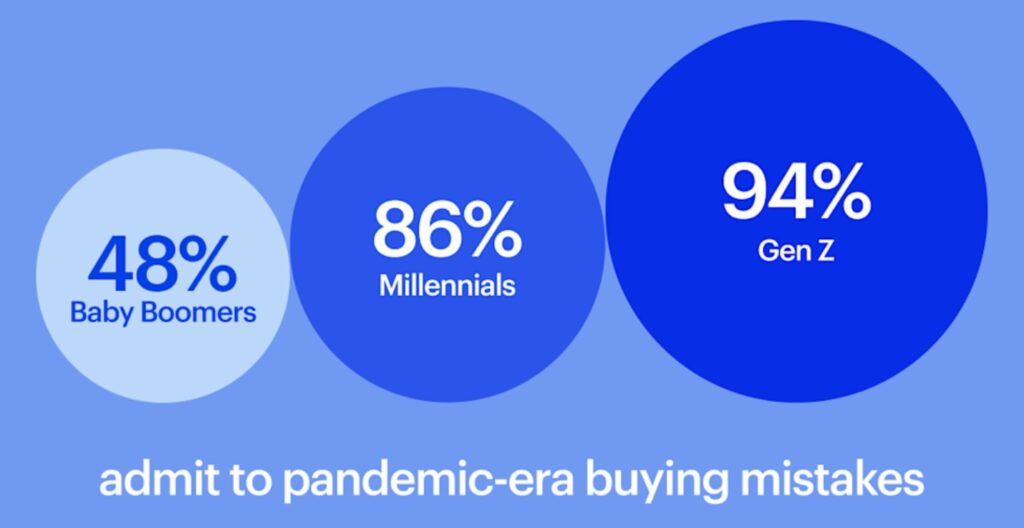

Mistakes when buying or selling a home can be very costly – Get Good Help!

https://www.opendoor.com/articles/homeseller-report

by Jim the Realtor | Mar 27, 2025 | Why You Should List With Jim |

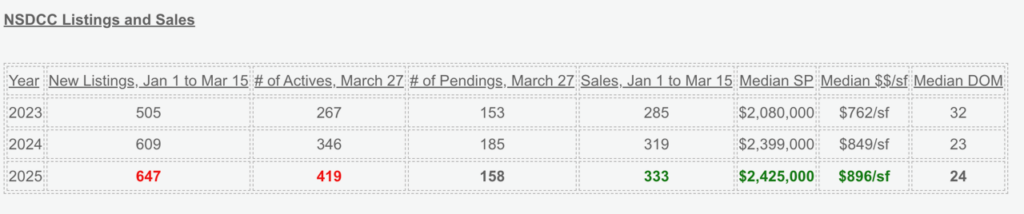

The grumbling has started that it’s not a good time to sell your home. It happens every time the casual observers see homes not selling, and today the count of active listings is higher and trending upward.

I don’t mind the grumbling. Let’s grumble about the facts!

By category:

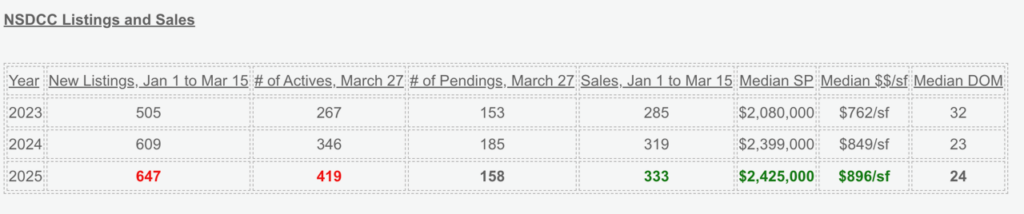

More homes have been listed for sale this year: Six percent more than last year, and 28% more than in 2023. Hey, it means more choices for the buyers!

There are 21% more active listings today than this time last year. Even though there have been only 6% more total listings since January 1st, there were enough that hungover from December that the overall supply is larger than in previous years.

Last year, the additional supply was getting picked up – there were 185 pendings! This year, it looks like we’ve found the equilibrium point where too much supply starts to affect sales. Having 21% more homes for sale has the number of pendings down 15%.

Important point: Sales this year have been great, and pricing is healthy (so far)!

Sellers just have to do a minor tune-up in relation to the age and condition of their home (the older, the more work needed), hire a good agent, and put an attractive price on it. For those folks, it’s a good time to sell!

by Jim the Realtor | Mar 26, 2025 | Realtor, Realtor Training, Realtors Talking Shop