Bonnie & Rickie Lee

These two share a birthday….today! They are five years apart.

These two share a birthday….today! They are five years apart.

Houses are getting bigger overall, but that doesn’t mean a larger house is right for you.

“Fit is super important, and people get complacent and they don’t think about if their home is still fitting them,” says Marni Jameson Carey, a home and lifestyle expert, author of “Downsizing the Family Home: What to Save, What to Let Go,” and president of Power to the Patients, a nonprofit organization.

Here are four signs your home may be bigger than you need or can handle.

And here are four things you can do about it:

There Are Rooms You Haven’t Spent Time in for Weeks

A four-bedroom McMansion may have once been perfect for a house full of teenagers and hosting extended family for the holidays, but now all but your own bedroom is a guest room and you no longer host Thanksgiving for the family.

“You’re overheating spaces that don’t need to be heated at all because you’re not using them,” says Eric Stewart, CEO and associate broker of the Eric Stewart Group of Long & Foster Real Estate in the District of Columbia metro area. “I think it’s the slow realization that the house owns you more than you own the house.”

You Haven’t Furnished the Whole House

Whether you don’t need a room or can’t afford to put furniture in it yet, the fact that your furniture choices can’t match the house you bought may be a sign it’s not the right real estate fit.

“Plastic chairs on a patio on an $800,000 house, and you go, ‘What happened here?’” Carey says.

If you’ve lived in the house more than a few months and you’ve left entire rooms bare, ask if you’re ever going to take full advantage of the total square footage you own. If you see it as unlikely, consider “right-sizing” your property to fit with your lifestyle as well as your wallet.

The Property Taxes Are Too Much for You

You can deduct your state and local property taxes up to $10,000 from your itemized federal tax filing, but for many homeowners that still means they’ve got a few thousand dollars to pay without annual relief.

If the limit on property deductions isn’t enough and means you’re financially strapped, you should rethink the home you own. Consider whether the location outweighs your ability to pay other expenses, and look at alternative cities or neighborhoods that might be able to provide the life you desire without the excessive costs currently tied to it.

Most of the Stuff Belongs to People Who’ve Moved Away

A classic empty nester problem is having all your kids’ belongings spanning from birth to college – and even beyond – with no real use for any of it. Trying to get your adult children to decide between keeping their macaroni art from first grade at their own house and letting you toss it can be tough for both sides, but keep in mind that your home shouldn’t be used as a storage unit.

Carey says, when given a certain amount of space, most people will naturally fill it up with belongings. In the case of empty nesters, that space is often filled with memorabilia that ultimately does not provide enough sentimental value to anyone to be kept. Put your foot down and have your kids come by to clean up and take what they would like to keep.

Even if you’d like to stay in your home in the long run, it’s important to regain control of the property when others stop living there. The worst-case scenario is realizing you need a smaller house or need to move to where you can get more care but feel overwhelmed by the task of clearing out the house. “Don’t be there as a default – be there by choice,” Carey says.

https://realestate.usnews.com/real-estate/articles/is-your-house-too-big-for-you

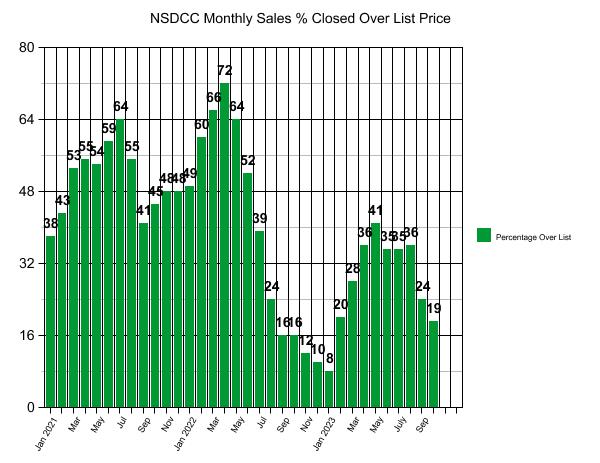

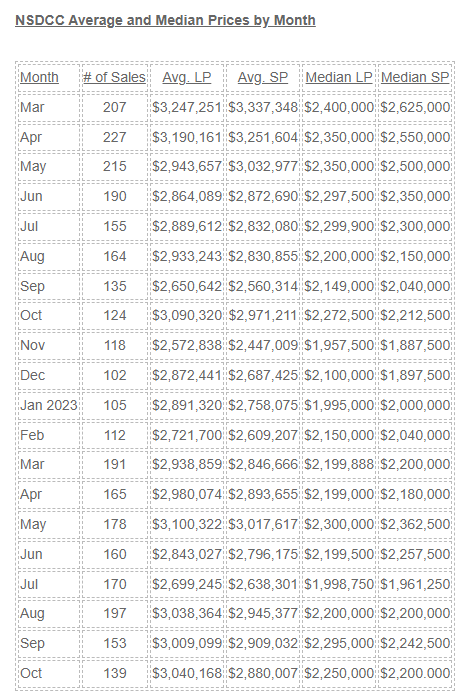

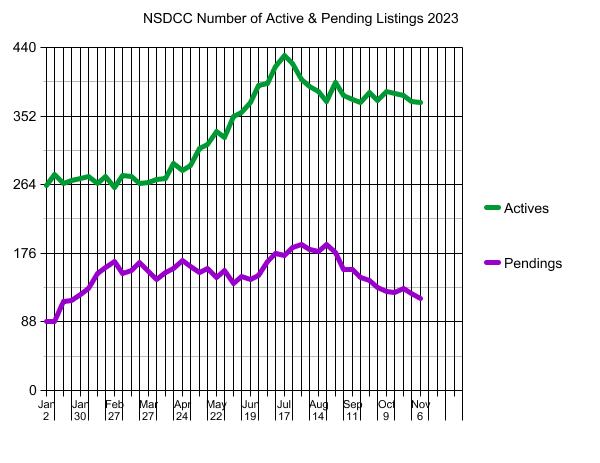

The number of sales and percentage of homes that closed over their list price were better last month than they were last October, but that’s not saying much.

The late-summer surge has subsided, and the last two months of 2023 should bring in a couple of hundred more sales without much change to the pricing stats.

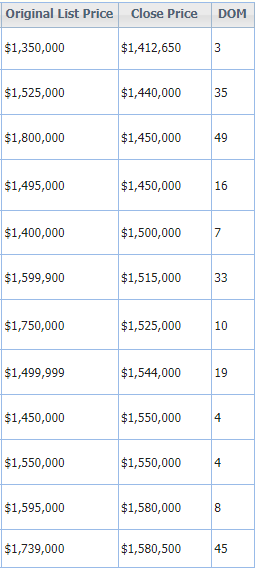

A look at the individual sales is more volatile though. This price point used to be 100% over list:

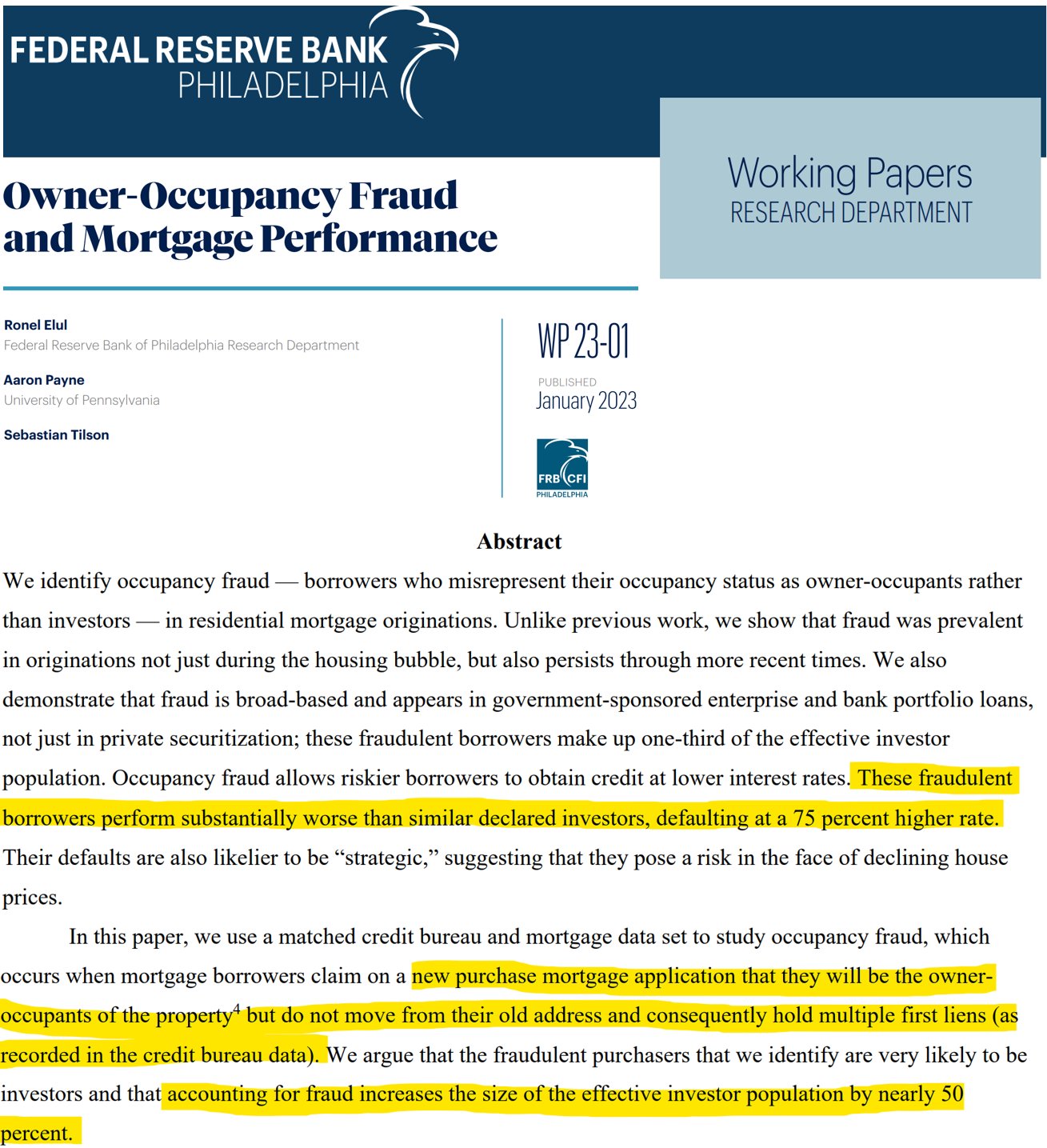

The interest-rate they get is only 1/2% better, but the down-payment requirements are lower – and that’s where the trouble starts. For those looking for some legit doom potential, here ya go!

Did you know that none of the jurors had sold a house before?

It was part of the screening too, and the defense attorneys were so cocky that they didn’t think it would matter. Their witnesses were a smart-aleck NAR CEO on his way out the door, and an elderly gazillionaire. Is anyone surprised we lost?

This is the American legal system, so there will be talk of settlement. Two brokerages already settled before the trial, and the other two would be smart to settle now – and leave the NAR to pay the bill. If NAR has to pay the entire amount, there will be trouble. They only have half of the money.

Given how quick the plaintiffs settled with ReMax and Anywhere (for only $130 million), a settlement could come flying down the pike any minute. Who knows? Are the NAR attorneys seeing the big picture, and crafting a settlement agreement that solves all the problems?

Probably not.

Can we package up all the things that can be manipulated into class-action lawsuits while we are at it?

Dual agency ensures that every buyer and seller in a transaction gets represented by an agent. But just the sound of ‘dual agency’ is nebuous – it sounds like realtors are up to something. There isn’t anything wrong with dual agency – in California, it is legit, legal, and practiced regularly by me and others. We like it!

But as we enter the single-agency era, only one agency/brokerage will be handling the sale. There will be two agents, but they are both employed by the same brokerage.

Today it’s called dual agency – because the broker represents both parties. The agents can give sound advice separately to their clients which qualifies as legitimiate represention, but lawyers could make it sound shady in front of inexperienced jurors.

If there will eventually be the Big Settlement, let’s find a way to include dual agency in it too so we can get on with the future of selling homes.

Going forward? After a settlement that absolves all previous dual agency, we should better describe the choices. In Colorado, there are transaction agents who don’t represent either side, but that sounds like it could cause a smaller commissions. Can we find the in-betweener that makes everyone happy?

As more buyers go direct to the listing agent to avoid paying a buyer-broker fee, they will be assigned a junior agent for assistance. A box needs to be checked here. Currently, you have to call it either single agency where that buyer is officially unrepresented, or call it dual agency.

While the listing agent is fully representing the seller and their best interests, the buyer only gets enough help from the junior-agent to make it to the finish line. Instead of dual agency, it’s more like single+ agency. Call it Agency 1.5.

Later a buyer could claim dual agency was the cause of all his troubles in the world, and sue realtors to get even. Did he get full representaion from his junior-agent that was comparable to the representation provided to the seller by the agent’s boss? It would sound unlikely and beg of another class-action suit.

Are agents going to call it single agency (only one side represented) and hope for the best?

Because it’s more than single agency, but not strong enough to be called dual agency.

Let’s add a third box for when the buyer gets the in-house junior agent: dingle agency.

If we don’t, we’ll be facing more class-action lawsuits shortly.

The first week after the realtor-lawsuit verdict went as expected – chaos, doom, and no sexy alternatives. It will take years to appeal, but it won’t matter how it turns out. Buyers are going to be paying their agents.

If sellers aren’t obligated to pay any commission to the buyer-agents, will they appreciate the benefit of incentivizing buyer-agents with a bounty, or reward? Probably not, unless their listing agent makes it very clear, and insists on it.

It is more likely that listing agents won’t push it, and because sellers naturally will want to pay less commission and not more, they will list for 2.5% or 3% and hope for the best. Both will shrug it off, and joke about how it’s about time commissions came down!

It will be a grave mistake.

Why? Because the buyer-broker agreement is a disaster:

Today’s buyers are picky, and you can’t blame them. They’ve had to endure +40% on prices, +200% on interest rates, and -50% on inventory…..talk about challenging!

The buyer-broker agreement will be a disaster because both agents and buyers will sign a short-term arrangement and hope the seller might kick in some of the commission. But then everyone will go back to doing it the same way we always have – refreshing your feed every hour and praying!

The real opportunity will be for buyers to hire an aggressive buyer-agent who does more than just watch the MLS. When a seller hires a listing agent, they get a thorough marketing campaign to source every potential buyer in the market. Buyer-agents can do the same, in reverse!

The buyer-agents who offer a rifle-shot soliciting of specific homes that fit the needs perfectly of their buyers will eventually find one. If an aggressive buyer-agent brings the complete package to the seller’s table without having to mess with a full listing, they will likely get an audience. It could even take the place of listing agents!

Because auctions aren’t close yet, this could be what changes the world of residential resales!

It will mean more off-market sales, which means more fuzzy comps because not much if anything is known about the home’s condition. But if it catches fire and the MLS or a rogue search portal insists on buyer-agents reporting everything about their sales including photos, we could still have a database full of accurate market data. But if we don’t, we don’t – good luck everybody!

Though the industry is reeling from the controversial lawsuit verdict last week, new listings and new sales keep happening every day – people want and need to move, thankfully.

We are too close to the end of the year to have any violent swings in the market. Anything that happens from now on will be blamed on the holidays. Thanksgiving is only 17 days away!

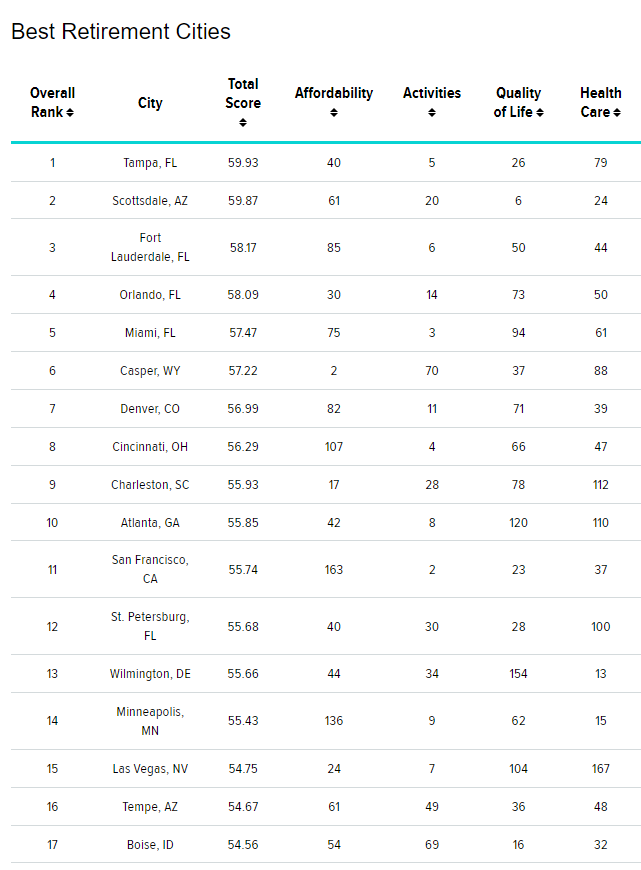

After putting in decades of hard work, we naturally expect to have financial security in our golden years. But not all Americans can look forward to a relaxing retirement. According to the Employee Benefit Research Institute’s 2023 Retirement Confidence Survey, 64% of workers reported feeling at least somewhat confident that they will have enough money to retire comfortably, but only 27% said they were “very confident.”

If so many American workers are worried about their financial future, what other options provide a pathway to a comfortable retirement? For some, the only solution is to keep working. According to Gallup polling, workers in 2022 planned to retire at age 66 on average, compared to age 60 in 1995. The alternative? Relocate to an area where you can stretch your dollar without sacrificing your lifestyle.

Retirement isn’t all about the money, though. Retirees want to live in a place where they enjoy safety and access to good healthcare, especially in the wake of the COVID-19 pandemic. The ideal city will also have lots of ways to spend leisure time, along with good weather.

To help Americans plan an affordable retirement while maintaining the best quality of life, we compared the retiree-friendliness of more than 180 U.S. cities across 45 key metrics. Our data set ranges from the cost of living to retired taxpayer-friendliness to the state’s health infrastructure.

The latest lawsuit will cause people to consider different pay structures for realtors.

If realtors were paid less, could they at least get some of it up front? Yes, if approved by the commissioner:

Before a broker may solicit, advertise for and agree to receive an advance fee, the paperwork material is to be submitted to the Commissioner of the California Department of Real Estate (DRE) for approval at least 10 calendar days prior to use.

If the Commissioner, within 10 calendar days of receipt, determines the material might mislead clients, the Commissioner may order the broker to refrain from using the material.

To be approved, the advance fee agreement and any materials to be used with the agreement will:

Further, the advance fee agreement may not contain a provision relieving the broker from an obligation to perform verbal agreements made by their employees or agents; or a guarantee the transaction involved will be completed.

It sounds like slipping a few thousand under the table won’t be tolerated! The paperwork involved will probably make the big brokerages shy away from the idea, but we should consider alternative ideas.

When tenants live in a property, they cause some degree of wear and tear. This can range from minimal scuffs on walls to more serious harm, such as stained carpets or broken appliances. It’s important to recognize that wear and tear is different from intentional damage or neglect by the tenants.

Landlords must think about factors like tenancy length, number of occupants, and property condition before the tenant moved in to decide what counts as normal wear and tear. A well-maintained property will get less wear and tear compared to one that has been neglected.

Here are frequently asked questions:

FAQ 1: What is wear and tear? It is the gradual deterioration of a property as a result of normal everyday use by tenants. It includes minor damages, deterioration, and natural aging of the property. Landlords cannot hold tenants responsible for the cost of repairing or replacing items due to normal wear and tear.

FAQ 2: How can landlords differentiate between degradation and tenant damage? Landlords should consider the overall condition of the property, the age of the item in question, and the length of the tenancy. Minor scuffs and marks are usually considered wear and tear, while significant damage caused by negligence or abuse is considered tenant damage.

FAQ 3: Can landlords deduct the cost of wear and tear from the security deposit? No. Security deposits are intended to cover intentional damages or neglect by tenants that go beyond normal use. Calculate depreciation to claim the correct amount from security deposits.

FAQ 4: How can landlords protect themselves? It is highly recommended for landlords to conduct a thorough move-in inspection with photographs will help in accurately determining any additional damages caused by the new tenant during their stay. Do an additional move-out inspection with photos when they leave.

FAQ 5: What can landlords do to prevent excessive wear and tear? Landlords can take several measures, such as, 1) regularly conducting property inspections, 2) providing clear guidelines on maintenance and care – especially for specific features of the property, such as hardwood floors or countertops, 3) promptly addressing repair requests, and 4) using durable and easy-to-maintain materials in the property.

Educating tenants about proper maintenance practices can help prevent unnecessary wear and tear too!