Allison Russell

Look for Allison at the Grammys next year!

Look for Allison at the Grammys next year!

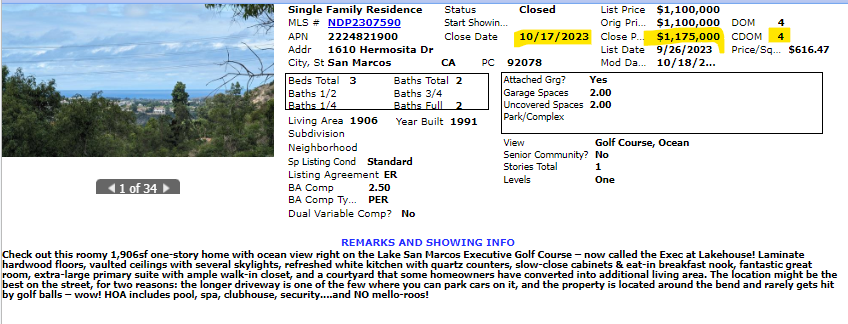

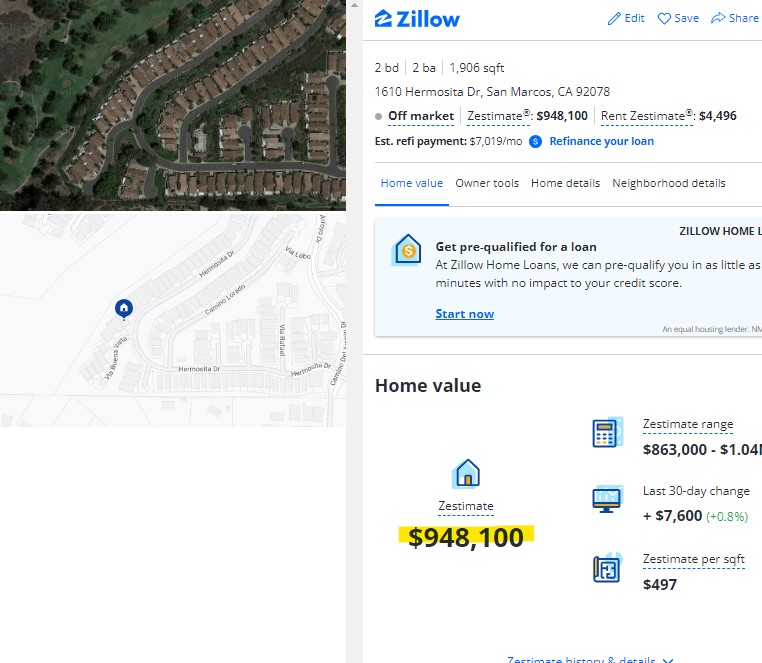

Remember when Doug said that buyers these days want something special? With all the domestic and international conflicts, mortgage rates at 16-year highs, and ultra-low inventory making the house-hunting almost unbearable for most buyers, there are still homes selling – the ones with something special.

We received four offers and closed escrow in two weeks with a cash buyer who paid $75,000 over list!

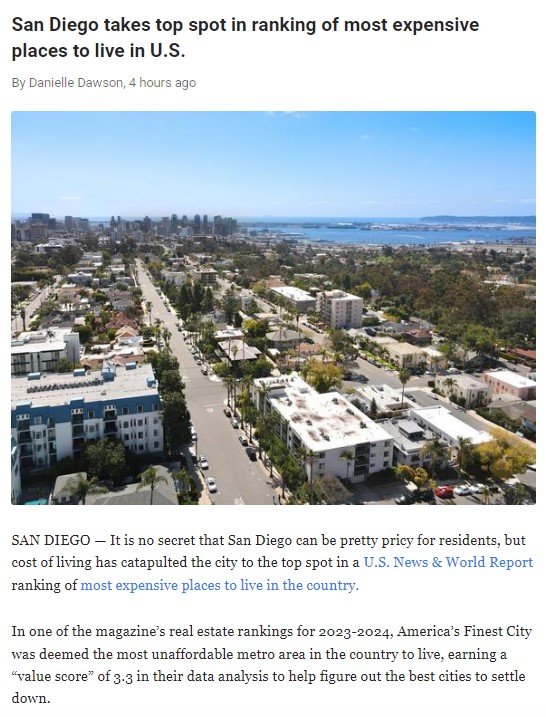

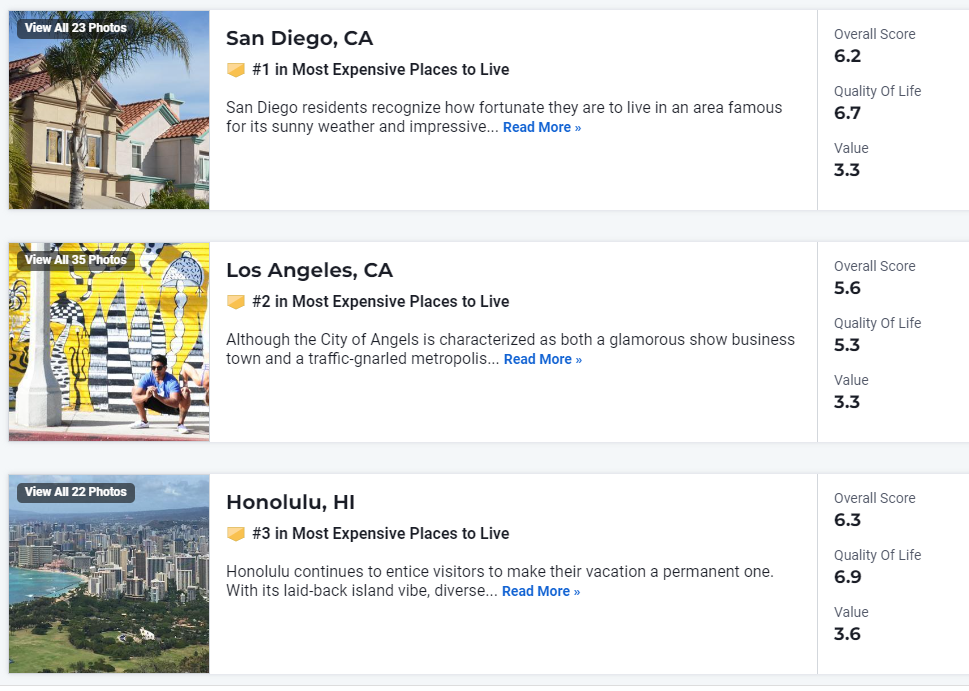

San Diego is #1! Hat tip to Mitch for sending this in:

According to the magazine, the Value Index measures how comfortably the average resident of a metro area can afford to live within their means. Specifically, it looks at housing affordability, as well as federal data on the parity between regional prices and national averages.

Home prices were one of the factors that pushed San Diego up on the ranking, given that average prices are considerably higher than the national rate.

In August, the median price for a single-family home came in right at $1 million for the first time in the region’s history — nearly $650,000 more than the national average by some estimates.

U.S. News and World Report also pointed to additional fees that San Diego residents have to pay, such as homeowners association dues or apartment complex maintenance costs, as another factor driving its unaffordability.

However, the magazine said that many residents are willing to pay elevated prices relating to cost-of-living, given other aspects of the region that make it an ideal place to live.

They added that some San Diegans often refer “to the cost-of-living differences as the ‘sunshine tax,’ or price of enjoying a year-round temperate climate.”

Many of the other metro areas that were placed along the top 10 have similar “sunny” reputations with their climate, including cities Los Angeles, Honolulu, Miami and Santa Barbara.

Los Angeles, which came in second place on the ranking, was also given a score of 3.3 for residents’ ability to afford living there. Although, San Diego’s northern neighbor comparatively had lower scores for other metrics used by the magazine to look at “best places to live,” including the overall and quality of life indexes.

A full list of the top 25 “most expensive places to live” in the U.S. can be found here. San Diego is #1.

This ranking comes as inflation rate nationwide remains to a persistent problem for federal officials, but San Diegans seem to have been feeling it even more.

In San Diego, the U.S. Bureau of Labor Statistics estimated that the city exceeded the year-to-year national rate of inflation, which was around 3.7% in September. Over the last 12 months, prices in the San Diego area advanced about 4.7% overall, according to the bureau.

Housing costs have been one of the most pressing issues facing elected officials, with prices skyrocketing for both buyers and renters due to a continued lack of available units to meet the demand in the region.

One of the funniest videos ever!

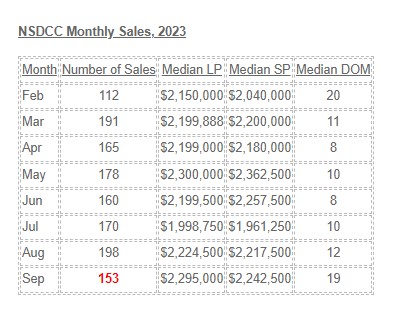

Even as the doom continues to pour in from other areas that aren’t as fortunate as the North San Diego County coastal region, our home sales are defying expectations. Two facts:

Although it would seem like a miracle, having 100+ sales per month in the fourth quarter of 2023 with a median sales price staying above $2,000,000 looks possible.

The White House issued a press release today that outlines more money to bolster prop up the FHA loans:

For millions of Americans homeownership is a foundation for so many parts of their lives, and for many it is also their primary source of wealth. The Biden-Harris Administration is committed to expanding access to homeownership, ensuring homeowners can afford to stay in their homes and make the repairs they need, and that the wealth building potential of homeownership works equally for everyone.

Today, the Biden-Harris Administration is releasing new data showing major federal investment in homeownership, and announcing key new actions to accelerate progress. These actions make important strides, but given the lack of homes on the market and current interest rates, to truly ensure homeownership is accessible to all households, we need Congress to act. That is why President Biden proposed $16 billion for the Neighborhood Homes Tax Credit, which would result in more than 400,000 homes built or rehabilitated, creating a pathway for more families to buy a home and start building wealth. The President has also proposed a $10 billion down payment assistance program that would ensure first-time homebuyers whose parents do not own a home can access homeownership alongside a $100 million down payment assistance pilot to expand homeownership opportunities for first-generation and/or low wealth first-time homebuyers.

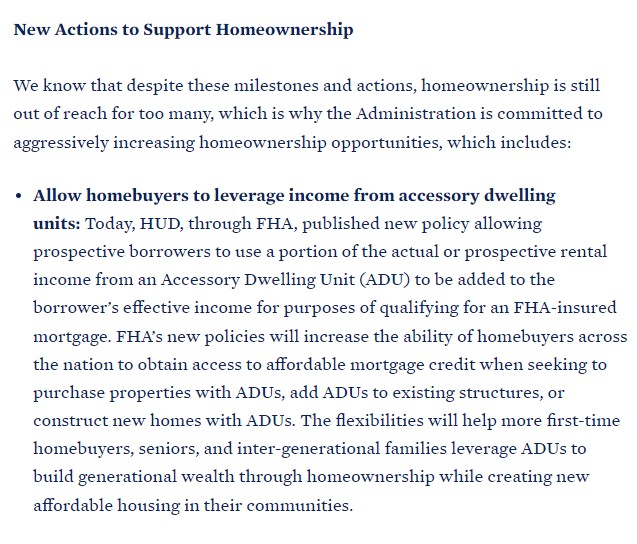

I love this new way to qualify – they will count the prospective income you might get from an ADU:

Recently the president of the local association of realtors was asked what the real estate market will do in the future. His response: “Nobody knows what the market is going to do in the future”. Of course, immediately after that comment he said, “Interest rates have to drop to 5.5%. Then you’ll see everyone get excited and say, ‘Hey, let’s sell our house and get another one.'”

Even if mortgage rates to go back to 5.5%, people are living in their forever home. The difficulty of finding a better home for a decent price will overwhelm any minor inconvenience at their existing home.

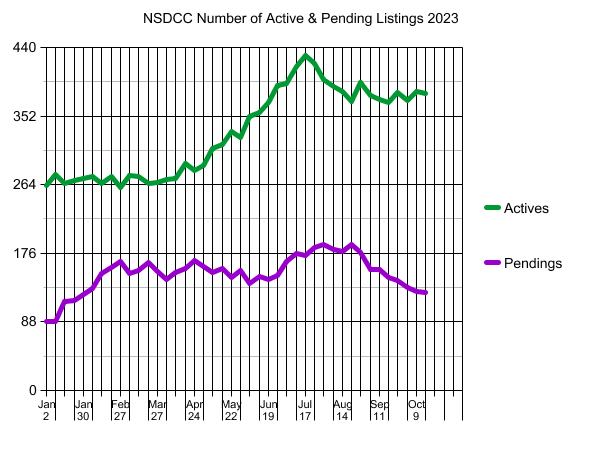

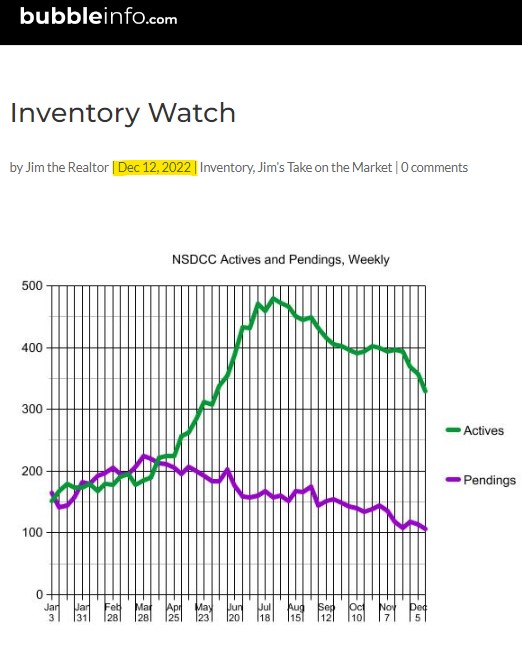

I don’t mind predicting the future. The rest of 2023 is going to look a lot like it did last year:

Next year, the inventory should grow quickly in the April-July time frame. Price will fix everything else!

A former federal regulator who served when the 2006 housing bubble burst is concerned that today’s housing market is on an unsustainable path.

The housing market’s affordability is worse than it’s been in decades as mortgage rates toy with 8%. The median price of a U.S. home was $322,500 in the second quarter of 2019. Then the pandemic housing rush hit, and prices across the nation shot up. High mortgage rates sent sales spiraling, but home prices only experienced a minor correction before heading back up. In the second quarter of this year, the median price was $416,100, according to the Federal Reserve Bank of St. Louis.

“Talk about a bubble. That’s a classic supply-demand imbalance,” Sheila Bair recently told CNN.

Even though Bair said home prices need to correct downward, she doesn’t expect that it will happen anytime soon because the U.S. is also experiencing a housing shortage, which has helped keep home prices high even amid today’s high rates, per CNN.

“If supply remains constrained, this could go on for some time,” she told CNN.

Bair doesn’t expect the bubble to burst, but she said “letting that bubble deflate a bit would probably be a good thing.”

“People who already own their home — and I’m one of them — don’t want to hear that,” Bair told CNN. “But for those who want to own, I hope home prices do come down.”

The good news is that Bair said she sees “much less speculation in the housing market today, thank goodness,” compared to the mid-2000s, per CNN. She also noted that even if prices come down, existing homeowners have built up a significant amount of home equity over the past several years alone.

So “even if home prices adjust a bit, people should not be under water,” Bair told CNN.

https://www.deseret.com/utah/2023/10/11/23913151/housing-market-bubble-crash-pop-deflate-sheila-bair

Mark Wahlberg says he has no regrets about leaving Los Angeles for Las Vegas a year ago.

In 2022, the actor said he moved his family to the Silver State to give his kids a “better life.”

Wahlberg is married to model Rhea Durham, and the couple has four children.

“Everybody’s adapted nicely. The kids are all out at school, and everybody’s happy,” the actor told PEOPLE magazine in an exclusive report. “I want to be able to work from home. I moved to California many years ago to pursue acting, and I’ve only made a couple of movies in the entire time that I was there,” he said at the time. “So, to be able to give my kids a better life and follow and pursue their dreams, whether it be my daughter as an equestrian, my son as a basketball player, my younger son as a golfer, this made a lot more sense for us.”

Wahlberg is part of a growing list of celebrities leaving California for a variety of reasons.

Months after Wahlberg revealed he moved to Nevada, actor Dean Cain announced he was moving there too. In an interview with Fox News in June, the “Lois & Clark” star revealed he moved to Nevada because of his issues with some of California’s “policies.”

“I love California. It’s the most beautiful state,” he told the network’s Brian Kilmeade. “Everything’s wonderful about it except for the policies. The policies are just terrible. The fiscal policies, the soft-on-crime policies, the homelessness policies.”

A month prior to Cain’s move, Scott Baio announced he was leaving California after 45 years, citing a KTLA story about homeless encampments in Beverly Hills. According to his X profile, Baio currently resides in Florida.

Three hundred people leave California every day. If you are thinking about it, I can help you!

The video seen here yesterday was an offshoot of the documentary film, Owned, A Tale of Two Americas, by Giorgio Angelini. He contacted me in 2013 when he first started out on his coast-to-coast journey to investigate the housing bubble, which I had become notorious for documenting myself.

He came here three times and filmed us for seven days total, but most ended up on the cutting-room floor. I didn’t mind, because the film took a turn towards housing discrimination as he found some heavy hitters in the space. It is a fantastic movie!

This is the full movie – my part begins at the 4:00-minute mark: